Economic Trucking Trends: Spot market rates, freight fundamentals improving

We begin 2024 with mostly good news. While December marked a softening of Canadian spot market freight volumes, in the U.S. spot market rates are rising and closing the gap with contract rates. That’s vital if we’re to see a recovery of the spot market, DAT Freight & Analytics reported.

Global shipping disruptions could also provide a boon to intermodal freight coming out of the west coast ports, and eventually benefiting truckload carriers. In fact, it’ll be a year of improving freight fundamentals, ACT Research predicts. Let’s get into it…

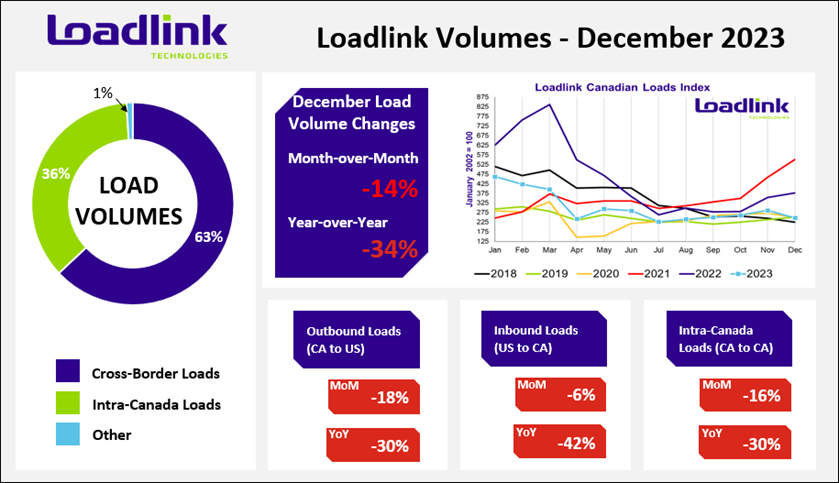

Canadian spot market ends 2023 on soft note

The year that was ended with soft Canadian spot market conditions, according to the latest monthly data from Loadlink Technologies. A hot run of monthly improvements came to an end with declining freight activity and truck postings.

The month began with so much hope – strong daily load volumes not seen since March, 2023. But they then fell 54% over the holiday period and overall monthly load volumes ended the month down 14% from November. The truck-to-load ratio improved by 3% to 3.68 trucks per load, which Loadlink says is indicative of improving balance in the spot market.

Cross-border loads to the U.S. were down 18% from November and 30% year over year. Northbound cross-border loads dropped 6% in December and were down 42% year over year. And domestic freight activity was down 16% from November and 30% year over year.

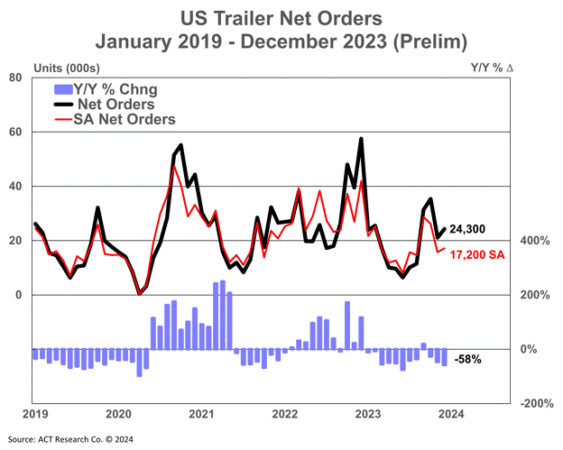

Trailer orders coming in at “slower pace”

Preliminary data on trailer orders indicate they strengthened 10% from November, but were 58% off December 2022 levels, according to ACT Research, which reported 24,300 orders.

“While orders were down materially from year-ago levels, preliminary net orders, at 17,200 seasonally adjusted, were about 10% higher sequentially,” said Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research. “After a disappointing, although not unexpected, drop last month, December’s preliminary net orders aligned with less-than-stellar expectations, particularly amid a backdrop of weak profitability for truckers and anecdotal commentary from trailer manufacturers who have shared that orders are coming but at a slower pace than they have the last few years.”

McNealy concluded: “This month’s results continue to support our thesis that when fleets don’t make money, their ability and/or willingness to purchase equipment is muted. That said, the lower orders don’t indicate a catastrophic year in the offing either, simply the slowest December we’ve seen since before the pandemic began.”

Rival forecaster FTR counted 23,434 orders, 16% better than the monthly average for the year.

“With orders coming in above production levels, backlogs in December rose somewhat, increasing by more than 3,000 units to more than 143,300 units in total,” said Eric Starks, chairman of FTR.

“The fall in production and increase in backlogs resulted in an increase for the backlog-to-build ratio to 7.1 months. The ratio is slightly elevated due to the lower production levels in December and is above the historical average before 2020. A jump in the ratio is normal around the holidays, and the overall picture is still of an industry that is continuing its move towards a pre-pandemic level of stability.”

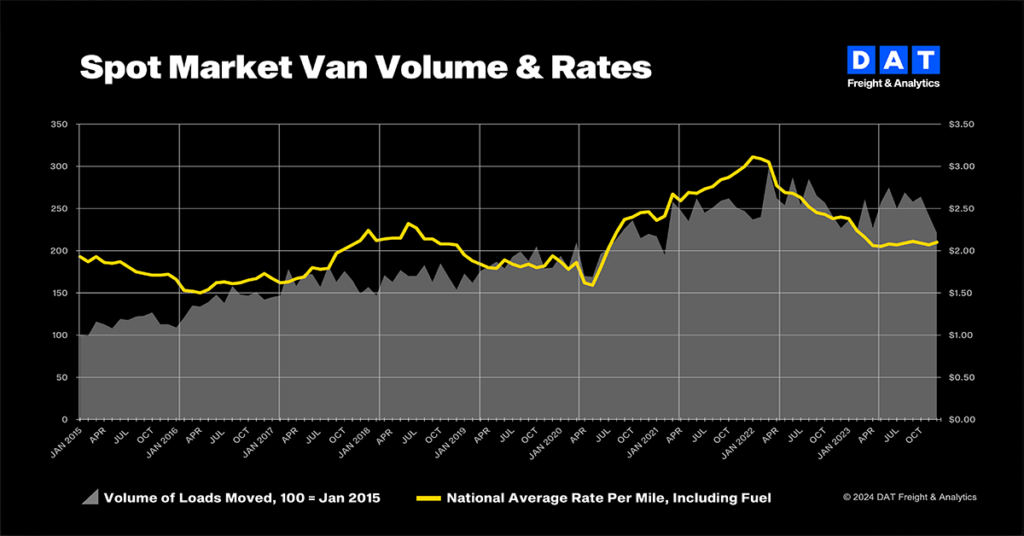

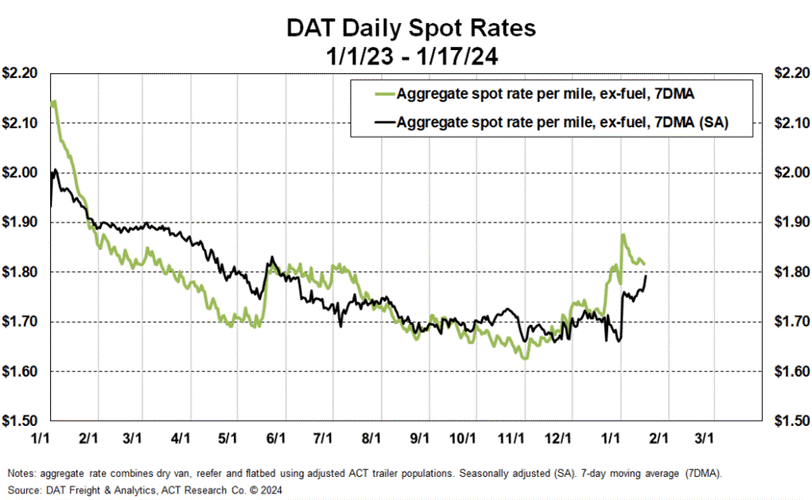

Gap narrowing between spot market, contract rates

In order for the spot market to fully recover, the gap between spot market and contract rates must narrow. That seems to be happening, according to December data from DAT Freight & Analytics. December saw the spread between those rates close to its narrowest margin since March 2022, when truckload prices were near all-time highs.

“At 39 cents, the spread between spot and contract van rates is still substantial but was down seven cents compared to November,” said DAT chief of analytics Ken Adamo. “The price to move van freight under contract hit its lowest point in nearly three years. Entering 2024, shippers are in a strong position as they negotiate contract rates, and carriers on the spot market have some optimism that the market will turn.”

Volumes for December were down across the board, 8.7% for van, 5.7% for reefers, and 14.7% for flatbed. But rates for those three segments were up. Linehaul van rates were up seven cents to $1.65 a mile, reefer rates four cents to $1.98/mile, and flatbed rates up four cents to $1.87/mile (all figures U.S.)

DAT’s load-to-truck ratio continued to indicate a soft market for carriers.

For the week ended Jan. 12, Truckstop reported “continued normalization of van equipment spot rates following the traditional holiday surge” while flatbed rates spiked the most since March 2022. Truckstop’s Market Demand Index was 69.3, the second strongest since the week of International Roadcheck last May.

Freight fundamentals to improve: ACT

The rise in spot market rates aligns with ACT Research calling for freight cycle fundamentals to improve this year. It reports in its Freight Forecast: U.S. Rate and Volume Outlook report that freight demand remains below trend, but is beginning to recover.

“The new year begins with global shipping in turmoil, import freight shifting from east to west, and for-hire demand on the long side of a two-plus-year downturn,” noted Tim Denoyer, ACT Research’s vice-president and senior analyst. “Changing ocean and inventory dynamics support an upturn in freight demand, particularly intermodal, where we raise our rate forecasts this month.”

The global shipping turmoil he refers to regards the two primary routes from Asia to the U.S., with conflict in the Red Sea and low water levels in the Panama Canal. This, ACT reported, is shifting imports to the west coast, where there’ll be strong intermodal demand, eventually bolstering the truckload market.

Further, Denoyer added: “Real retail sales recently turned positive after a year of declines, and after 18 months of destocking, a restock is drawing near, spurred by ocean risks. Supply dynamics are also shifting as 2024 begins, setting up a new stage of the cycle. While partly temporary, the mid-January cold-related slowdown in rail volumes is already sparking truckload spot activity.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.