Economic Trucking Trends: Spot market improved in November, but remains ‘flush’ with capacity

Good news this week from Loadlink Technologies, which has noted a continuing improvement in Canadian spot market load postings and a corresponding tightening of capacity. Motive tracks truck visits to big box retailers and noted increasing shipments as inventories are replenished ahead of the peak shopping season.

But ACT Research warns ongoing weakness in freight markets and carrier profitability could cause a downturn in the Class 8 market following peak order season, which is currently underway.

Canadian spot market load volumes continue to improve

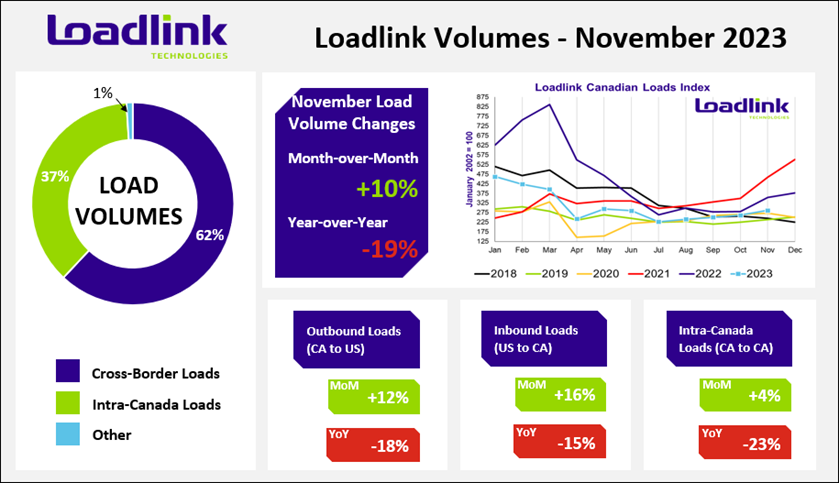

Canadian spot market load volumes jumped 10% in November, while fewer truck postings caused the truck-to-load ratio to tighten by 13%. The most recent data from Loadlink Technologies indicates most of the volume gains came from improved cross-border performance, both north- and southbound.

Inbound load growth was strongest, up 16%, while U.S.-bound loads grew 12%. Intra-Canada load postings were relatively flat. But year over year, intra-Canada loads were still off 23% while truck postings were 14% higher than last November.

Loadlink reports a truck-to-load ratio of 3.78 in November, down from 4.33 trucks per load in October. The ratio, however, was sup 32% year over year; there were just 2.86 truck postings per load last November.

Retail freight also improving

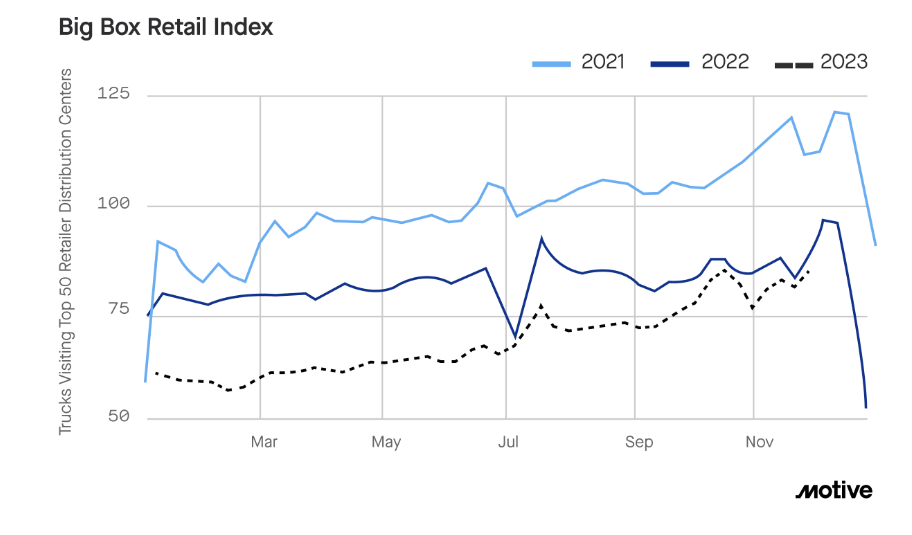

Motive has issued its monthly economic report, which shows top retailers are bringing in more inventory in advance of the holidays. The company’s Big Box Retail Index saw trucking visits to retail DCs rise closer to 2022 levels, down just 3% from last November.

But Motive also noted the transport of durable goods like large appliances and furniture to retail warehouses was down 16% from early October to the end of November.

Trucking bankruptcies continue to grow in the U.S., with 4,931 carriers leaving the market in November, a 55% increase from October levels. New carrier registrations are also down 9% from October and 16% since the end of Q3, suggesting capacity is tightening.

Diesel prices dropped 5% in November and are now down 50 cents a gallon from this time last year.

Still plenty of capacity

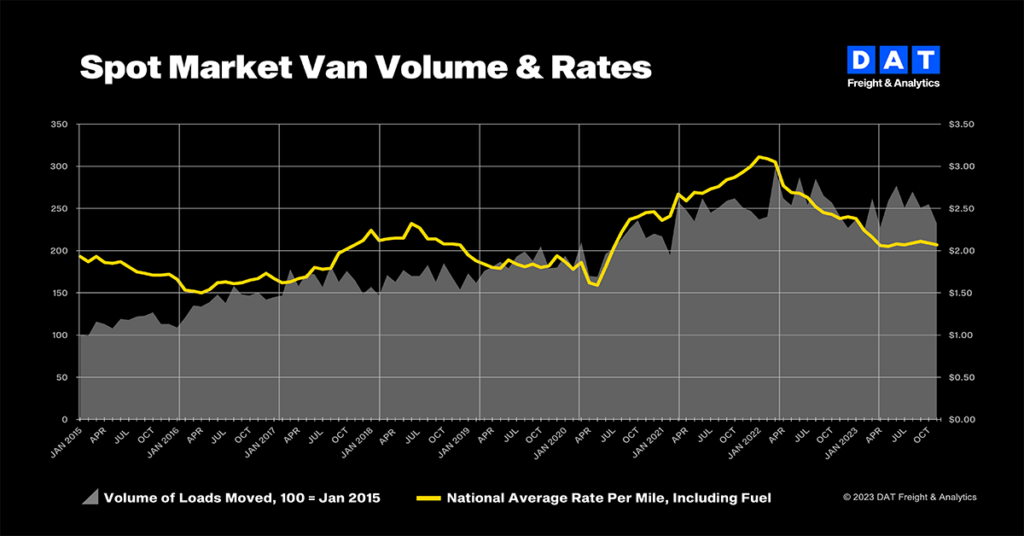

Despite a tightening of capacity seen in the Canadian spot market truck-to-load ratio, and backed by Motive’s report highlighting carrier exits from the industry, the market remains “flush” with capacity, according to DAT Freight & Analytics.

Overall, November load volumes on the U.S. spot market were strong thanks to a U.S. Thanksgiving surge.

“Thanksgiving and Black Friday were early in the month, which meant there was almost a full week of shipment activity after the holiday,” said Ken Adamo, DAT chief of analytics. “Businesses running leaner inventories compared to the last couple of years are taking advantage of lower transportation rates as they position goods ahead of peak retail shopping.”

While November’s volumes were strong relative to previous years, load postings were down from October by 9% (van), 3.5% (refrigerated), and 11% (Flatbed). There remains excess capacity, DAT concluded.

“For every 10 carriers that left the market in November, eight new ones came in,” Adamo said. “There’s been an acceleration of capacity out of the longhaul freight sector, where carriers are subject to spot rate volatility and high diesel costs, and a shift back to other parts of the economy, like regional dedicated operations.”

Spot rates saw little movement in November. Year over year, average spot rates were down 16 cents per mile for van, 30 cpm for reefer, and 19 cpm for flatbed. Rates were stronger than in November 2019 and the gap between spot and contract rates tightened to its narrowest margin since March 2022.

Weak freight markets could weigh on truck sales

ACT Research reported in its North American Commercial Vehicle Outlook that while Class 8 orders remain strong, demand may weaken due to continuing softness in freight markets.

“Freight markets have not improved as we have trekked through the second half of 2023, with no demand-side relief to date, even as strong Class 8 tractor sales have continued to add to the supply side of the equation,” said Kenny Vieth, ACT’s president and senior analyst. “In the short term, one of the things staying our hand from deeper forecast cuts in the face of weak freight fundamentals and falling carrier revenues and profitability has been a solid industry-wide start to ‘order season.’”

Order season for truck makers is in full swing and typically stretches through Q1, ACT reported.

“While orders have been strong season to date, weak freight fundamentals are expected to limit the duration of this year’s peak order season. Looking forward, we would note that December is typically the strongest month of the year for Class 8 and nearly the strongest for trailers: Seasonality alone suggests a big number to end the year. Q1 is historically weaker for orders than Q4,” Vieth said.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

A number of groups in the U S want to companies from Canada and Mexico to stop from using foreign drivers with less than 30 months in Canada or came into to Canada as a foreign student to haul freight into the U S more than 40 kms

This is believed to be a easy way to get rid of the low rates and truck surplus in the United States?