Trucking employment dives in latest signs of Covid-19’s impact on industry

Skyrocketing unemployment. Cratering freight volumes. Plummeting spot market freight rates. Record-low Class 8 truck orders. These are just a few of the new realities the North American trucking industry is grappling with as global economies reel under the effect of the Covid-19 pandemic.

The North American economy is largely consumer-driven, but consumers in the U.S. and Canada are losing their jobs at an unprecedented rate, bringing an abrupt end to what Mullen Group chairman and CEO Murray Mullen refers to as the “wants” economy.

“I don’t want to even guess on how our business can or will perform over the next couple of months. The next two to three months, I really expect business to be challenging,” he said during an April 23 earnings call with analysts.

The fleet laid off 1,000 employees, and it wasn’t the only company forced into such drastic measures.

The U.S. Bureau of Labor Statistics reported that 88,300 trucking jobs were lost south of the border this April. “This was more than the total job reduction in the industry during 2008,” tweeted Bob Costello, chief economist for the American Trucking Associations (ATA).

In Canada, the numbers were nearly as grim. The country shed nearly 2 million jobs during the month, on the heels of a million job losses in March, according to a Statistics Canada Labour Force Survey published May 8. Many who remained on the job were working reduced hours. TFI International, the nation’s largest fleet, shifted 1,000 employees to four-day work weeks, among a series of temporary layoffs and other cost-cutting measures.

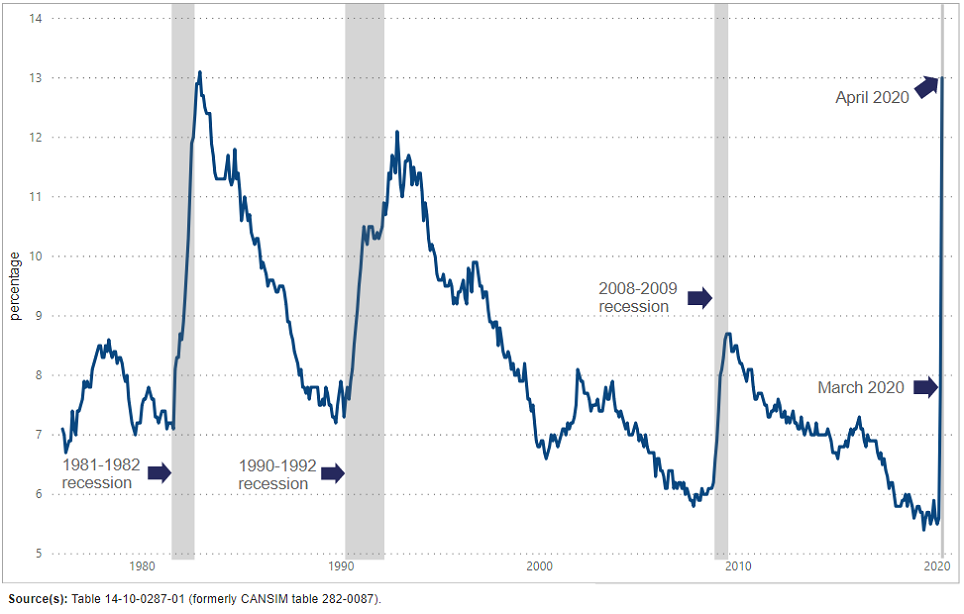

Canada’s drop in employment was “unprecedented,” according to Statistics Canada. Unemployment in April hit 13%, second only to the 13.1% rate observed in December 1982.

The Conference Board of Canada issued a release April 15 declaring “Canada is in the midst of an economic downturn unlike anything most of us have ever experienced,” and predicted Canadian GDP will fall by 25% in the second quarter – its steepest drop ever.

If you’re looking for good news, Alicia Macdonald, associate director, economic forecasting for the Conference Board of Canada offered this: “Our forecast expects that the downturn will be short-lived and growth will resume in the second half of the year, assuming businesses slowly reopen over the spring and summer.”

Dropping sales

As the North American economy was virtually shut down to slow the spread of Covid-19, freight volumes took a nosedive and spot market freight rates plunged as well. This after a fleeting bump in volumes related to the retail sector’s restocking of panic-bought items such as toilet paper.

In mid-March, Guelph, Ont.-based Wellington Group told Today’s Trucking the company’s volumes increased week-over-week, thanks in part to the delivery of 28 loads of toilet paper to one region in the U.S.

“We are seeing the healthcare, home essentials, food goods, and cleaning supplies sectors all pick up, while automotive, electronics and want-vs.-need items were flat,” fleet president and CEO Derek Koza said at the time.

But the spike in demand was temporary as panic-buying eased.

“In April we did experience a 10% drop-off in sales compared to budget, as we were impacted by want items continuing to slow down as consumers froze spending,” he said on May 8. “Wellington experienced some customers which closed their manufacturing due to Covid-19, along with several large-scale special projects in the nursery space.”

May looked more promising, though.

Canadian spot market volumes told a similar tale. TransCore Link Logistics reported spot market volumes surged 19% in March, reflecting the restocking of retail inventories and essential goods. However, it noted a “considerable decline” seen in certain markets and commodities reflected in early April load volumes.

“TransCore Link Logistics saw April volumes fall in line with predictions made at the end of March,” the company told Today’s Trucking May 8. “Volumes were seen trending downwards and the busy Quebec to Ontario lane clearly demonstrated the decline. This lane saw an outbound truck-to-load ratio of 1:1 in the third week of March. This truck-to-load ratio ended up averaging out at 6:1 for the month of April. For perspective, there were less outbound loads from Quebec to Ontario in all of April than in the third week of March.”

In the U.S., spot market rates fell to unsustainable levels in many markets. U.S. freight exchange DAT Solutions reported truckload van rates hit a four-year low in April, with load-to-truck ratios hitting historic lows. In a May 7 update, DAT’s data began to reflect a bounce.

“For the first time in well over a month we are starting to see earnest signs of a rebound in the spot market,” the company reported, attributing the bump to produce season, seasonal goods shipments, and relaxed social distancing requirements. “We are treating these trends with cautious optimism, understanding that the forces driving the market are very fragile and largely depending on how successful states are with their reopening plans.”

Low border volumes

Nowhere was the impact of falling freight demand more evident than at the Canada-U.S. border, where truck traffic thinned substantially. Trucks entering Canada fell 36% for the week of April 27-May 3 compared to the same period last year, according to the Canada Border Services Agency (CBSA). That was on the heels of a 33% decline the prior week.

Data collected by the Logistics, Transportation and Cross-Border Committee of the Windsor-Essex Covid-19 Economic Task Force showed truck traffic on Huron Church Road was down 43%, while the Windsor-Detroit Tunnel saw an 88% decrease in traffic. The Detroit-Windsor Truck Ferry was forced to cease operations for the first time in its 30-year history.

A Canadian Trucking Alliance (CTA) survey of fleets collectively representing 60,000 workers reported an average 27% drop in revenue, and a 300% increase in empty miles – with a drop in backhauls sacrificing margins and the ability to cover full costs. Sixty-three percent of respondents said customers have asked for payment deferrals or simply not paid for trucking services.

More than half (52.4%) of those surveyed by Today’s Trucking said their trucking businesses have laid off staff and/or downsized in the wake of Covid-19.

“It’s totally unpredictable…We’re working harder than ever to keep the trucks moving.”

Wendell Erb, Erb Group of Companies

Erb Group of Companies, a refrigerated fleet based in New Hamburg, Ont., saw a year-over-year increase in March as grocers scrambled to restock emptied shelves.

“About 10 days ago that’s completely reversed itself,” president and CEO Wendell Erb said in late April. “It’s totally unpredictable…We’re working harder than ever to keep the trucks moving.”

Drivers are sitting longer waiting for loads, where traditionally they never stop.

“I’m sitting in my office, looking at six trucks and every one of them has a driver waiting for a load to go somewhere,” Erb said. “In the meantime, we’ve got customers that are telling us that we’re switching our terms from 30 days to 60 days. We say yes, we smile, we thank them for the business… If the phone rings and they’ve got freight, we need it.”

Equipment demand evaporates

Those who produced trucks faced challenges of their own.

All North American truck OEMs halted production this spring, both to prevent the spread of Covid-19 and respond to falling demand for new equipment. Orders for U.S. trailer manufacturers, including business from Canadian fleets, fell 54% in March from already depressed February levels, according to industry forecaster FTR.

The 6,500-unit order month was down 55% year-over-year, with dry van orders particularly weak.

“The trailer market is mirroring the Class 8 side, as fleets are extremely cautious due to the anxiety about the virus,” said Don Ake, FTR’s vice-president, commercial vehicles. “The orders placed in March are for units that are perceived to be absolutely necessary for relatively short-term needs. Fleets will also delay replacing older trailers until the economic situation stabilizes.”

And how about Class 8 orders? Preliminary data from ACT Research showed a 46% drop in April, to 4,100 units, down 72% year-over-year.

“April represents the first full month of Covid-19 impacts on the trucking industry, and given broadly halted economic output leading to a sharp drop in freight volumes and rates, as well as more empty miles from fragmented supply chains further impacting carriers’ profitability, a negative order number was within the realm of possibilities,” said Kenny Vieth, ACT’s president and senior analyst.

OEMs, in response, began offering attractive financing options including low-to-no down payments and extended deferrals on initial payments. And by early May, truck manufacturers were beginning to ramp up the temporarily silenced North American production.

What’s next?

Bill Witte, chief economist for FTR, quoted baseball legend Yogi Berra when trying to make sense of the current economic situation: “It’s tough to make predictions, especially about the future.”

This is especially true since the Covid-19-sparked recession is unlike any other.

“I don’t think this is a normal recession-recovery situation. It’s not a business cycle event, it’s a completely artificial event,” he said. As such, looking to past recessions for guidance – even the Great Recession of 2008-2009 – is not useful.

FTR breaks the current economic environment into three phases: the shutdown; containment; and the restart. Mid-April marked the early containment stage, and the longer this phase lasts, the slower the recovery will be, Witte predicted.

“If the containment period is short, the restart could be a pretty rapid event,” he added. “We are working on the assumption the restart is going to take place sometime toward the end of this (second) quarter.”

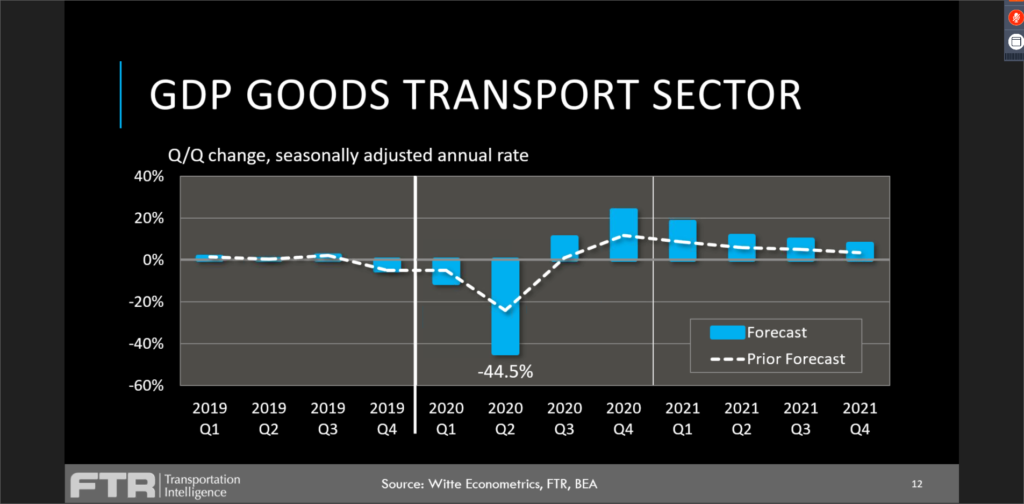

FTR expects U.S. GDP to fall 23.6% in the second quarter, but when stripping out services and adding back imports to better reflect the impact on trucking, the numbers are worse. FTR projects a 44.5% decline in the goods transportation sector in the second quarter of this year.

“We don’t see a noticeable jump until the fourth quarter,” said FTR CEO Eric Starks, adding the trucking industry won’t return to normalized levels until mid- to late-2021. “I think that’s a big deal for us to understand.”

— With files from Abdul Latheef, John G. Smith and Derek Clouthier

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

We control nothing in the future . We can only work to limit our exposure to changes

Wishing all the best to everyone

This virus did create all sort of opening like for what ever someone promote to save the planet would work because of the big scare existing among the population. Now in trucking same thing load are less and less in demand and now for the drivers with family ..Well they are having a hard time even more for small owner operators.

Although this virus would create an eye opening now as far to say is ti worthy to stay in that field perhaps if you are close to retirement than a huge decision come to play.

Even on the jobs site on the net they kept their jobs alive by promoting and saying there is a great demand form drivers if it is true it will be going backwards as far of pay either for company drivers or owner operators. Our dollars is worth way less now and it become very expensive for a driver to go to the states and delivering loads food and everything will be insane.