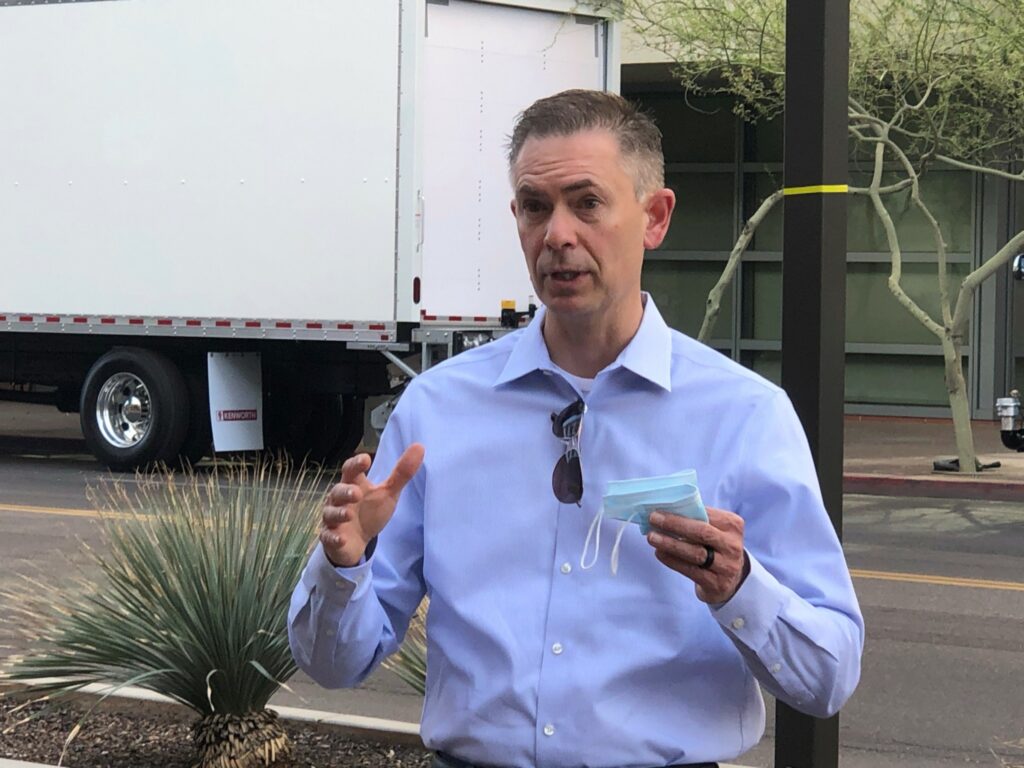

In conversation with Kenworth’s Kevin Baney

Standing in downtown Phoenix, Ariz., preparing for the second big Kenworth truck launch in three weeks, Kenworth general manager and Paccar vice-president Kevin Baney seemed relaxed and eager to put the Covid-19 pandemic and its associated economic slowdown behind him, and focus on a brighter future ahead.

But, before he could do that, he first briefed transportation journalists attending the launch of Kenworth’s new medium-duty truck line on the latest news concerning a serious microchip shortage that has hobbled North American truck production over the past few weeks, before sitting down with Today’s Trucking for a one-on-one interview on a variety of industry topics.

Baney began by noting that the current microchip shortage is the result of several factors, from the pandemic to the weather, but said that so far, Kenworth has managed this relatively minor crisis well, while noting that be believes the situation will soon be corrected with only minimal production disruptions.

“This chip shortage is primarily centered in Taiwan, where the bulk of microchips are manufactured, as a result of the pandemic,” Baney noted. “However, it was water damage at shipping facilities in Austin, Texas, coming in through Mexico, which ruined entire shipments of chips already shipped to the U.S. from overseas that created the short-term supply issue we’re facing now.”

Baney added that while demand for microchips has skyrocketed globally, along with sales of consumer electronic devices as people purchased new gadgets to help them pass time while in quarantine, truck OEMs, which purchase a relatively low volume of chips compared to automotive and consumer electronics manufacturers, were quick to feel the supply chain pinch.

In response, Baney said Kenworth and parent company Paccar have been reaching out daily to Tier 1 suppliers to understand the current supply chain situation and make sure any chips that are delivered are focused on automated manual transmission, ADAS modules and other critical production components for trucks.

“During the winter storm that hit Texas, we were forced to shut down truck production briefly to deal with the microchip shortage,” he added. “But we haven’t been in a position to do that since. And I feel like we’re on our way back to full production before too much longer.”

Baney had some additional thoughts on the current microchip shortage, as well as the outlook for the North American trucking industry in general, as well as thoughts on current technology trends later in the morning as he spoke with Today’s Trucking.

Today’s Trucking: What’s your general assessment of the North American trucking industry as we start to move out of the pandemic and (hopefully) return to some sense of normalcy this year?

Baney: In general, business is good. As a country and an industry, we did all the things we needed to last year during the pandemic. And for Kenworth, our focus last year was very clear: The safety of our employees was paramount.

But secondly, we knew that trucking was an essential industry that was critical for getting the U.S., Canada and Mexico through the pandemic. And we viewed ourselves in a support role for the fleets and drivers on the front lines, moving freight. Our priority was to make sure they had the trucks, parts and services they needed to keep moving freight. Now, as we transition past the pandemic, we’re starting to see the market overall increase. Orders are strong.

Today’s Trucking: But we’re not quite out of the woods yet, are we? Suddenly issues like this microchip shortage pop up out of nowhere.

Baney: Yes. As the recovery ramps up, the demand for chips, which was already at a premium, went up as well. And then the winter storm hit. So right now, we have to make sure our manufacturing strategy is right and adjust it according to the microchip supply.

And it’s not simple due to the shortages. We could justify build rate increases right now. But we’re holding our production rates steady at the moment, since the best information we have is that this chip shortage won’t start to ease until the end of the second quarter this year. But overall, we have a strong market and a strong order intake. More people are starting to get out. Consumers are spending. So, I see the next two years as being really strong for us.

Today’s Trucking: Do you have an idea what kind of Class 8 production numbers we’ll see this year?

Baney: I think we’ll see around 275,000 units built. Industry inventory will define the Class 8 market this year. I think we’re looking at a replacement rate of around 220,000 to 230,00 units. So that’s pent-up demand from last year, with some room for growth. So, I feel good about where we’re headed this year.

Today’s Trucking: What has customer response to the Next Generation T680 highway tractor been like?

Baney: It’s been overwhelmingly positive so far. We’ll get production of the new model ramped up by the end of this month. Right now, we’re still doing validation builds. But so far, feedback has been very good, particularly on the truck’s ride quality.

We’re also getting a great deal of good reviews on the new LED turn signals mounted on the back edge of the front fenders. Drivers are telling us passenger cars are more responsive to lane-change signals and seem to be letting them over more frequently in the new truck. I find that interesting. That was our intent from the outset, of course. But they’re so visible, they seem to be performing even better than we predicted out on the road. Beyond that, I just love the styling on the new, Next Generation T680. It’s just such a bold statement.

Today’s Trucking: You guys have a lot going on with that and the launch of the new medium-duty line.

Baney: Yes. And we have one more coming up later in the year. It’s not secret anymore that we’ve got both Class 8 and medium-duty electric trucks coming later on this year.

Today’s Trucking: I’m glad you mentioned that, because electric trucks are getting talked about a lot these days. What are your thoughts on that technology, and how do you think fleets are going to receive it once the trucks are available?

“The total cost of ownership (TCO) for an electric Class 8 truck doesn’t pencil out yet. But medium-duty makes a lot of sense right now.”

Kevin Baney, Kenworth

Baney: Obviously, with the new emissions regulations coming out of California in 2024, that has driven a lot of investment in electric trucks. And of course, Tesla certainly got the industry’s attention when their plans for the Semi truck broke.

So, we view this as a known development for our industry. But it’s important to remember that there’s more to this than just trucks. There’s a lot of activity going on around electric trucks – infrastructure, products, charging systems.

The Biden administration’s just-announced infrastructure bill with help boost the development in many of these areas. But the truck is obviously one part of the whole electric picture. At Kenworth, our approach when talking to fleets is more about selling the entire system, as opposed to just selling a diesel truck. In other words, we have to talk to our customers, and educate them about every aspect of using these trucks. Because there’s a lot that’s going to new and different when they do enter the market.

Today’s Trucking: What markets do you think they’ll move into first?

Baney: The total cost of ownership (TCO) for an electric Class 8 truck doesn’t pencil out yet. But medium-duty makes a lot of sense right now – as do final mile applications. So, I think that’s where the bulk of the first sales will be – with Class 8 electric trucks gaining significant market share a bit further out.

But, at Kenworth and Paccar we are ready to service and support this new technology. We have a dedicated battery-electric fleet sales manager on staff, we have electric component support from Paccar Parts and we are working with our customers now to understand their needs and how they plan to deploy these trucks.

Today’s Trucking: Paccar recently announced a new partnership with Aurora Innovation to develop autonomous truck technology. Any new developments on this front?

Baney: We are lucky in that Paccar established a new Innovation business unit in Silicon Valley early on to begin understanding and developing autonomous technology for trucks. And we’re working now with a wide range of Tier 1 suppliers as well. And both these moves have given us insight and access to this technology has it’s being developed.

Early on, we worked with everyone on autonomous technology – both Kenworth and Peterbilt – have demo trucks ready early. Now, the road to full autonomous is both long and expensive. But over time, we felt that Aurora was the right player and partnership for us to commit to. For one thing, they’re a company that is interested in working with us to understand the trucking industry. And that wasn’t always the case with some of the companies we were dealing with. But now, we feel like we have a better pathway forward because we understand what our customers need from this technology and what they think about it.

Today’s Trucking: Any thoughts on how we’ll see that technology come to market?

Baney: Initially, I think it will be in the southwest regions of the U.S., since the weather there is simply easier for the autonomous systems to deal with. And I think the first trucks will be in fixed course, point-to-point applications. But there’s still a lot to learn.

Our customers are very clear that they view drivers as their company ambassadors. And they feel like they’ll need drivers on-board the trucks to handle other functions and tasks during a haul. So, we need to understand that aspect of what’s coming.

Today’s Trucking: It seems, though, that for the first time, we’re starting to see the fruits of your work on autonomous technology in the Next Generation T680. The technology on that truck has a much more integrated feel to it.

Baney: Yes. Without a doubt. We’ve been planning for this and thinking about it for some time now. An you’re right – the Next Generation T680 is where we’re now bringing those Level 2 autonomous systems to the fleets with the driver at the center of all that technology.

We are viewing this as more of an evolutionary process. The way we see it, the building blocks for full autonomous trucks are being released as today’s advanced safety systems. Things like traffic jam assist, adaptive cruise control, lane keeping assist and other systems are early forms of autonomous systems designed to help drivers and make them safer.

And at the same time, they advance the conversation about autonomous technology by making people more aware of how these systems work, what technology is available today, and open up discussions about what is coming next.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

I’m interested in autonomous and batter technology. I’ve been following some universities that are testing in the woodlands operations in Canada.