Economic Trucking Trends: Continued weakness ahead, but spot market rates continue to improve

Speakers at an industry outlook conference cautioned that trucking conditions are likely to remain challenging into next year, but there are signs U.S. spot market rates are gaining some strength. Even flatbed recorded a tiny gain in the most recent week.

Truck orders also suggest fleets are still confidently looking to add new equipment, albeit at a pace below replacement levels. And a survey of freight brokers reveals most feel the worst is behind us.

Here is more on the latest economic trends in trucking.

Weak conditions into ’24

Industry forecaster ACT Research brought together trucking thought leaders at its recent semi-annual seminar, where Ryder CFO warned that weak freight conditions are likely to continue.

“We’ve been living at a level of uncertainty. Hopefully, rates will begin to stabilize. We will see weakening conditions in the freight market into the beginning of the year. As you’re looking to replenish your fleet, now is the time to do it,” Diez said, according to a recap from ACT Research.

Jodie Teuton, co-founder and vice-president of Kenworth of Louisiana, noted these are uncertain times for fleets.

“Rising interest rates and insurance are always struggles,” Teuton said. “Increased truck costs and labor costs. Those things are a concern. But we go to work every day, and that will never change. We manage those challenges. From a dealer perspective, we have to educate our customers about what we see coming. Truck dealers are always consultants.”

Freight broker sentiment improving

A semi-annual survey of freight brokers by Truckstop and Bloomberg Intelligence reflected continued optimism among brokers asked about expected prospects over the next six months.

“Despite fewer spot opportunities and moderate economic activity, brokers remain fairly optimistic with about 61% surveyed expecting demand growth over the next six months,” said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence. “Freight broker sentiment is becoming less bleak as spot-rate conditions might be nearing a bottom and an economic soft landing may be achievable.”

But that’s not to say it’s been clear sailing for freight brokers. Forty-six per cent said their volumes fell in the first half of the year compared to the prior year. They also reported spot market rates (excluding fuel surcharges) fell 31% since peaking at the end of 2021, and are down 13% from year-ago levels.

However, brokers feel the bottom is in, with about 46% anticipating rates to improve over the next three to six months.

Class 8 truck orders edge upward

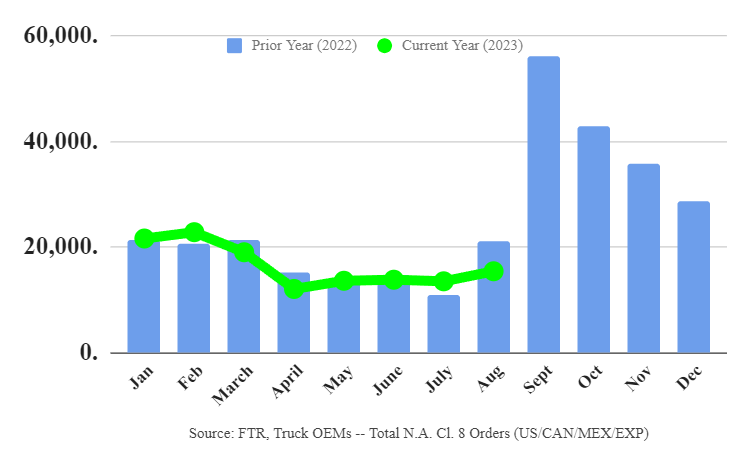

FTR reported 15,400 preliminary Class 8 truck orders for August, up 16% from July levels but down 26% year over year. But the industry forecaster reminds us that last year’s comparisons are exceptionally strong.

“As build slots start to open for 2024 production, fleets are starting to place orders on the books. However, much of the ordering for 2024 has yet to be seen and typically will not show up until September or October,” said Eric Starks, FTR chairman.

“Despite rising order activity, the year-over-year comparisons will look horrible through November due to record order activity in the second half of 2022. The actual unit order levels will be more significant in the near term than the year-over-year change in analyzing the strength of the market. Even though order activity is still below replacement demand, a key takeaway from the August data is that fleets are not shying away from ordering new equipment, which is a good sign for the second half of the year.”

ACT Research reported 19,000 preliminary orders, reflecting the strongest month since February.

“As represented by seasonal factors, the industry remains at that time of the year when expectations for order activity are low, as most of the current year’s orders have been booked and out-year build plans are only starting to open,” revealed Kenny Vieth, ACT’s president and senior analyst. “For Class 8, August is the last month of ‘weak order season,’ the four-month period that begins in May. Adding to downward pressure, the 2023 build plan has been essentially filled since the end of Q1.”

Are spot market rates gaining momentum?

Truckstop and FTR Transportation Intelligence have reported the week ended Sept. 1 saw an expected increase in U.S. spot market rates. It was the second straight week of modest total market rate increases – the first back-to-back weeks of increases since May.

It was also the first time since May that rates were higher over the previous week across all equipment types. However, flatbed — which has lagged dry van and reefer — saw only a “tiny” gain, the companies said.

Dry van rates gained six cents, their strongest jump since the end of June. Reefer rate gains were more modest but achieved their third consecutive week of improvements – a first since November 2022.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

More of forward looking positive news inside compare to the headline.