ECONOMIC TRUCKING TRENDS: Spot market recovery continues, truck demand weakens

The spot market continues to reflect improving rates, even though volumes pulled back in the most recent week on record.

Truck buyers took to the sidelines in March, with orders down about 34% from February levels. And aftermarket parts demand is also suffering.

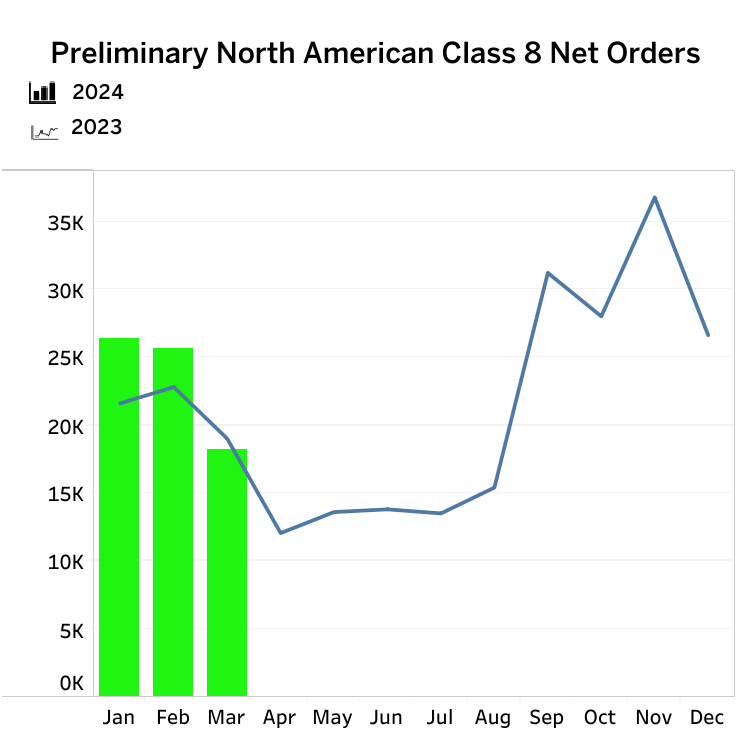

‘Waning demand’ for Class 8 trucks in March

Truck buyers put the brakes on Class 8 orders in March, with preliminary data from FTR indicating there were 18,200 orders, down 34% from February levels.

Those numbers were in line with seasonal expectations, according to the industry forecaster, and were in line with last March numbers.

“Despite weakness in the freight markets that has persisted for more than a year, fleets continue to be willing to order new equipment,” said Eric Starks, chairman of the board at FTR.

“Order levels in March were below the historical average but remained in line with seasonal trends. Demand is not declining rapidly, but neither is the market doing significantly better than replacement level demand. Our expectation for replacement output by the end of this year is unchanged.”

ACT Research reported 17,300 orders, which were 18.7% below year-ago levels.

“Nascent improvements in the freight market and select OEMs’ efforts to smooth demand, notwithstanding forced conservatism among a portion of the truck buying populace, capped Class 8 order activity in March,” said Steve Tam, ACT’s vice-president and analyst. “While we will have to wait for the details of the month’s order volumes, logic suggests waning demand for tractors in the market retrenched in March.”

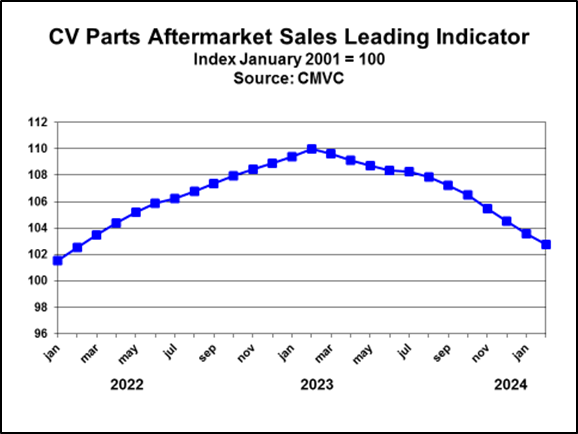

Aftermarket parts demand suffering, too

CMVC’s Commercial Vehicle Parts Aftermarket Sales Leading Indicator index declined 0.8% in February from the previous month, marking the 12th straight month of decreasing demand.

“The process of rationalizing capacity in linehaul applications is weighing on parts aftermarket sales as it is decreasing the number of trucks operating in linehaul applications, increasing the supply of idled trucks on the used truck market and causing fleets to operate newer model year trucks on average as fleets place older trucks with more depreciation on the used truck market as they rationalize capacity,” said Chris Brady, president of CMVC.

“Trucks in linehaul applications make up a large share of Class 8 population and trucks in linehaul applications generally depreciate at faster rates than trucks in local and regional applications, as linehaul trucks generally operate at higher utilization rates than trucks in local and regional applications. The combination of these factors is weighing on parts aftermarket sales.”

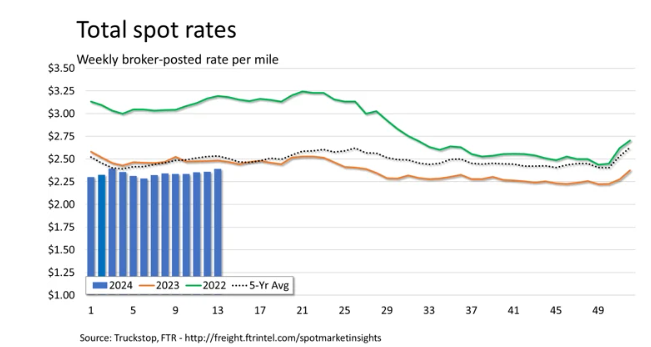

Spot market rates continue to improve

But there’s good news for truckers relying on the spot market. Rates for the week ended March 29 firmed up with their greatest increase since mid-February.

Truckstop and FTR reported dry van and reefer rates were the strongest since a weather-related surge in January. Flatbed rates were their highest since July 2023.

Total rates have now increased for four straight weeks.

However, load postings were also down, weakening the overall Market Demand Index, which remains higher than it was two weeks prior.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.