Economic Trucking Trends: Less Class 8 demand, lower used truck prices and stronger rates

As we close the books on 2023, we see Class 8 orders weaken but close out a strong year with healthy demand and a historically strong run rate.

Used truck prices in the U.S. plummeted to levels not seen since April 2021, with prices down 6% in November from the previous month.

But truckers who kept on trucking during the final week of the year were rewarded with a surge in spot market volumes, at least in van and reefer segments.

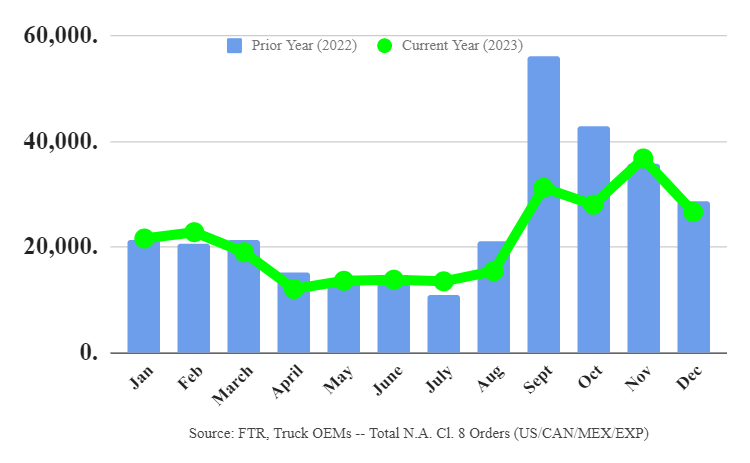

Class 8 orders end year on weak note, conclude strong year

Class 8 truck orders slid to end 2023, according to preliminary data from industry forecasters. FTR reported orders of 26,620 units for the month, down 26% from November levels and 6% year over year.

But it says the lower tally falls in line with seasonal tendencies. Orders for the year came in at 253,000 units, and OEMs continue to take orders at a “healthy rate,” the company reported.

“Despite the slight year-over-year decrease in orders in December, the market is still performing at a high level historically,” said FTR chairman Eric Starks. “Even as the freight markets have been weak for an extended period, fleets are still ordering equipment. Order levels were above the historical average but continue to follow seasonal trends, reinforcing our expectations for replacement demand in 2024.”

ACT Research took a somewhat dimmer view of the numbers, reporting 26,500 units.

“After a strong and upside-surprising November, Class 8 orders surprised in the opposite direction in 2023’s last report,” said Kenny Vieth, ACT’s president and senior analyst. “With the largest seasonal factor of the year, seasonal adjustment pushes December’s intake sharply lower, to 20,900 units. The full-year 2023 Class 8 order tally fell 7% year over year to 278,500 units.”

Regarding medium-duty performance, Vieth added: “Classes 5-7 net orders were an identical 26,500 units in December, up 53% against a very easy year-ago comp. Unlike Class 8, medium-duty seasonality is modest in December, lowering the seasonally adjusted order tally to 25,200 units, up 4.6% from November, and the best month of the year on both a nominal and seasonally adjusted basis. For all of 2023, Classes 5-7 orders were 245,700 units.”

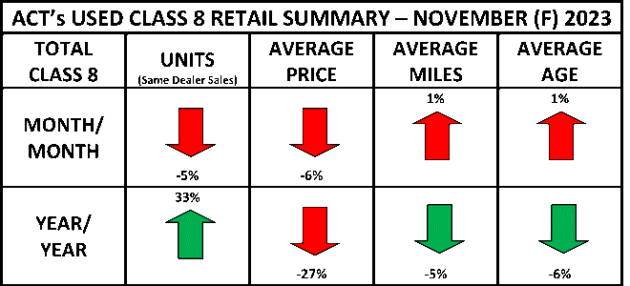

Used truck prices plummet

We don’t normally report U.S. used truck pricing trends here, since Canadian buyers tend not to buy from the U.S. market. However, there is some correlation between pricing north and south of the border and it’s notable that used truck prices in the U.S. plummeted in November to levels not seen since April 2021.

ACT Research reports used Class 8 truck prices fell 6% on the month to US$59,300.

“Less-than-expected declines in August, September, and October may have been an early Christmas present. Our expectations are unchanged, with lower prices through the end of 2023 and a return to month-over-month growth toward the end of 2024,” said Steve Tam, vice-president of ACT Research.

Regarding volumes, Tam explained, “Combined, the total market same dealer sales volume expanded 19% month over month in November. With only one more month remaining in the year, the overall market has improved 35% year to date compared to the first 11 months of 2022.”

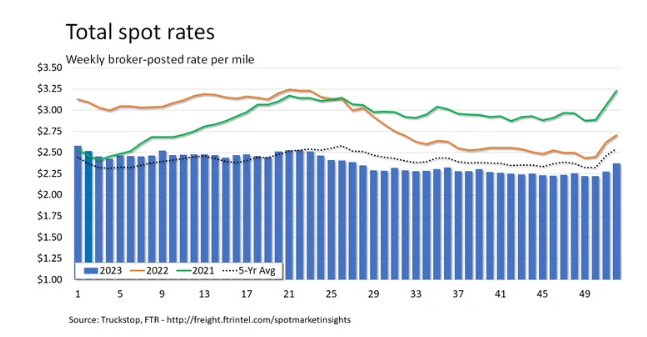

Spot rates surge to end year

The final week of 2023 was kind to truckers relying on the U.S. spot market for loads. Truckstop and FTR Transportation Intelligence report that the week ended Dec. 29 showed “robust” gains in broker-posted spot rates for van equipment.

It’s not unusual, however, since many truckers park their equipment for the holidays, reducing capacity.

“The rate gains were very strong, however, even for a final week of the year,” Truckstop reported. “The surge in refrigerated spot rates was one of the largest on record, surpassed in at least the last decade only by the spike during the final week of 2017.”

Dry van rates also rose more than usual for the final week of the year, while flatbed rates pulled back more than usual for the week.

Lest you should get too excited, Truckstop hastened to add not to read too much into the week’s strong performance. “ Because of the major disruption in capacity during the holiday week, the strong rate increase has no bearing on how spot rates might perform in January 2024 and beyond,” it concluded.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.