Aftermarket suppliers preparing for tighter emissions, safety standards for trucks

Aftermarket parts suppliers are preparing themselves for everything from tighter emissions controls to tougher safety standards — along with a “Buy American” mandate — as a new U.S. president takes office.

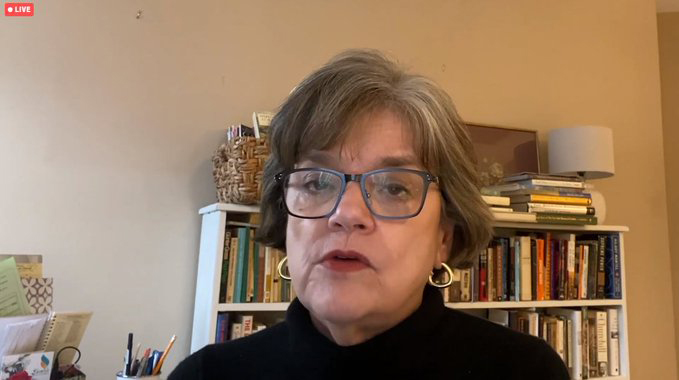

“Make no mistake about it, there are no absences of challenges in Washington, DC,” says Motor and Equipment Manufacturers Association (MEMA) senior vice-president – government affairs Ann Wilson.

Predicting a national emissions policy that touches on light and commercial vehicles alike, she noted during a Heavy Duty Aftermarket Dialogue presentation that mandates and incentives for electric school buses are coming.

“I think we’re going to get an electrification mandate. The question is how long is the transition going to be,” Wilson added. “We have to look at what the standards are going to be, what the transition period (will be), what room there is for other technologies while we’re in that transition.”

The Biden Administration can also be expected to push forward tighter NOx limits at the federal level as well, she said.

As the changes come, Wilson stressed North America’s aftermarket industry will need access to investments to support research and development, and financial support for those who ultimately buy the new technologies.

“It is unlikely that the heavy-duty industry will come out on the other side of this debate without some form of mandate toward electrification. We must continue to be a player in these discussions and fight hard for the elements we need for success,” she said.

Safety mandates

The regulatory environment that drives many safety-related investments is expected to tighten as well.

“We are going to see a strong push for mandates strengthening safety technologies. This can take the form of mandated pre-crash technologies including AEB (Automatic Emergency Braking). We will also see mandates for new safeguards including a new standard for rear underride guards on trucks, and research to study the addition of side guards,” she predicted.

“There will probably be efforts to address Hours of Service, drug testing, and driver training.”

Specifically, she referenced limits that could be expected on expanding the driver pool to include younger drivers.

Looking further into the future, Wilson suggested that the debate around autonomous vehicles will also continue – and she called for more action at the federal level.

While the U.S. Department of Transportation has identified best practices, the U.S. Congress has been unable to secure the votes for related federal legislation, and unions have thwarted efforts to include commercial vehicles in such legislation.

But Wilson says the lack of federal standards is “foolhardy” as other nations move ahead with standards of their own.

“The U.S. must play a role or we will fall behind.”

Competitive pressures

In the midst of it all, the trucking industry’s aftermarket suppliers face the potential of new competitive pressures driven by a push for a higher minimum wage and coming “buy American” provisions that would affect the domestic content in goods sourced for federal work.

“They’re talking about a tax incentive to repatriate goods. But what does that mean to someone who can’t?”

MEMA will be monitoring the impact of the Canada-U.S.-Mexico trade agreement, steel and aluminum tariffs, tariffs that apply to goods source in China, and changes to immigration policy that might affect skilled labor, Wilson said.

Covid represents ongoing challenges of its own, of course.

Wilson encouraged aftermarket manufacturers to refer to state plans for vaccine distribution, as well as emergency temporary standards that could mandate requirements for related business plans, assess Covid-19 standards, expand definitions for physical distancing, and require testing for employees.

Aftermarket suppliers represent about 900,000 direct jobs in the U.S., and that total increased between 2015 and 2019. Policy makers need to recognize they operate in a global economy, Wilson observed.

“Protecting a global industry does not mean that we turn our backs on U.S. jobs,” she said. “Rather, we must embrace the role that strong global industries have on a vibrant U.S. economy and workforce.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.