Canada’s spot market sees change of pace

TORONTO, Ont. – TransCore Link Logistics’ Canadian spot market saw a dramatic shift from the norm in March, setting multiple new precedents during the month.

For the first time in Loadlink history, load volumes in March were below that of the February preceding it.

Truck volumes climbed upwards to cement March 2019 as the month with the second highest total truck volumes in history, behind only October 2018. The highest number of truck postings ever recorded on Loadlink for a single day occurred on March 25, 2019.

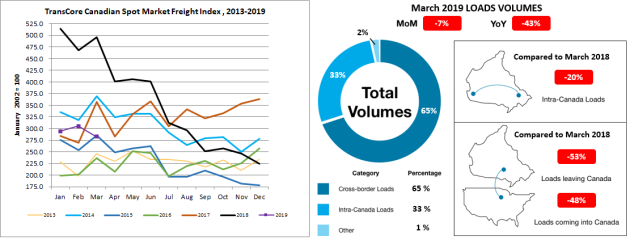

Month-over-month, March’s load volumes finished seven per cent lower than February, while these numbers were down 43% year-over-year.

First quarter load volumes were up 21% compared to the fourth quarter of 2018, but were down 40% from the historic numbers noted in the first quarter of 2018.

First quarter equipment postings were the strongest first quarter postings in Loadlink’s history. Overall, the first quarter of 2019 falls behind the fourth quarter of 2018, which saw very strong volumes in the month of October. This contributed to capacity peaking to an all-time high in the fourth quarter. Equipment volumes for first quarter 2019 were up a significant 70% year-over-year. In the first quarter of 2018, truck availability was very limited.

Intra-Canada loads accounted for 33% of the total volumes. Load postings within Canada decreased three percent compared to February and were down % year-over-year.

- Loads within Canada entering Ontario and Quebec decreased 11 and seven per cent, respectively.

- Loads within Canada entering Atlantic Canada increased 44%, while loads entering Western Canada were relatively flat, increasing by one per cent.

- Loads leaving Ontario and Quebec to the rest of Canada decreased six and 11%, respectively.

- Loads leaving Atlantic Canada to the rest of Canada increased 30%, while loads leaving Western Canada saw a small uptick of two per cent.

- Cross-border load postings represented 65% of the data submitted by Loadlink users.

An overall decline of 10% in cross-border load postings was observed in March, mainly due to a decrease in loads entering Ontario and Quebec, similar to declines noted in February.

- Loads leaving Canada to the United States decreased 14%; however, loads entering Canada from the U.S. slipped eight per cent.

- Loads from the U.S. entering Ontario decreased 17%, while loads entering Quebec decreased seven per cent.

- Loads from the U.S. entering Western Canada increased 16%, while loads entering Atlantic Canada increased 18%.

Equipment performance

March equipment numbers increased 21% while the daily average number of truck postings increased by nine per cent. Compared to March 2018, capacity was up 72% year-over-year. Capacity for the month was the highest for any March ever recorded in Loadlink’s database.

Truck-to-Load Ratio

The truck-to-load ratio in March was 2.79. This 30% increase over February was driven by surging truck volumes, compounded by a surprising dip in load volumes during a period when load volumes typically exceed the preceding two months. Year-over-year, the average ratio increased 203% from 0.92 in March 2018.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

What ??? LOL ,told you ! This clearly indicates that there is NO driver shortage as well ! It’s a “mirage” .

Driver shortage rants are hocus pocus at it’s finest ! Poor guys in the trucking industry have been mislead ! And trucking associations want the trucking industry to recruit our youths too become drivers ???

Our youths are not attracted to driving trucks , they’re designing them into autonomous ones !

Quote :

“This 23-Year-Old Robotics Prodigy Is Leading The Pack In The Driverless Truck Race ”

https://embarktrucks.com/press.html

Have a nice day !

We do not need foreign truck drivers at this time. Wages per hour are less than many other jobs at this time. With the carbon tax rates need to be at least $2.00 per mile both ways plus dispatch fees. Many load gross $1.75 to $2.05 per mile minus 10 percent dispatch fees. There is a shortage of skilled mechanic s but to compete with other jobs in the trades need to pay $30 to $40 per hour for mechanic and $24 to $30 for truck drivers. The rates are dropped to the point that is hard to pay those wage rates.