Economic Trucking Trends: ‘This downcycle has been the worst one’

There’s no short-term fix coming to the freight markets, with van and reefer spot market rates continuing to fall while flatbed demand improves.

ACT Research brought together industry leaders for a recent seminar, with one saying “This downcycle has been the worst one,” he’s ever seen. But ACT also sees some signs for optimism as imports and intermodal trends are pointing to increased trucking demand later this year.

Shippers aren’t feeling it though. Conditions for them were flat in December and a recent survey indicated their expectations going forward are muted.

Signs of freight recovery later this year

ACT Research reported in its latest Freight Forecast, U.S. Rate and Volume Outlook report that rising imports and intermodal trends are pointing to a trucking recovery later this year.

Recovering goods demand, inventories, and global ocean shipping disruptions will likely add to freight movements in 2024 as shippers seek to buffer safety stocks, the industry forecaster suggested.

“The January surge in rates following the extreme cold mostly reversed quickly as temperatures rose into seasonal market softness, but in late February, seasonally adjusted spot rates were still at six-month highs, excluding the cold snap,” said Tim Denoyer, ACT Research’s vice-president and senior analyst.

“With January freight volumes slowed by weather, we see signs the next few seasonally soft months could turn above trend as shippers work to make up lost volumes. The truckload CEOs we interviewed at ACT’s seminar on Feb. 21 are seeing volumes improve enough to get more selective on freight mix, but this demand is not finding its way into the spot market yet.”

For now, however, the freight market remains loose, ACT reported.

“For-hire capacity continues to tighten at the margin and fleet capex budgets are sharply lower for 2024. There are certainly pockets of strength, such as in LTL, where capacity additions are likely, but the message of capital discipline from the industry suggests tighter supply this year, as demand begins to recover,” Denoyer concluded.

Industry leaders give their outlooks

As for the aforementioned ACT Research seminar on Feb. 21, the company shared some insights shared at the event.

“I’ve been in the industry 40 years, have seen many different cycles, and this downcycle has been the worst one,” said Bill Kretsinger, chairman and CEO of American Central Transport.

According to ACT, panelists agreed that this downcycle has been one of, if not the, worst experienced in their careers so far; however, they are feeling optimistic about the road ahead.

“Freight markets have been bouncing along the bottom for a while, but there are positive signs that this is turning. Conditions for a transition into early cycle are still not all in place, but rebalancing is progressing,” said ACT’s Denoyer.

Regarding equipment purchases, all panelists indicated they didn’t get the allocation they expected during the pandemic, and now it’s time to catch up. Fleets are right-sizing their fleets now, getting back to a regular trade cycle.

Muted expectations from shippers

BlueGrace Logistics released a survey indicating shippers’ confidence is “flat” for the second quarter of this year.

Responding shippers expressed a cautious outlook on revenue growth, with a slight uptick in those sharing negative sentiment.

“Prudent confidence for revenue growth can be associated to lower certainty in orders and a notable shrinking forecast with inventories,” said Mark Derks, chief marketing officer for BlueGrace Logistics.

Negative views on inventories climbed to 16%, the highest level seen in the seven quarters BlueGrace compiled its Logistics Confidence Index.

Confidence in orders is lower with a 56% neutral outlook, and a falling positive response of 9% down from Q1 2024. “A cautious and uncertain outlook in orders persists with businesses adopting a wait-and-see approach to current market trends,” said Derks. “Despite more elevated shipper concerns, a stable median impact implies no significant shift in order expectations for Q2 2024.”

Shipper conditions flat in December

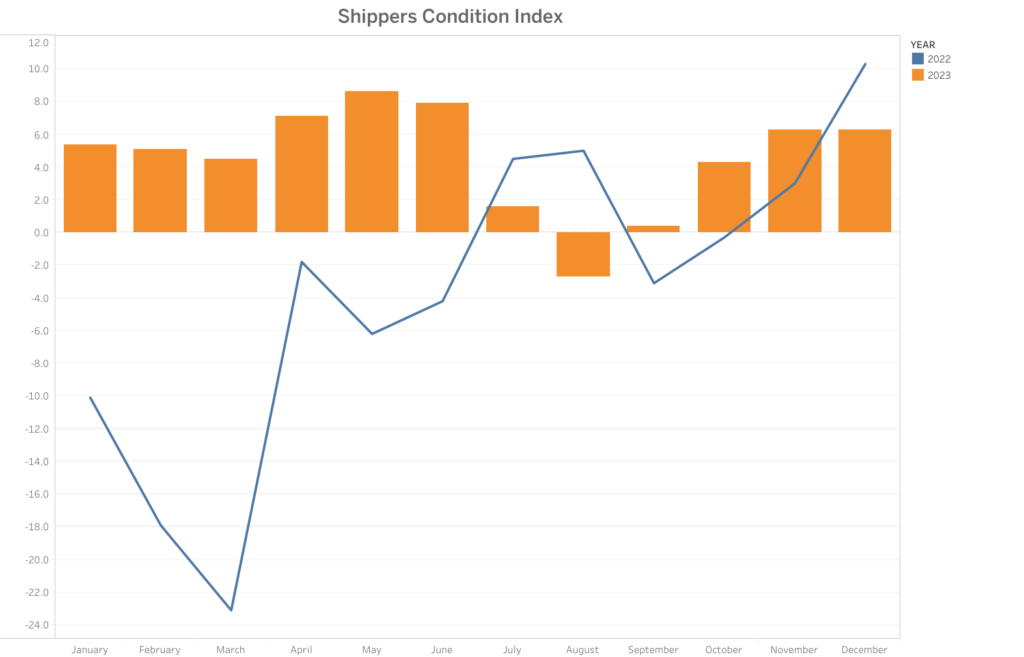

Meanwhile, FTR reported its Shippers Conditions Index was flat in December, with a reading of 6.4. But the industry forecaster warns that the outlook is weaker for shippers through the rest of the year as fuel prices declines are likely to stop and freight rates stabilize.

“We are seeing firmer freight demand than our forecasts had been indicating, and that will start chipping away at the favorable capacity utilization and rate environments that have benefitted shippers for some time,” said Avery Vise, FTR’s vice-president of trucking.

“Shippers should start mulling over how they will respond to a freight market that is considerably more balanced and, therefore, more susceptible to volatility. However, we do not forecast consistently unfavorable conditions for shippers until 2025, and even then, we would not expect negative SCI readings to match the scope of positive readings seen in 2023.”

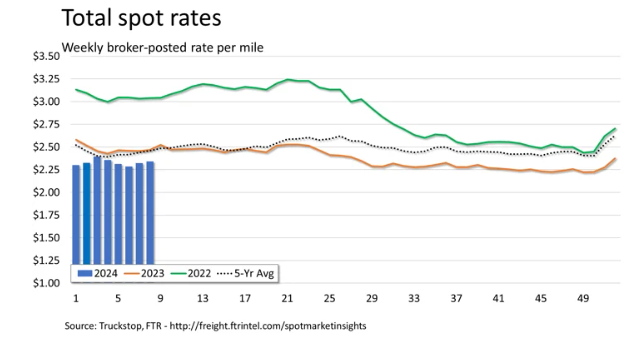

Spot market continues to be boosted by flatdeck

Truckstop and FTR reported the week ended Feb. 23 showed further declines in rates for van and reefer equipment, while flatbed demand rates reached their highest levels since July.

Dry van and reefer rates were down for the fifth consecutive week, with dry van rates at their lowest levels since June 2020. Reefer rates are within 8 cents of their May 2020 low.

With load postings decreasing and truck postings rising slightly, the total Market Demand Index declined to 60. However, the MDI for flatbed equipment was the highest since May, the companies reported.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

We have lost over 7000 units already in Canada and need to loose another 8000 units to bring the balance back to the demand. Many were experience truck drivers with their truck and trailer or small fleets of under 25 units. What I do not understand is why we brought in foreign ( students) drivers when many people said we did not have enough freight from mid Dec to mid April to keep the current truck drivers busy. I think we need to look at total freight demand and freight rates and housing costs in ont and Vancouver BC and set a wage rate for experience truck drivers on the cost of supporting a family with 3 children and a stay at home spouse if the truck drivers are O T R or work more than 50 hours per week