Economic Trucking Trends: Fleets jump at chance to place ’24 truck orders

Truck makers saw a surge in Class 8 orders as they fully opened 2024 order books last month — something industry analysts anticipated but nonetheless were encouraged to see.

The spot market also continued to slowly improve, with flatdeck leading the way, while reefer rates continued to struggle. And aftermarket parts demand is weak, according to newly released data. It’s expected to remain below trend for the foreseeable future, too.

Class 8 order season begins with a bang

Class 8 truck makers opened their 2024 order books in earnest in September, and FTR reported a 94% surge in preliminary orders from August, though down 45% year over year.

“Build slots have opened for 2024 production, and fleets are placing orders at a solid pace. Although a large increase in September was expected due to available build slots, it is still a positive indicator for the industry,” FTR chairman Eric Starks said of the 31,200 orders placed.

“We saw increases across the board versus August – another indication that this is a broad-based gain for the market. Despite the weakness in the overall freight market, fleets continue to be willing to order new equipment. We did not anticipate matching the level of orders that we saw this time last year, but increasing orders confirm our expectations of replacement demand in 2024.”

ACT Research reported preliminary September Class 8 orders of 36,800 units, marking the strongest month in the past year.

“Between reports of falling carrier income and margins, still sloshy load-to-truck ratios, weak spot rates reported by DAT, and a sense over the past six weeks or so that the U.S. economy’s year-to-date outperformance was starting to lose some momentum, we were unsure how the market would respond when the 2024 order boards officially opened,” said Kenny Vieth, ACT’s president and senior analyst.

“One thing we did know was that nearly all the August-ending Class 8 backlog was scheduled for build in 2023, so strong orders are imperative for the industry to maintain current strong production rates very far into 2024. While it is too early to infer much from September orders, data from the OEMs confirm the ‘season’ started on the right foot.”

Spot rates move higher

U.S. spot market prices moved higher the week ended Sept. 29, according to FTR and Truckstop, and they were led by gains in flatbed and dry van segments. That marks four weekly increase for flatbed rates in the past five weeks, while dry van rates bounced after two consecutive down weeks.

Reefer rates declined for the fourth straight week and were their weakest since late July.

Spot market freight volumes also rose and were just 7% below the same week last year. That’s the least negative year-over-year comparison seen since July 2022. Truckstop’s Market Demand Index, which takes into account truck postings relative to available freight, reached 60.3, its healthiest level since early June.

Aftermarket parts demand weakening

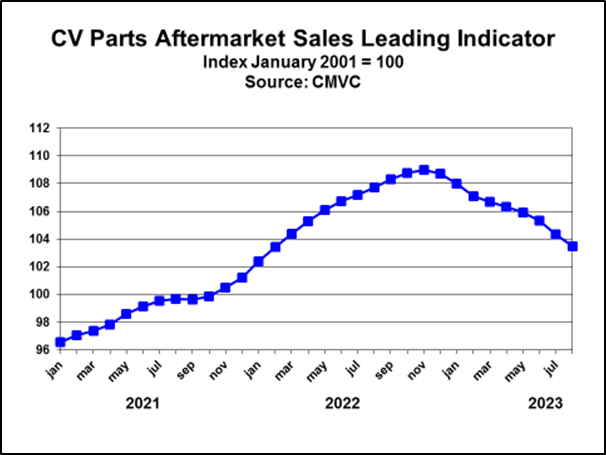

Commercial Motor Vehicle Consulting’s (CMVC) Parts Aftermarket Sales Leading Indicator (PLI) fell for the ninth consecutive month in August, decreasing 0.8% from July, signaling aftermarket parts sales will expand at growth rates below trend in the coming months.

Chris Brady, president of (CMVC) said, “PLI has fallen to a level signaling the growth rate of parts aftermarket sales will be below trend in the coming months, and [the] trend is defined as the long-term growth rate of the commercial vehicle population.”

Brady added: “Strong new and used truck sales over the past 12 months [have] resulted in new and used truck operators returning the average age of their fleets back to a norm, which would support growth of parts aftermarket sales at trend rates.

“But the downward trend in fleet capacity utilization indicates the rate at which the truck population is depreciating is slowing to levels [that are] dampening parts aftermarket sales below trend. For instance, in the for-hire trucking industry, the shift in freight volumes by carriers’ brokerage operations to company-owned tractors to keep truck utilization high has depressed third-party carriers’ truck utilization, slowing the rate at which trucks depreciate to an extent that it is dampening parts aftermarket sales.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.