Facility Association introduces telematics, surcharges, tightens insurance oversight

Facility Association (FA) — an insurer of last resort — is introducing several changes including a telematics program to help Alberta fleets and owner-operators; new efforts to keep closer tabs on those who misrepresent where they’re based or repeatedly change trucks on policies; and altering its U.S. exposure surcharge.

The Facility currently provides services in Ontario, Alberta, New Brunswick, Nova Scotia, Newfoundland and Labrador, Northwest Territories, Nunavut, P.E.I., and Yukon.

It serves as an insurance safety net for individuals and businesses who struggle to obtain coverage elsewhere. They provide coverage for those with poor driving records or those considered high-risk and unwanted in the regular insurance market.

“The best way I would describe [the Facility] on the commercial side is – we are the orphanage,” says Saskia Matheson, president of the Facility Association.

Different insurance

Unlike the general market, Facility Association doesn’t require fleets or owner-operators to meet specific criteria for insurance approval.

This is why the fleet insurance process through the FA is different.

In FA, coverage is offered through Individually Rated Commercial Auto (IRCA) insurance, where each vehicle used for business purposes is individually rated and priced based on specific risk factors associated with it. Each truck must be listed individually on the policy by its VIN.

The general market, however, often offers ‘blanket’ insurance policies for fleets, covering multiple trucks at various locations under one policy, regardless of whether each truck is listed or not.

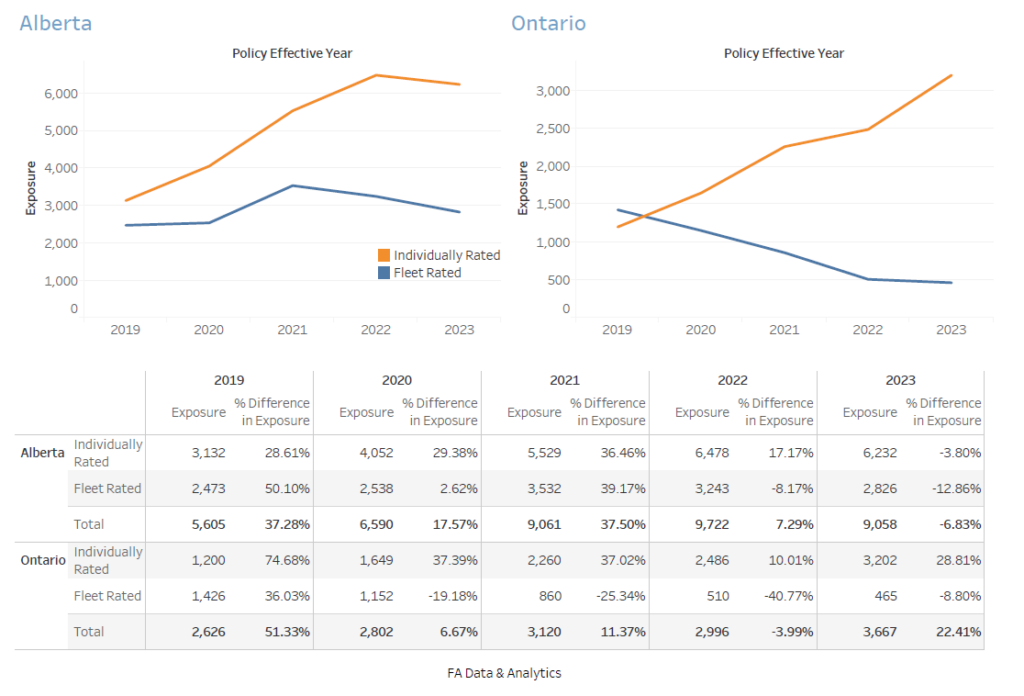

In the last year, Facility has seen an increase in individually rated trucks in both Alberta and Ontario, says Matheson. The organization has also seen a leveling off in fleets in Alberta and a continuing decrease in Ontario fleets over that time.

On average, Matheson says, they tend to stay with Facility for three years.

Alberta telematics program

FA introduced initiatives to address some of the ongoing trucking issues in Alberta, as it remains one of the “problematic” provinces.

This includes a telematics program introduction. The program allows companies and operators to install telematics units in their vehicles to accurately track their routes and distances traveled.

It is meant to ensure transparency and help companies find a place in the general insurance market.

“We give them a discount to sign up for the program. So, it’s better than free,” says Matheson. “We are the anti-marketing association. We keep trying to send them away because they’re better off in a regular market. They’ll pay less, they’ll have more choice.”

Facility will collect data on trucking risks during 2024 and 2025 to compile information on driving experiences and associated risks to produce experience letters for trucking companies. This way, new or inexperienced trucking operators will have a chance to establish a track record of safe and reliable driving, increasing their credibility and chances to leave Facility behind.

Matheson says this approach was first used by Facility with taxis in Ontario over a year ago, where telematics use has successfully helped many operators secure coverage in general market.

“We wanted to try it for trucks in Alberta,” she says. “So far, we’re not getting a lot of traction. I think that Albertans can be a little suspicious of the data we are collecting.”

Misrepresentation

It makes sense that some fleets might be resistant to the changes that promote transparency, since in the past, some operators across the country engaged in intentional information misrepresentation to shave off costs and “play the game of not telling.”

“If you’re a trucking operation that works in Ontario and you have a captive and you’re going, ‘Oh, maybe what I’ll do is register my trucking fleet in Nova Scotia,’ then the average premium for hauling unit in Ontario is somewhere in the mid $20,000s, whereas it’s $5,000 or $6,000 in Nova Scotia,” Matheson says, adding that FA worked hard over the last two years to improve its ability to find where fleets are operating.

This includes a set of surcharges that has been introduced across Canada and coordinated with provincial regulators. This ensures that regardless of where a truck is registered, if it operates in a different province, it will be subjected to a surcharge.

“Regardless if you register your trucks in New Brunswick, but you drive in Ontario, you will get a surcharge on your premium so that you are paying the same price as the guy who’s located in Ontario.”

Fuel tax reports alignment

Facility has also made efforts to align fuel tax reporting with insurance disclosure. This means FA would ensure that the fuel tax reported to the government aligns with what is reported on the insurance forms.

“We’ve got bits and pieces of this in place, and we’ve got some provinces where that’s on the go.”

Switching vehicles

One of the other practices that Facility has noticed fleets do is swapping vehicle registrations on the policy. Matheson says while this is not a common practice, the association noticed some individual cases.

“They say, ‘Well, I’ve got 10 trucks, but I only have five on the road at any given time. Why shouldn’t I just flip them back and forth?’” she says speculatively, explaining that insurance premiums are based on the assumption that a portion of the fleet trucks are parked part of the time as is.

By constantly adjusting their coverage, operators not only cheat other trucking companies by skewing the average, but they also expose themselves to major risks.

“If that document is not going to go in [on time], and something’s going to go wrong — for example, there’s going to be a WiFi failure, or there’s going to be an accident and a vehicle is going to hit a school bus full of children in Saskatchewan — there’ll be no insurance. So, people play games with insurance, because many times they don’t understand the full risk.”

Matheson adds in such a scenario none of the excuses will work. If the VIN number is not listed on the policy, the truck is not covered.

U.S. surcharges

When it comes to coverage outside of Canada, last year Facility introduced higher surcharges for operators who travel through high-risk zones in the U.S.

Prior to that, the surcharge was at 1% across the U.S., meaning if 30% of the truck’s operations were in the U.S., the surcharge would be 30%.

However, as of Nov. 1, (Dec. 1, 2023, in New Brunswick), fleets and owner-operators saw higher surcharges for separate U.S. regions — 1.25% or 1.50% per percentage based on exposure in moderate and high-risk zones (Regions 2 and 3), respectively.

Meanwhile, the surcharge remained at 1% in lower-risk states (Region 1), such as Alaska, Iowa, Utah, Idaho, Oregon, North Dakota, Nevada, Nebraska, and more.

Meanwhile, the highest risk zones are mostly located on the eastern seashore. Non-eastern states on the list are Alabama, Hawaii, Louisiana, Mississippi, Texas, Vermont, and West Virginia.

Matheson says these changes make a big difference in pricing.

“Our trucking situation, which was really bad profitability-wise a few years ago, is much better now,” she says. “With the exception of fleets in Alberta, that are still struggling. But we are working on that.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

-

It’s law that you must have insurance, ergo “the government” must provide an avenue for insurance. So no, they don’t turn anyone down However, there is also no limit on what they can charge 🙂

I fail to understand the FA inability to view the carriers fuel tax reports. I provide our companies reports prior to renewal every year.

Further – I believe companies would be more open to “following the rules” regarding truck on the road, if the repercussions of false reporting were presented in a clear fashion. The insurance company could also review a public Carrier Profile on the carrier and/or request the carrier undergo a National Safety Code review – which can be costly, but can also be very beneficial.

I recently had a situation in which I wanted to add a driver to my policy but his previous employer would not provide proof the person was in fact a qualified AZ driver with over five years of driving experience. Consequently I did not put him on my policy to drive a D class truck because of the cost. He is on the policy to drive a 1/2 ton pick up.

Is there any way that my insurance company can access his previous insurance rating?

Thanks

Excellent article Krystyna, a quick question. do they turn anyone down?