Continued capacity tightness, higher rates expected in ’21

It’s a tale of two economies in 2021. The good news for trucking is that the goods economy will outpace the overall economy, and with no quick end to capacity tightness in sight, that should translate to higher rates for truckers.

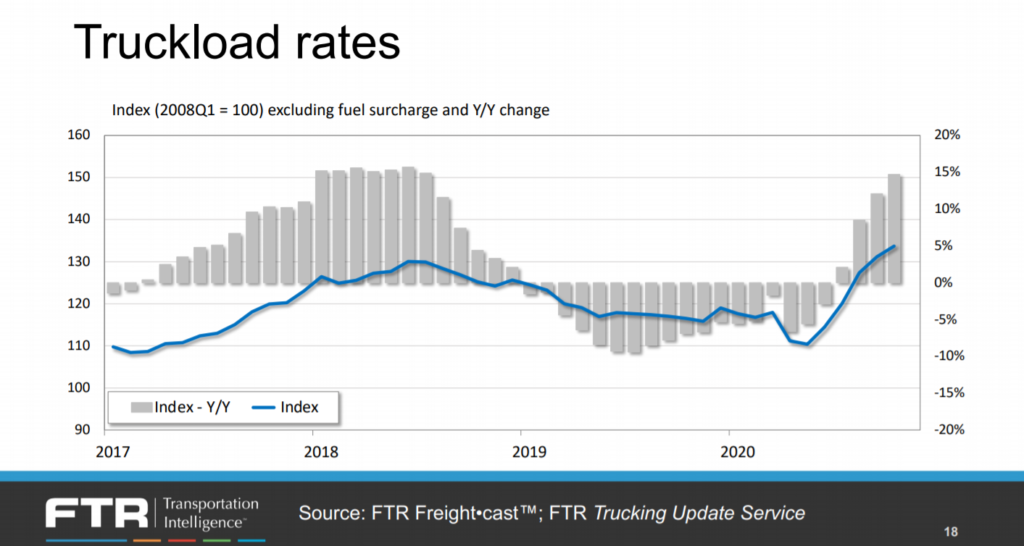

That was one of the conclusions from industry forecaster FTR during its most recent State of Freight webinar Jan. 14. Avery Vise, FTR’s vice-president of trucking, said contract rates should be up about 11% year-over-year in 2021, as they tend to lag the spot market by six to eight months.

Spot market rates should also climb, about 4-4.5%, Vise added. Rates ended 2020 up about 3% versus 2019, despite all the volatility caused by the Covid-19 breakout in March.

“It doesn’t look like much if looked at in isolation,” Vise said. “But if you look at what happened in 2020, it’s pretty amazing.”

While there are some risk to FTR’s rate predictions, Vise said “I don’t think this can pan out to be a weak year for rates because of the capacity tightness that’s built in. Even if there is some weakness in freight below what we’re projecting, I don’t think we’re looking at a 2021 where [rate increases] are in low single digits.”

Eric Starks, CEO of FTR, said this also aligns with anecdotal reports from fleets as they bid on contract freight.

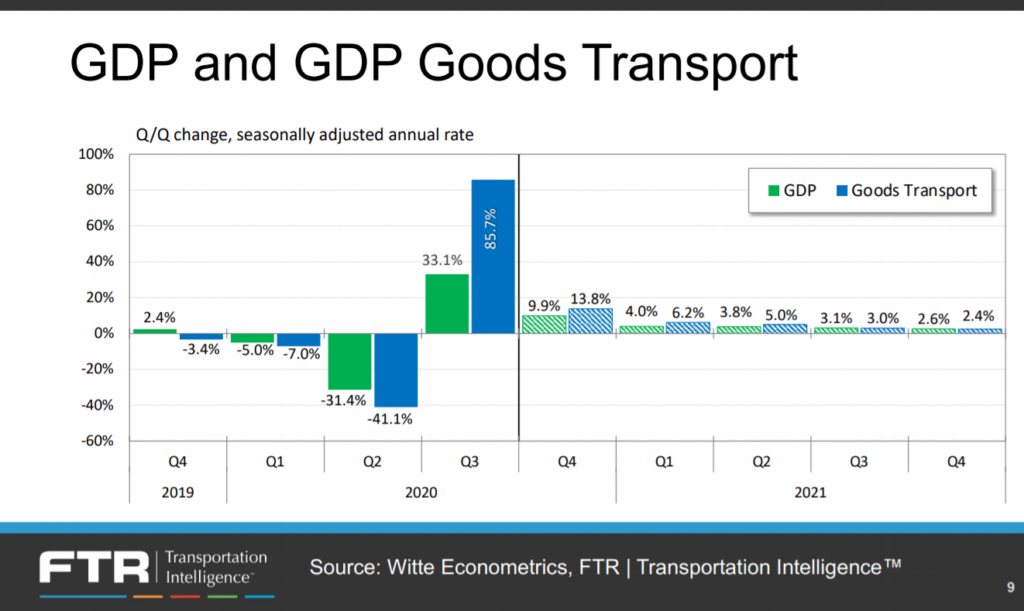

Since the pandemic hit in early 2020, the goods economy has recovered much more quickly and fully than the broader general economy. Vise expects that trend to continue, even though the goods economy has already nearly recovered to pre-pandemic levels.

“We are expecting to see the goods economy outpace the overall economy for a few more quarters,” he said.

This is because consumers are shifting their spending from services to goods, as many services such as meals out or live events remain unavailable or inadvisable.

Consumer spending on services remains down 6% from February 2020, while spending on goods is 6.7% above pre-pandemic levels.

Truck freight will continue to benefit from retail inventory replenishment, with the retail inventory-to-sales ratio near an all-time low. Increased spending on goods is making it difficult to restore that ratio to traditional norms.

Industrial and manufacturing investments remain weaker than before the pandemic, but Vise is optimistic they will rebound.

Freight volumes on the U.S. spot market set a new record high in the first week of January, but Vise cautioned that reflects some carryover holiday shipments that were delayed. The next few weeks will paint a clearer picture of freight demand.

Overall, freight loadings were down about 4% in 2020, but have mostly recovered to pre-pandemic levels. Active truck utilization is on the rise with driver availability continuing to limit capacity.

Trucking payroll jobs were down 3% from before the pandemic. This is in part to the new drug and alcohol clearinghouse sidelining more than 45,000 drivers for failed drug tests, representing about 1% of all U.S. drivers. Only a third of those have begun the return to duty process, Vise noted.

The biggest risk to FTR’s 2021 outlook is the continued spread of the Covid-19 pandemic.

“It will probably be February at a minimum before we see any sort of peaking out, and hopefully not just stabilization but a reduction,” said Jonathan Starks, FTR’s chief intelligence officer, adding it will be a few weeks yet before the impact of holiday gatherings comes into focus.

The unemployment situation also remains a risk, if consumers can’t continue to drive the economy through spending on goods

Even if Covid-19 cases continue to rise, Jonathan Starks said regional responses are expected, so a broad nationwide economic shutdown will likely not be repeated.

“I think you’re going to see a much more practical response,” agreed Clay Slaughter, chief strategy officer. “As more people have the opportunity to be vaccinated, some of the reasons for the shutdowns will dissipate.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.