ECONOMIC WATCH: Class 8 orders surge on renewed fleet optimism

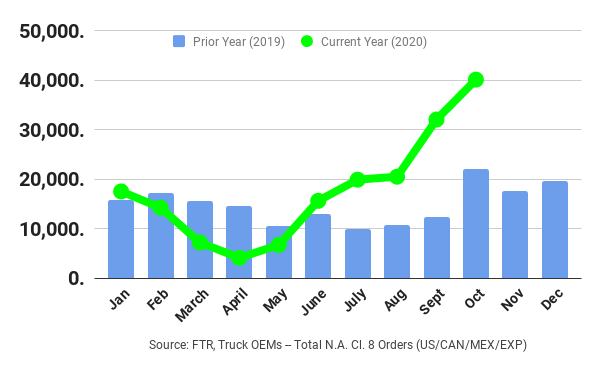

BLOOMINGTON, Ind. – Class 8 orders surged to 40,100 units in October, marking the first month over 40,000 since October 2018.

Preliminary data from FTR showed orders up 26% from September and 88% from last October. The orders are being driven by fleets looking to secure 2021 deliveries, as consumer retail sales are driving freight demand.

FTR reports the strong orders reflect a return to traditional order cycles.

“September was the turning point for the Class 8 market. Fleets became much more confident about future freight demand and began placing large orders to replace older units and for expansion purposes, as capacity tightened. In just a few months, the industry has gone from fear, to hope, to optimism. It appears the industry has sluffed off the uncertainties about the pandemic for now,” said Don Ake, vice-president, commercial vehicles for FTR.

“There is still some pent-up demand from the OEM shutdowns in March and April, but there is also widespread momentum generated after the economic restart that is continuing to build. Industrial freight is still lagging somewhat. If manufacturing starts to rebound, sales go even higher.”

ACT Research’s view

ACT Research reported North American preliminary orders of Classes 5-7 units totaling 29,300, up 6% from September and 84% year-over-year, setting a 10-quarter high. Its preliminary Class 8 tally was 38,900 units.

“Keeping in mind the freight backdrop of consumer spending on goods expanding and those for services contracting, preliminary October North American Classes 5-8 vehicles order data rose to 68,200 units. That volume represented a 17% gain from September and an 80% improvement compared to year-ago October,” said Kenny Vieth, ACT’s president and senior analyst.

“October was the largest Classes 5-8 order tally in 26 months, and this month’s orders marked a fifth consecutive positive year-over-year reading, after 18 consecutive months of negative comparisons.”

Regarding the medium-duty market, Vieth added, “There is a symbiotic relationship between heavy-duty freight rates and medium-duty demand, and clearly, the shift in consumer spending from experiences to goods has been beneficial for the providers of local trucking services, as e-commerce has grown by leaps and bounds during the pandemic.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

This is proof that most trucking companies with over 50 trucks should have to payback the wage subsidies for any trucking company that bought any new tractors or other equipment or another company within 20 months of get money from the Fed gov or Ont gov. The wage subsidy for larger trucking companies and higher insurance costs will push out many owner ops and small trucking companies in Ontario. These truck drivers should not be replaced with low wage foreign workers