Economic Trucking Trends: More signs of an improving market for truckers

The latest data reflects improving conditions for truckers, an uptick in for-hire truck tonnage to end the year, and a jump in spot market prices.

Lower diesel prices are bringing relief to truckers but may also slow the pace of exits and the thinning of capacity. Private fleets are still adding capacity but at a slower pace and market dynamics are shifting back in a healthier alignment. Lots to digest this week, so let’s get at it…

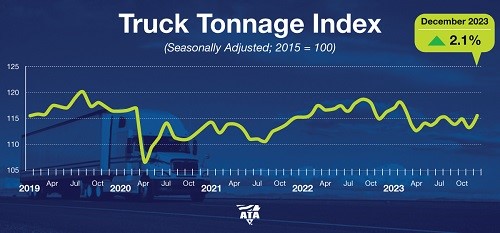

Tonnage ends bad year on an up-note

Well, it’s official. The December reading of the American Trucking Associations’ (ATA) For-Hire Truck Tonnage Index is in and 2023 was the worst year for freight since 2020, and the only year since then in which tonnage contracted.

This despite ending the year on an up-note in December, up 2.1% from November.

“While 2023 ended on a better note, truck tonnage remained in a recession as it continued to fall on a year-over-year basis,” said ATA chief economist Bob Costello. “With that said, for-hire contract freight, which is what comprises our index, in December was 2.6% above the trough in April. For the entire year, tonnage contracted 1.7% from 2022 levels. This makes 2023 the worst annual reading since 2020 when the index fell 4% from 2019, and the only year since 2020 that tonnage contracted.”

Year over year, tonnage was down 0.5% in December, marking the 10th straight YoY decrease.

Parts and labor costs resume rise

Additional data from the ATA, specifically its Technology & Maintenance Council (TMC) and service management platform Decisiv, confirms that parts and labor expenses rose 1.9% in the third quarter of 2023.

“This return to increasing parts and labor costs highlights the fact that fleets must remain vigilant when it comes to managing their maintenance expense data,” said TMC executive director Robert Braswell.

The increase comes after a 1.3% decline in Q2, across the top 25 Vehicle Maintenance Reporting System (VMRS) level codes. Parts and labor costs contributed equally to the Q3 increase. Year over year, parts costs are up 0.9% and labor up 4.9% for a total combined increase of 2.5%.

Decisiv and TMC feel the rise in costs is due to ongoing inflationary pressures, as truck tonnage and mileage are on the decline.

“Despite running fewer miles to handle lower freight volumes and the influx of less repair intensive new trucks, fleets and service providers are still challenged by inflationary cost pressures on parts prices and higher labor costs,” said Decisiv president and CEO Dick Hyatt.

Signs of ‘gradually recovering freight market’

ACT Research reports in its For-Hire Trucking Index that there are signs of a gradually recovering freight market.

“With volumes stabilizing and capacity contracting, the for-hire Supply-Demand Balance has been signaling an impending increase in freight rates for a few months,” explained Tim Denoyer, ACT’s vice-president and senior analyst. “Truckload spot rates are 12% above the seasonal pattern in January following the cold snap. While weather effects should revert in the coming months, freight is an outdoor sport, so the cycle will likely find a higher trajectory as the reversion happens amid tightening capacity and recovering demand.”

Denoyer added capacity continues to be added by private fleets, but the pace of additions is slowing. For-hire trucking capacity, by contrast, is contracting.

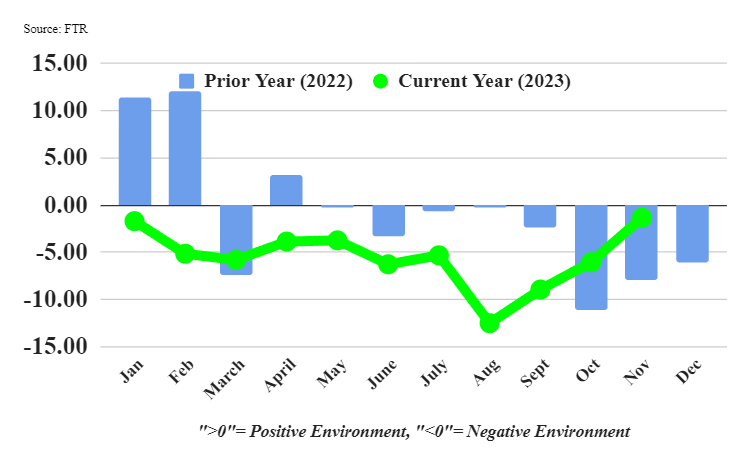

Trucking conditions improved in November

Trucking conditions improved in November thanks to steadily falling diesel prices. FTR’s Trucking Conditions Index jumped from -6.07 in October to a near-neutral -1.35 reading in November.

FTR maintains a “modestly negative” outlook for trucking conditions through late 2024.

“Unfortunately for carriers, November’s market conditions likely were the least unfavorable that they will be through at least the first half of this year barring another sustained slide in diesel prices,” said Avery Vise, FTR’s vice-president of trucking.

“However, as we have noted frequently, lower fuel costs are complicated. Falling diesel prices tend to slow exits of very small carriers, which could further depress capacity utilization and deflate any upward pressure on rates. Meanwhile, freight demand shows no signs of improving significantly in the near term. Trucking should see incremental improvement throughout 2024 but not enough to create any real inflection in the market.”

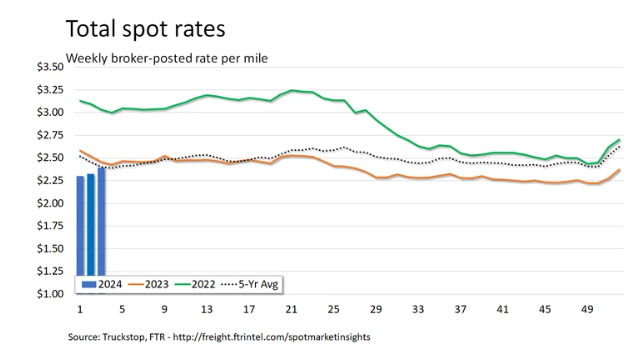

Winter weather drives spot market rates higher

The week ended Jan. 19 reflected a spike in spot rates thanks to severe winter weather that engulfed much of the U.S., Truckstop and FTR report.

The week’s spot market gains were the largest seen since May, excluding the final week of 2023 which was higher due to sharply lower capacity. Both dry van and reefer rates were up sharply on the week, exceeding levels seen the same week in 2023.

Total load postings were also higher than a year ago, the first time since March 2022. The Market Demand Index improved to 71.8, its highest reading since International Roadcheck last May, aside from the first week of this year.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Based on the number of drivers and lease ops that are not working in Jan major changes need to happen

I see many drivers besides myself unable to find work that are disabled as their is a surplus of truck drivers that are willing to work cheap that came as foreign students.