Transparency, technology help secure best insurance rates

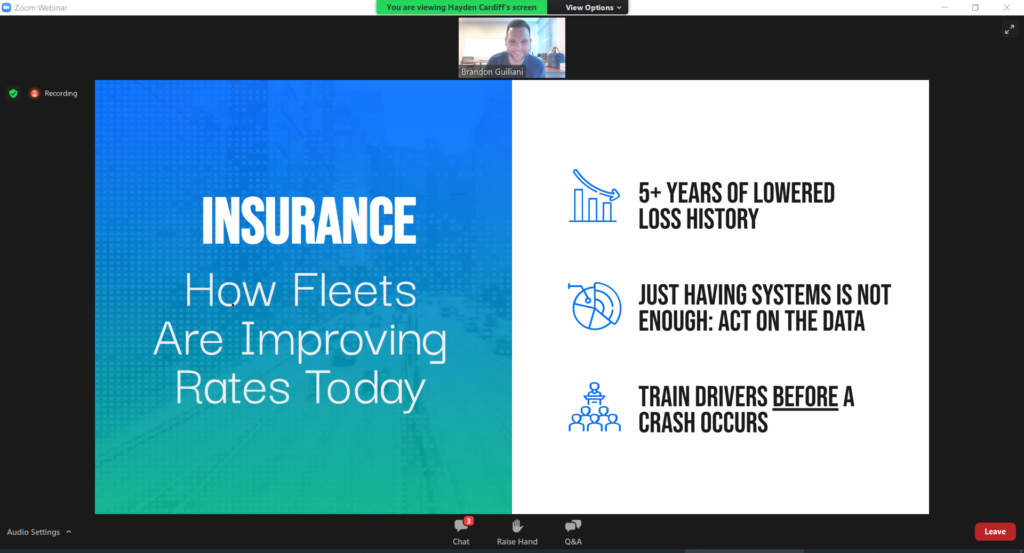

Transparency — along with safety-related investments in technology and personnel — continue to emerge as the keys to help fleets secure favorable insurance rates. But Brandon Guiliani, Seubert & Associates’ transportation practice leader, urges carriers to act on such matters months before their policies are up for renewal.

“Put proactive coaching steps in place,” he said during a webinar hosted by the Truckload Carriers Association (TCA). “Nuclear verdicts are on the rise. Give yourself 12 months to put key ingredients in place. It gives you time to evaluate an insurance carrier.”

It’s more important than ever. Fleets are facing challenges that include rising insurance rates, decreasing insurance availability, and unpredictable costs, said Idelic founder and chief innovation officer Hayden Cardiff, who moderated the discussion.

Safety cultures

If fleets do not use the data they have, plaintiff attorneys will use it against them when a claim arises, Guiliani added, noting that available technology provides loads of useful information to set drivers on the proper path.

Gary Flaherty, Nationwide senior vice-president – commercial auto E&S, noted that insurers explore fleet safety cultures as well as driver and vehicle files. It’s why things like optimized routes are becoming evermore important to those behind the insurance policies.

Those fleets that are rapidly growing will need to show they have the capacity — as well as the right people and technology — to handle the growth, Flaherty said.

Approaching claims

When claims do occur, Cardiff said fleets need to know who will be handling the files.

Guiliani, for example, said fleets should evaluate the insurance carrier’s expertise around trucking-related claims claims.

Fleets, meanwhile, will also be scrutinized when it comes to the ways they approach claims. Whether it is a minor or major crash, insurers want to see signs that steps are being taken to minimize losses.

Every driver-related violation could lead to bigger problems in the future, after all. It’s why Guiliani stresses the importance of training or retraining. If someone is involved in a collision, plaintiff attorneys won’t care if it was the first such collision in the past five years. Warning signs need to be identified and addressed.

Trucking companies should approach renewals like preparing for a test, Guiliani advised. When an underwriter asks a broker questions, and answers are ready, the process is easy, he added.

Insurers might assume the worst if a fleet is not transparent, Flaherty said. If a problem or issue is discovered later, it leaves a bad taste and could affect the relationship. And that relationship is a valuable asset.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.