Why M&A activity should heat up this year

Owners of trucking and logistics companies could fetch a premium for their businesses in 2021, thanks to pent-up buyer demand and an increase in interest from non-traditional buyers.

Spencer Tenney, president and CEO of The Tenney Group, gave an overview of the M&A landscape during a Truckload Carriers Association (TCA) webinar Jan. 26. He predicted a 20% uptick in overall transactions (by value) in 2021, with valuations up 10% for companies with US$50 million or more in revenue. Valuations are expected to remain flat for companies below that threshold.

“I think we’re going to see in the next six to nine months, a tremendous uptick in deal announcements that’s really going to reflect 12 to 15 months squeezed into that,” he said, noting many transactions were put on hold last year due to the Covid-19 pandemic. “As we get to the end of 2021 and the supply of available companies normalizes, so will the current leverage at the negotiating table for sellers.”

Many trucking company owners looking to exit the business in 2020 put those plans on hold to help their companies weather the storm created by the pandemic. Meanwhile, buyers threw out their playbooks, added Eric LeMarbre, managing director with the Tenney Group.

Some buyers shrugged off 50% dips in quarterly performance, acknowledging it was related to the pandemic, while other companies put talks on hold because their entire office was off sick with Covid.

“A lot of things happened in 2020 that we don’t anticipate happening again,” LeMarbre said.

But the fundamental driver of M&A – deals getting done when a buyer has a need that a seller can meet – remains today, he added. The number of trucking and logistics transactions counted by The Tenney Group was up last year, despite a period of inactivity caused by the pandemic.

“That gives us a lot of expectation for 2021 activity of pent-up need,” LeMarbre reasoned.

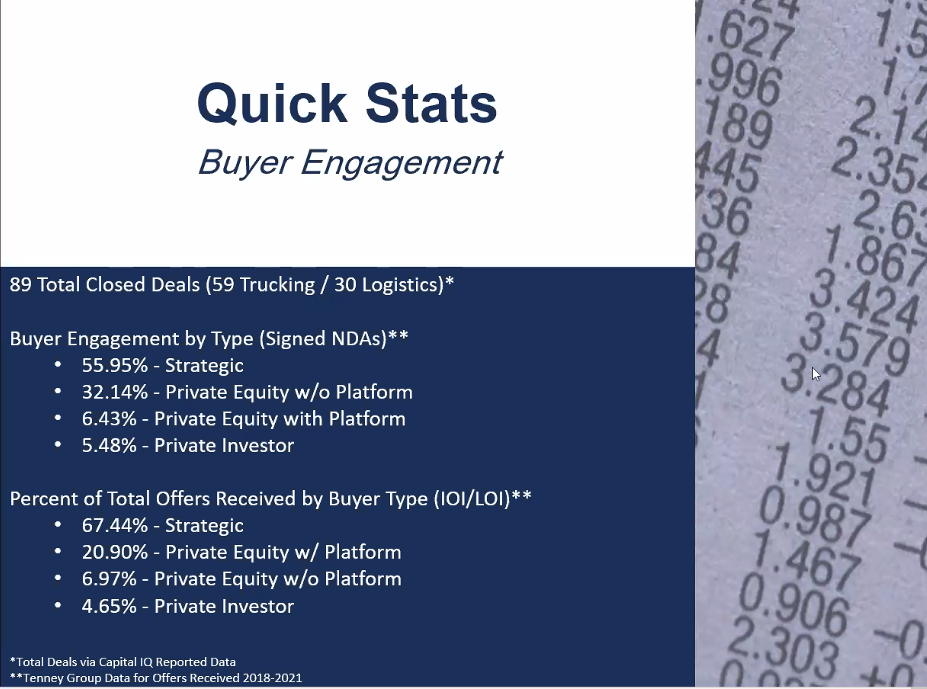

Tenney counted about 89 deals reported, including 59 trucking companies and 30 logistics firms, including Canadian acquisitions including James Richardson & Son’s recently announced purchase of Bison Transport. Most buyers continue to be companies already in the trucking and logistics industries, looking for a strategic fit, but private equity firms are becoming increasingly comfortable investing in the space, Tenney noted.

One change seen in 2020 was a new measure of value – EBITDAC, or Earnings Before Interest Taxes Depreciation and Amortization…and Coronavirus.

“An earn-out is simply an instrument that addresses the risk around the transfer of ownership.”

Spencer Tenney, The Tenney Group

“EBITDA became useless in 2020,” Tenney said, noting the virus had a universal impact on companies, for better or worse.

Buyers and sellers had to have open discussions about the impact of the pandemic on earnings, and in some cases orchestrated some non-traditional deals – for example, increasing earn-outs – to give buyers more peace of mind. Sellers shouldn’t dismiss earn-outs, Tenney advised.

“An earn-out is simply an instrument that addresses the risk around the transfer of ownership,” he said. In some cases, earn-outs can be done over a short period, say eight months, which is effectively a cash payout with two installments.

Another trend the dealmaker has noticed is buyers are becoming more flexible with their targets. Where they previously may have only looked at companies with $500 million or more in revenue, they’ll now consider companies with $150 million in revenue, or will consider companies operating outside their traditional segments.

Looking further ahead, LeMarbre said in the U.S., transactions may be affected by President Joe Biden’s planned corporate tax regime. He also said a capacity crunch will increase deal activity as the only way to add scale is through acquisition. And first-time buyers should increase, as more interest has been seen from non-traditional companies.

Tenney advised individuals looking to exit the industry and sell their businesses to begin by sitting down with their advisors and make a plan. This should include envisioning what they want their post-working life to look like.

“Think about your goals,” said Tenney. “How do you want to live when you retire? What do you want your lifestyle to look like in 10 years? Then back into, what your business will have to look like to ensure you can experience what you want to experience. People don’t do that early enough – start doing that now.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.