Canadian spot market sets record for monthly load increases

TORONTO, Ont. – Canada’s spot market freight volumes continued to climb in November led by Western Canada and inbound cross-border freight activity, Loadlink Technologies reports.

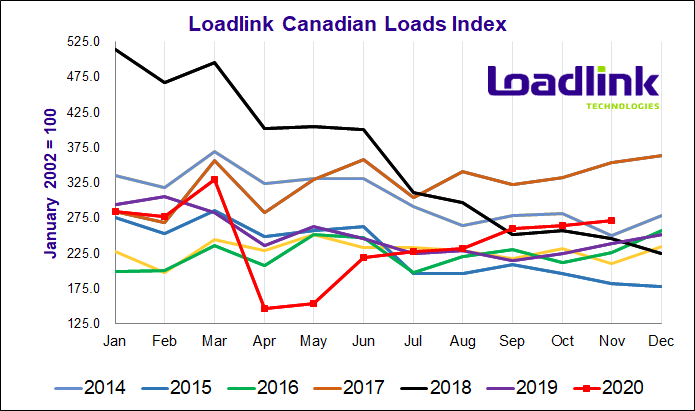

November marked the seventh straight month of improved average daily and overall monthly load volumes, which is the longest streak Loadlink has recorded since tracking the data.

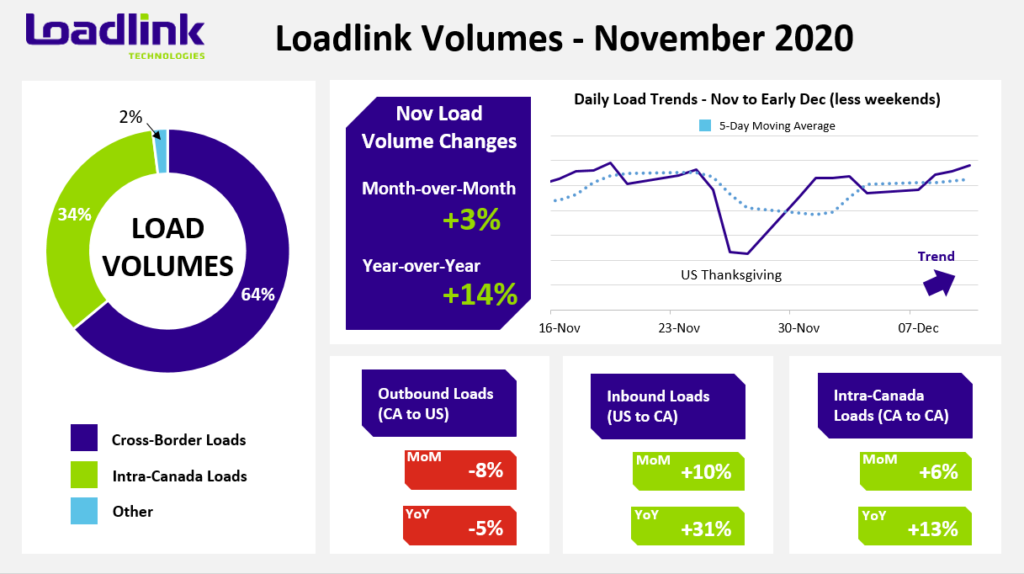

Average daily and overall monthly loads were up 3% from October, and 14% year-over-year, while equipment postings decreased a tick. Domestic activity was driven by strong freight volumes in Western Canada, Loadlink reports. November was highlighted by the best single week for loads since the pandemic struck in the third week of the month. The following week saw volumes dip 13%, likely because of the U.S. Thanksgiving holiday.

December is expected to be another strong month, according to Loadlink.

“December load volumes have historically followed no clear trend and can fall on either end of the spectrum in regards to higher or lower number of loads compared to November,” the company said in a release.

“But with a larger shift to online shopping during the pandemic and less in-person gift hauls from large retailers and big box stores, the Canadian spot market may see an uptick in activity, year-over-year, to accommodate increased demand to fulfill this need. Loadlink Technologies expects load volumes to rise slightly in December while equipment availability will take a slight dip.”

When it comes to cross-border freight, southbound loads were down 8% in November, and dipped 5% y-o-y. But inbound cross-border freight was up 10% from October, and 31% higher y-o-y. Equipment postings, meanwhile, were down 11% from October. Western Canada was the biggest benefactor, with a 22% increase in inbound loads from the U.S.

Within Canada, loads increased 6% and were up 13% from last November. Western Canada led with a 24% increase in domestic loads. Ontario and Quebec, both experiencing a resurgence in Covid-19 cases, saw domestic loads decrease by 6% and 9%, respectively.

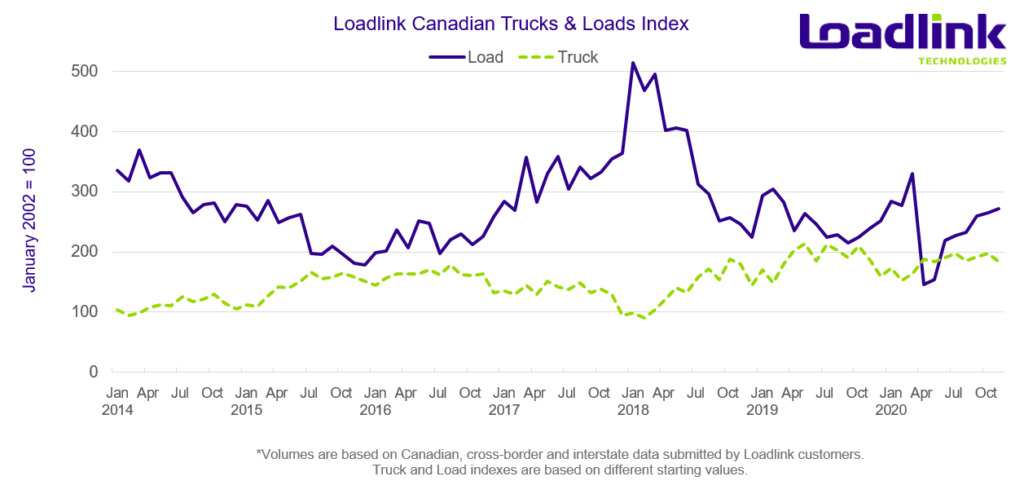

Capacity was tighter in November, with a 9% decrease, the largest tightening since June, with 2.98 trucks per load, down from 3.28 in October. It was the first time the truck-to-load ratio was below 3.00 sine March. Truck postings reached their lowest point since March, and the ratio was 13% below November 2019 levels of 3.43.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.