Conditions stay positive for shippers: FTR

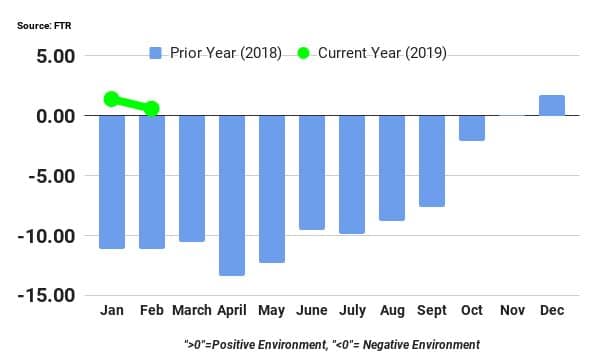

BLOOMINGTON, Ind. — At a reading of 0.6, FTR’s February Shippers Conditions Index (SCI) reflects a balanced freight market.

February is the fifth month in a row that the SCI has been in positive territory with forecasts for the shipping environment to gradually improve through early Q4. After that, conditions should settle into a near neutral range with truck freight rates expected to be down, capacity additions likely decelerating and a relatively stable fuel cost outlook. However, if recent increases in crude oil prices continue, that could raise shippers’ costs and negatively impact the SCI reading, FTR said.

Todd Tranausky, vice-president of rail and intermodal at FTR said: “The freight market remained relatively balanced in February despite the beginning of significant weather-related disruptions to freight flows. A stable truck market combined with resilience in the eastern rail networks have helped keep shippers conditions from deteriorating.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Quote:

June 1 2019

“Weak Consumer Spending And Trade War Madness Fuel 2020 Recession Chances

The most recent GDP numbers are out, and they reveal that US consumer activity is weak. This is important, because consumer spending represents more than 2/3 of total GDP.

Consumption weakness is most obvious in the declining spending on goods, where purchases are at their lowest percentage of GDP since the Great Recession. Including services, consumer spending added 0.9% to the recent 3.1% GDP growth number, a contribution that is well below its average over any period since records started in 1947.”

Quote :

“However, if recent increases in crude oil prices continue, that could raise shippers’ costs and negatively impact the SCI reading, FTR said.”

LOL !

If ,as you say , which is not the case , but responding to your analogy , crude oil /gasoline /fuel prices were to continue to rise then consumer spending would decrease of which would decrease demand for goods. Therefore , FREIGHT would decrease as would freight rates !!! Thus decreasing shippers costs ! Furthermore , since high oil/gasoline/fuel prices weigh negatively on consumer spending , higher oil ,gasoline and fuel prices are UNSUSTAINABLE !

So my dear Watson , you got it backwards ! Elementary my dear Watson , it’s “elementary” !!!!!

By the way , consumer spending has been and is decreasing my dear Watson !!!!! Oh my and so has the price of Crude Oil TODAY !

Rather than elaborate and write a mile long paper myself , I found this simple but clear article for you ……….

ENJOY my dear Watson !

https://www.marketwatch.com/story/behind-that-great-gdp-number-the-real-economy-is-slumping-2019-04-26