ECONOMIC TRUCKING TRENDS: Tonnage dips but signs emerge of improving market

It was a tough month for for-hire truck tonnage in March, with tonnage sliding 2%. However, industry watchers continue to see signs of improvement on the near-term horizon for truckers.

ACT Research indicated a freight rebound could be as little as two months away. Let’s dive into the latest reports.

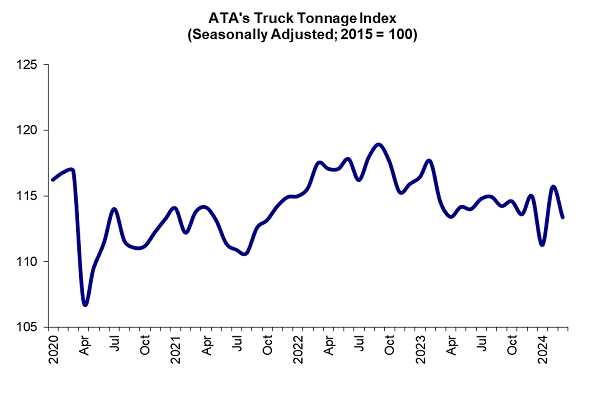

Truck tonnage slides

U.S. for-hire truck tonnage dropped 2% in March, indicating continued softness in freight demand, according to the American Trucking Associations (ATA).

“Tonnage in March suggests that truck freight volumes remain lackluster, and it is clear the truck freight recession continued through the first quarter,” said ATA chief economist Bob Costello. “In the first three months of 2024, ATA’s tonnage index contracted 0.8% from the previous quarter and declined 2.4% from a year earlier, highlighting ongoing challenges the industry is navigating.”

Compared to last March, tonnage was off 1%. That’s 13 straight year-over-year declines, but the smallest over that period.

ACT seeing signs of improvements

However, ACT Research, in its latest Freight Forecast: U.S. Rate and Volume Outlook report, says there’s reason for optimism. The industry forecaster says an upturn in goods spending, a turning inventory cycle, and rising industrial production all point to greater freight demand within the next two months.

“We’re frequently asked who’s buying all these trucks with spot rates at sharp operating loss levels and carrier margins under severe pressure. In our view, private fleets who operate vehicles on longer trade cycles are likely planning for the 2027 emissions regulations, which may drive record demand for new commercial vehicles in the next few years,” said Tim Denoyer, ACT Research’s vice-president and senior analyst.

“For the past year, cost economics have taken a back seat to supply chain resilience and planning for upcoming climate rules, as we see it, supporting new truck demand and pressuring freight rates. But this is changing in 2024 as order intake has softened and private fleets join for-hire fleets in reconsidering costly capacity additions. We think a lower Class 8 tractor supply dynamic will be very helpful in bringing freight back to the for-hire market.”

ACT feels weakening truck sales combined with a growing economy will help “shake the truckload market out of the doldrums.”

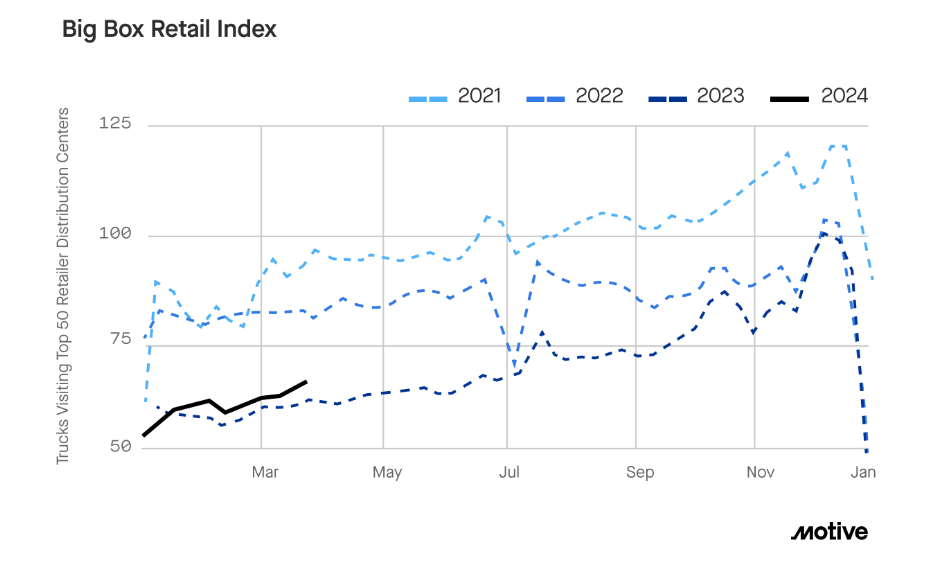

Retailer restocking efforts boosting freight

Meanwhile, Motive put out its monthly economic report for March, which suggested the trucking market is improving. Its Big Box Retail Index saw a 6.9% jump in truck visits to retail warehouses. Visits to home improvement retailer warehouses led the way.

Motive predicts that heading into Q3, consumer demand and improvement in rates will create a more carrier-friendly environment by the second half of 2024. Motive anticipates higher carrier rates and consumer demand keeping its current pace in the second half of 2024, leading to fewer carrier exits in addition to the previously mentioned gains in net-new registrations.

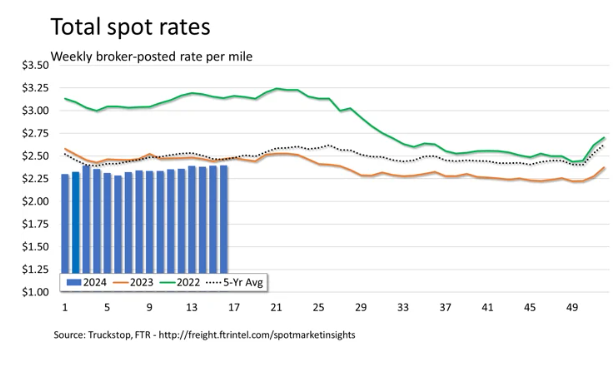

Spot market rates flat

Truckstop and FTR Transportation Intelligence reported the week ended April 19 saw stable spot market rates. Higher flatbed rates offset slightly lower van rates.

The total market rates reached their highest level since the end of June. The Market Demand Index fell to 68.7, its lowest level in seven weeks.

DAT Freight and Analytics, meanwhile, reported that March spot market rates dropped for the third straight month (van and reefer). Van rates averaged US$2.01 a mile, down 6 cents from February and 15 cents year over year. Reefer rates fell 8 cents a mile and flatbed rates rose by a penny.

“The decline in van and reefer spot rates coincided with the demand for truckload services picking up marginally toward the end of the month,” said Ken Adamo, chief of analytics, DAT Freight & Analytics. “There were no big swings or signs that spot-market volumes or capacity will change beyond what we expect from produce, construction materials, and summer retail goods starting to move.”

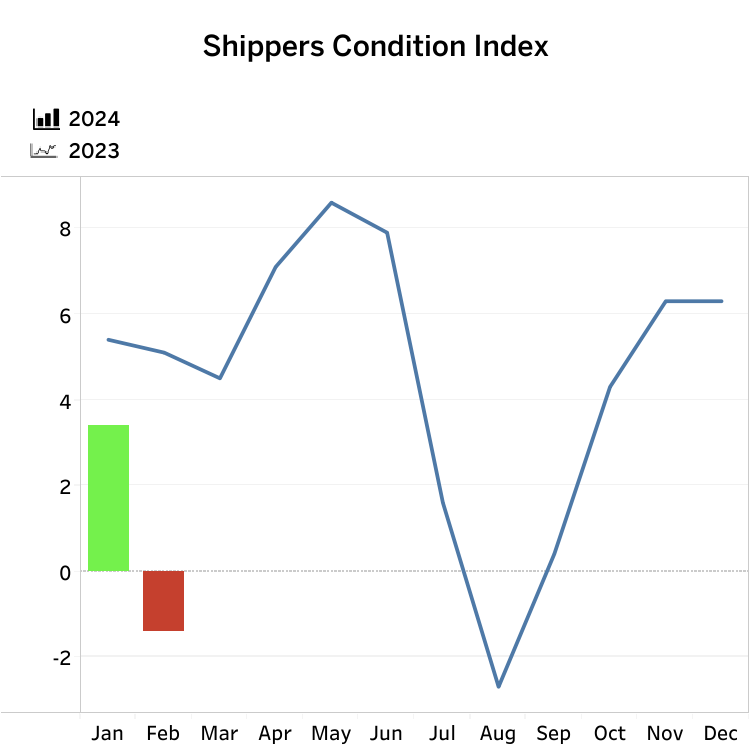

Shippers stung by rising fuel costs

FTR’s Shippers Conditions Index turned slightly negative in February, largely because of the rising cost of fuel. It was the shipper’s index’s first time in negative territory since September, at -1.4.

Avery Vise, FTR’s vice-president of trucking, said, “Although February might prove to be a near-term outlier due to the 21-cent spike in diesel prices, the days of favorable market conditions for shippers are numbered. By the first quarter of 2025, we expect a steady but incremental tightening of the truck market to yield a modestly tougher environment for shippers. However, we do not see anything like 2021 or 2018 on the horizon.”

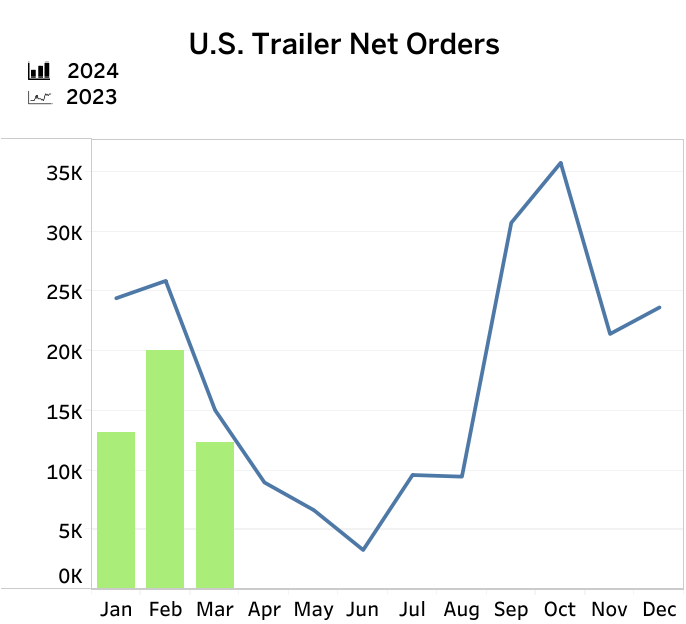

Trailer orders slumped in March

Trailer orders fell 38% in March, to 12,313 units according to FTR. Those totals were down 18% year over year and 25% below the average of the last 12 months.

“With orders coming in below production levels, backlogs in February fell somewhat, shedding more than 11,500 units to end at more than 151,000 units,” said Eric Starks, FTR’s chairman.

“The increase in production coupled with the fall in backlogs resulted in some reduction in the backlog-to-build ratio, which stands at 6.4 months. This ratio is slightly below the average level for the last half of 2023 but is above the historical average prior to 2020. The current ratio suggests that, overall, trailer manufacturers have little incentive to alter production levels in the near term.”

Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research, indicated “Anecdotal commentary from trailer manufacturers and suppliers through the past several months have indicated this slowing, as they have shared that orders are coming, but at a more tepid pace when compared to the last few years.”

She added, “This month’s results continue to support our thesis that when fleets don’t make money, their ability and/or willingness to purchase equipment is muted. For the trailer industry, this is compounded by the power unit pre-buy ahead of the EPA’s implementation of 2027 regulations, which we believe has already begun. As a result, cancellations remain elevated, and the choice about how to spend limited capex dollars is swinging the pendulum against trailer purchases right now.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.