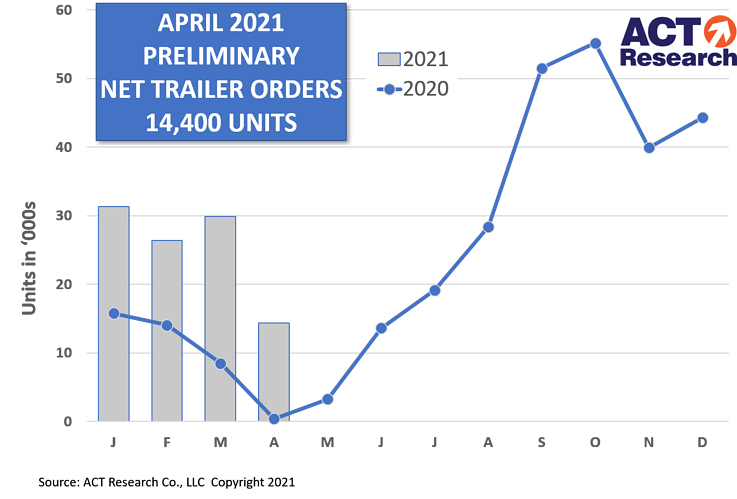

Trailer orders decline as build slots fill up

Trailer order activity cooled in April, with ACT Research reporting preliminary orders of 14,400 units – less than half of March’s volume – but blamed it on lack of supply, not demand.

Orders were 3,600% above Covid-impacted levels seen last April.

“Given the dramatic market impact of Covid shutdowns that occurred at this point last year, year-over-year comparisons provide minimal insight. Year-to-date net order volume of just over 102,000 trailers, up 164% versus last year, gives us a better metric that indicates fleet equipment demand remains strong,” said Frank Maly, director commercial vehicle transportation analysis and research at ACT Research.

“Strong fleet commitments, pushing the average backlog for dry vans and reefers into Q2 2022 at recent production rates, are generating headwinds to further order placement. Perhaps that should be better phrased as ‘further order acceptance,’ since some OEMs have indicated that they are not accepting orders until longer-term component and materials supplies and pricing can be determined. There also appears to have been a bit of an upturn in cancellations during April.

“Some re-visiting of pricing, the result of component and material cost pressures, along with some reassessment by fleets regarding projected delivery dates and their actual equipment needs, were likely both contributors to those adjustments. Finally, OEMs continue to struggle to increase production rates, with components, materials, and staffing still challenging their efforts.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.