Canada’s commercial vehicle market to recover slower than U.S.

The market for commercial vehicles is beginning to climb back from the steep downturn seen in 2020. But an association representing the work truck industry doesn’t expect a return to peak levels until at least 2025.

Short-term challenges such as a shortage of computer chips and long-term issues such as debt-ridden public sector buyers will continue to weigh on the recovery, says Steve Latin-Kasper, senior director -market data and research at NTEA.

“We are still expecting a fairly long slog back to the 2019 peak.”

It took a decade for the commercial truck industry to recover from the 60% decline seen during the recession of 2007/09, he noted in an online briefing for media. Even then, the 2019 peak for Class 2-8 truck sales was still a little below the one established in 2006, although some specific market segments performed better than others.

Following that, the economic downturn seen in the second quarter of 2020 had not been seen since the 1930s, and the rebound in the third quarter had not been seen since the economic surge in the wake of World War Two, he added. In a macroeconomic sense, today’s economy almost “looks normal”.

Better, but hardly back to the levels seen in 2019.

The Canadian market

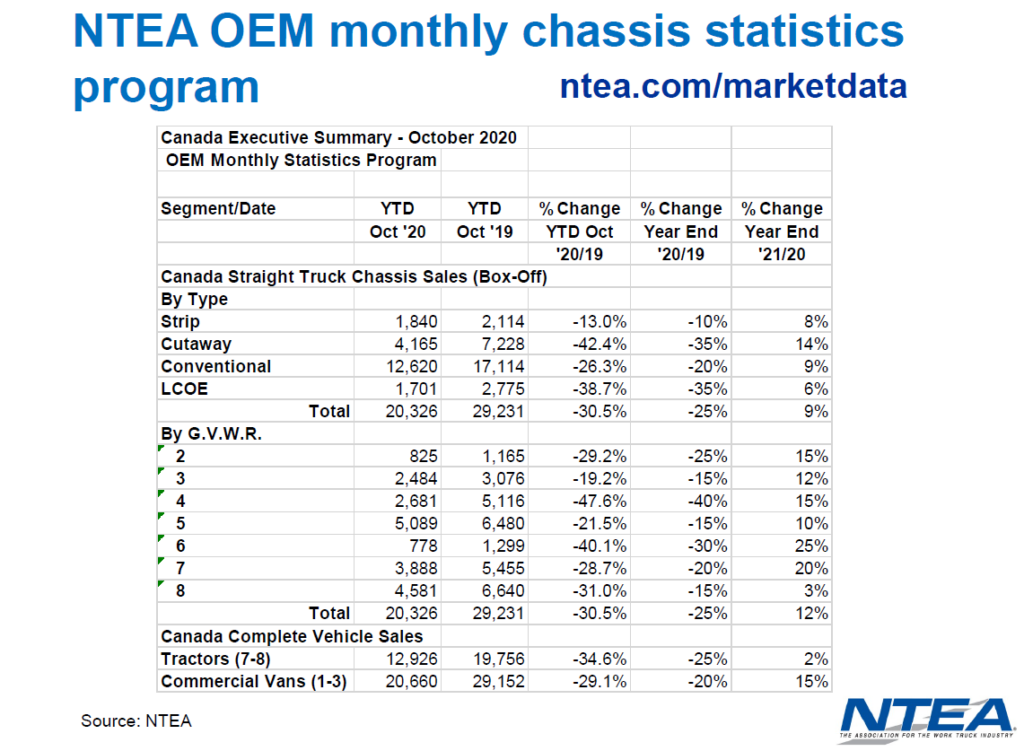

Canada’s year-to-date straight truck chassis sales had dropped to 20,326 units as of October 2020, compared to the 29,231 year-to-date sales seen as of October 2019. While the market improved somewhat in the final months of the year, the year-end totals are expected to be 25% lower than those seen in 2019.

NTEA projects such sales will increase 9% this year.

Complete Class 7-8 tractor sales were down 34.6% to 12,926 year to date units as of October 2020, compared to the 19,756 seen as of October 2019. Recent increases mean the annual market was down 25% as of the end of 2020, but NTEA projects the market to be up 2% by the end of 2021.

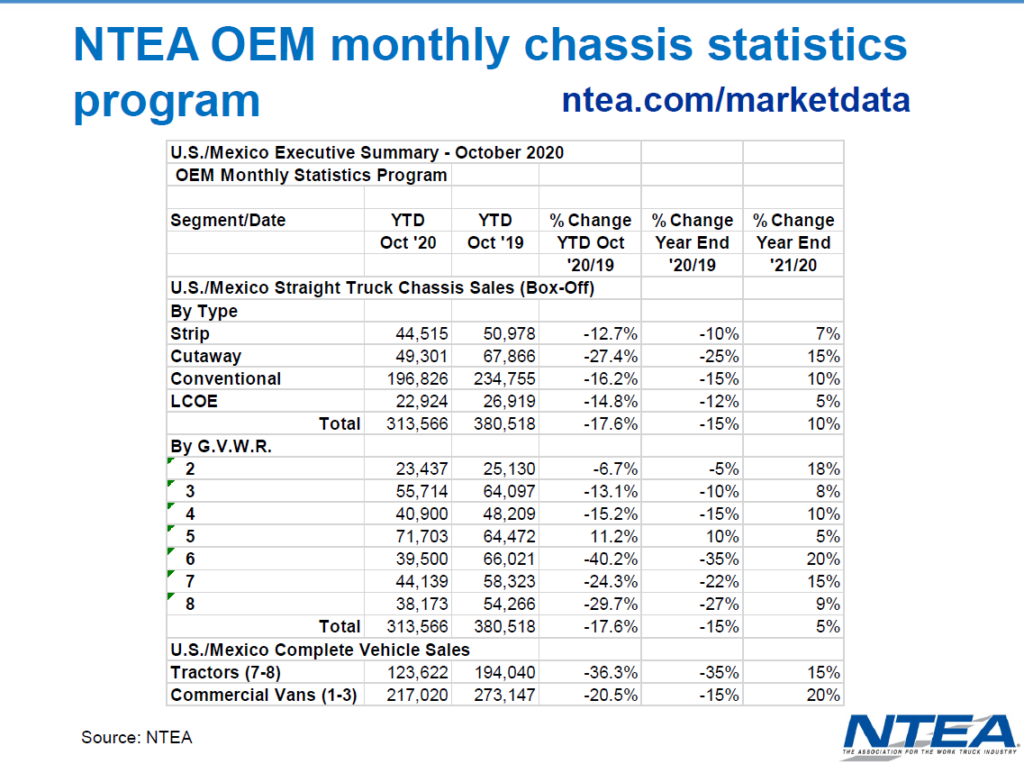

This lags behind the recovery expected in the U.S. and Mexico, where Class 7-8 tractor sales dropped 35% in 2020. The association projects sales in those markets to grow 15% in 2021.

Canada’s Class 1-3 commercial van sales faced a drop of their own, reaching 20,660 YTD as of October 2020 compared to the 29,152 in October 2019. But that market improved to a 20% year-over-year drop as of the end of 2020, with projections of 15% growth by the end of 2021.

In the U.S. and Mexico, a 15% drop in this market segment during 2020 is expected to shift to 20% growth in 2021.

Market forces

An increase in Final Mile activity has boosted the market for Class 2-5 trucks more than Class 6-8 vehicles, Latin-Kasper said. The projected growth in Class 2-5 unit sales is also expected to be much higher than heavier classes because Class 3-5 trucks are the largest industry segment in terms of volumes.

The 2019 totals were admittedly skewed somewhat by Amazon, which ordered 100,000 units that year.

“That couldn’t last. The spikes never do,” he said. “We are now back essentially on the trend that had been established.”

But when OEMs restarted manufacturing activities in June, there was still a huge increase in shipments that matched the spike seen in 2019. “We’re looking for good things to continue happening in the commercial van segment,” Latin-Kasper added.

The pandemic also sped up the steep decline in trailer demand that began in 2019, but that market rebounded to near-record levels in November and December. The activity is expected to continue this month.

“The level of freight has already increased substantially and you can see the freight shipment in terms of year-to-year change leveling off,” Latin-Kasper explained. “They’ll need more trailers to accommodate that difference in freight.”

In terms of trucks, chassis availability is expected to improve in the first quarter of 2021, but there will still be challenges.

“There are some supply chain issues,” Latin-Kasper said. Last month there were broad challenges with sourcing computer chips that are used by the dozens in typical trucks. That will lead to some production slowdowns, although that’s expected to be temporary.

Commodity prices will face some pressures of their own, as growth in China drives steel sheet and plate prices higher. But he expects the price pressures to be offset by re-opening capacity among suppliers, meaning that increases in the steel prices should be slower than those already experienced with aluminum

“The aluminum industry is already reaching what appears to be a near-term peak,” he said. “We may yet see another little spike in the aluminum industry pricing.”

Even then, he isn’t expecting to see the peak prices seen in 2018.

Financial markets

Interest rates could have a bigger effect on the market.

Heavy-duty truck production will be dictated in part by prime interest rates, and the U.S. federal reserve is holding rates close to zero through 2022.

“I don’t expect that to hold up,” Latin-Kasper said, referring to economists who believe inflation could move beyond 1.5-2% by the third quarter. “Inflation is expected to become an issue.”

State and local governments, meanwhile, will have to address the debt loads linked to Covid-19 relief efforts, and they account for about 15% of commercial truck purchases in the U.S.

“That’s going to cause some big problems for a big market for a big market for commercial truck and truck equipment for at least the next two, probably three years,” he said. “It’s going to take them awhile to dig out of this.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.