5 reasons why 2021 will be better

Congratulations. You’ve made it through one of the most unpredictable, volatile, chaotic years in the history of trucking. Or as some economists like to refer to it, a “dynamic” year.

As 2020 came to a close Covid-19 cases were still surging, and regional lockdowns were being implemented in various regions of the U.S. and Canada. But, the delivery of vaccines was underway, being first administered to those most at risk of infection. As the vaccine is rolled out, we can all eagerly look forward to a return to some semblance of normalcy. But what will normal look like in trucking? All signs point to a much better year than the one we just endured. Here are five reasons to believe 2021 will be a better year for the trucking industry than 2020:

It’s not 2020

No one could have anticipated what 2020 had in store for global economies, supply chains, and the trucking industry itself. The good news is, a dearth of freight was short-lived and the year ended better for trucking than many could have dreamed for in April. The better news is, a vaccine has arrived and began going into arms in late 2020.

This should restore some level of normality in 2021. While there are pockets of resistance against the vaccine, Bill Witte, industry forecaster FTR’s economic expert, said there will be pressure to be vaccinated – and provide proof of vaccination – to once again enjoy life’s pleasures such as attending sporting events, concerts, restaurants, or even to travel. For this reason, Witte feels even vaccine skeptics will line up to receive it, as the desire to return to in-person events and activities will outweigh fear of the vaccine itself.

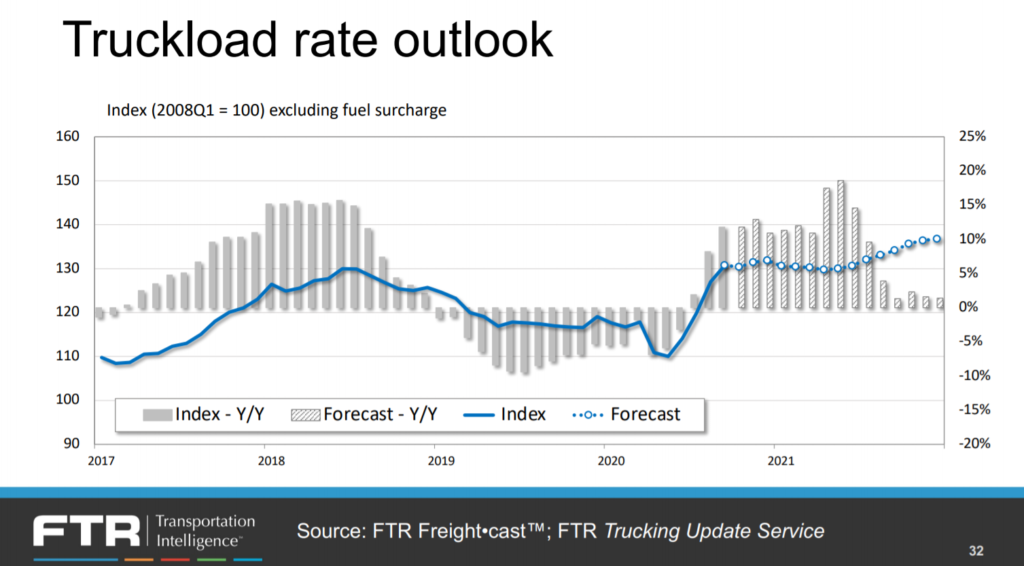

Rates are expected to rise

Spot market rates surged in the second half of 2020, and contract rates normally follow about six months later. So, it’s little surprise that analysts are expecting contract rates to rise in 2021.

FTR is projecting 8-10% rate increases this year, with truckload contract rates to lead with as much as a 10% increase. In a recent market update, Paul Kroes, market insights leader for Thermo King Americas, suggested carriers will see double-digit contract rate increases next year in the U.S.

When discussing third quarter earnings, Ted Daniel, CEO of Titanium Transportation, expressed optimism of some more modest rate increases in the neighborhood of 3-5%. “There is some concern on the part of customers to lock in [capacity],” he said.

Fleets are racing to secure build slots

Improving rates and increasing freight demand have prompted carriers to begin scrambling to secure equipment build slots this year.

Trailer orders from U.S. and Canadian fleets reached their lowest point in the modern era in April, at just 300 units, according to data from FTR. However, they shot up to 54,200 units in October, marking the third best month ever, according to ACT Research, before pulling back in November. Trailer orders are seen as a leading indicator of trucking market conditions.

“Increases in both freight volumes and rates, along with capacity challenges, have influenced fleets to aggressively enter the market,” said Frank Maly, director of commercial vehicle transportation analysis with ACT Research.

Class 8 truck orders are also surging, from a record low 4,000 units in April, to a robust 52,600 in November – also the third best month on record.

“Fleets became much more confident about future freight demand and began placing large orders to replace older units and for expansion purposes, as capacity tightened. In just a few months, the industry has gone from fear, to hope, to optimism. It appears the industry has sluffed off the uncertainties about the pandemic for now,” said Don Ake, FTR’s vice-president of commercial vehicles.

In addition to being optimistic about freight demand, fleets may also be concerned about supply and labor shortages at truck and trailer plants. Ake said the first half of the year will be strong for equipment orders, but if the economy doesn’t live up to expectations, cancelations could sour build rates in the second half.

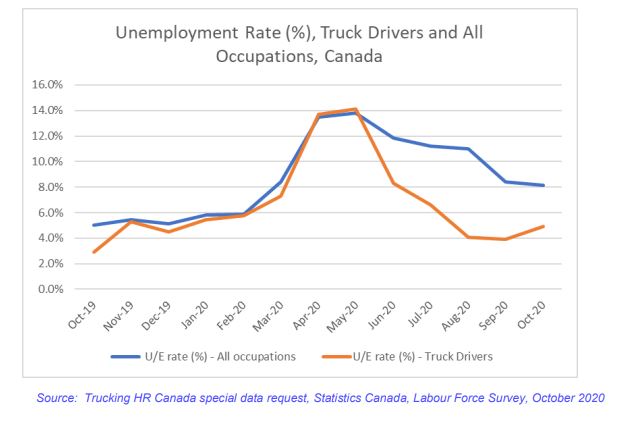

Driver shortage will keep lid on capacity

Despite the flood of new equipment into the market next year, the driver shortage will keep a lid on capacity and keep the pricing pendulum swinging in carriers’ favor. Drivers, especially older ones, exited the market in growing numbers in 2020 to protect themselves and their families from the virus. At the same time, new entrants were limited as training schools and fleets’ new-entrant training programs were halted due to social distancing requirements, and driver licensing agencies temporarily ceased issuing new licences.

Surging demand for courier and messenger jobs also siphoned off some truckers, who wanted to remain closer to home.

Trucking HR Canada recently produced a labor market update that indicated transport truck driver unemployment was just 3.9% in September, compared to 8.4% across the broader population. Trucking HR said the upward trend in employment is even higher than expected, signalling that a return to pre-Covid labor shortages could happen sooner than anticipated.

“This factor serves as an urgent call to action for industry and government to work together to overcome this labor shortage so as not to hinder the economic recovery,” Trucking HR said in a release.

In the U.S., the new drug and alcohol clearinghouse will have put about 60,000 drivers on the sideline by the end of 2020; they can’t be rehired as drivers until completing a return to duty program. All these factors combine to put extreme pressure on the driver market, which should give carriers pricing power well into 2021 and limit their ability to add capacity.

Inventory shortages persist

Of course, all the above is great in theory, but only if there’s continuing strong demand for trucking services. But that, too, is a positive story heading into 2021. Retail inventory shortages continue to create strong freight demand and the pandemic shifted consumer buying habits from experiences, to goods that move by truck.

U.S. imports hit record levels in late 2020, according to Tim Denoyer, ACT Research’s vice-president and senior analyst.

“We have a flotilla of containerships off Southern California waiting to unload,” he said in a mid-December market update. “This bottleneck suggests strong freight volume growth will continue even after the holiday season, as retailers restock inventories.”

Canadian spot market load volumes set a new post-pandemic high in the third week of November, according to data from Loadlink Technologies. The latest numbers available show November marked a record seven straight months of load volume growth. Capacity also was tightening, with 2.98 trucks posted per load, a 9% reduction from October, and 13% below November 2019 levels of 3.43 trucks per load.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Good informative update, thank you

Get rid of Trudeau and this country would be a better place!