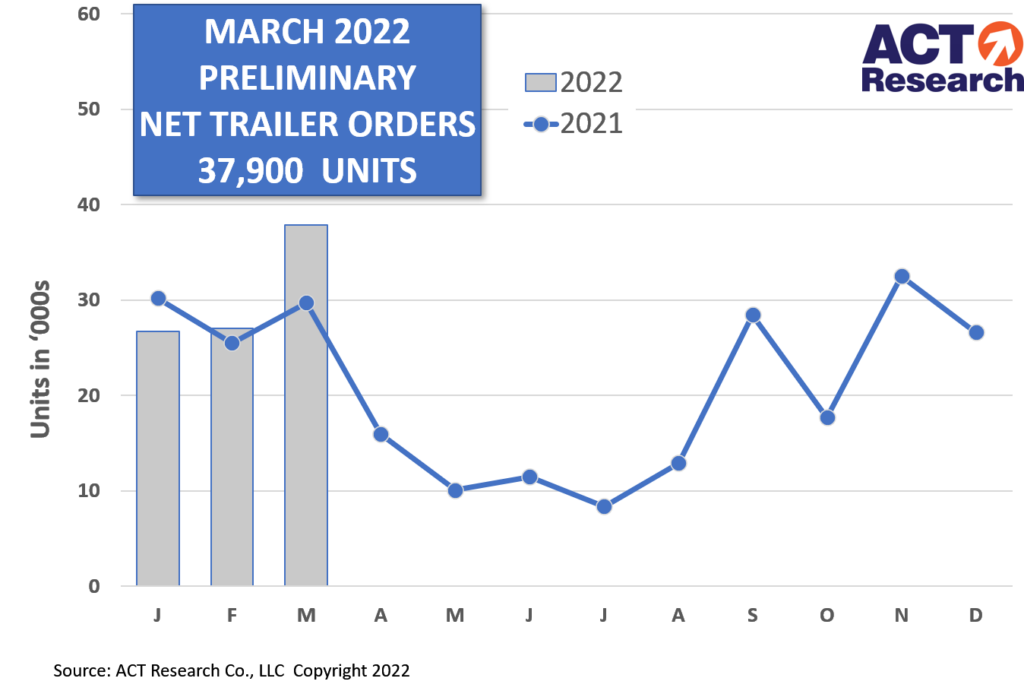

Trailer order backlogs stretching into December, ACT Research says

Demand for trailers remains strong in the U.S., with February’s net orders reaching levels not seen since December 2020.

The 37,900 units booked during the month were up 40% over the previous month and 28% higher than a year prior, ACT Research said, releasing preliminary numbers. The preliminary estimates tend to be within 3% of final tallies.

Final figures are expected to show order backlogs stretching into December based on current production rates, the analysts said.

“Some OEMs noted that their extremely low order volume was the result of a ‘sell out’ of their projected available production slots for the remainder of the year. Others, accepting higher order volumes, were in the process of filling their remaining production capacity for 2022,” said Frank Maly, director – commercial vehicle transportation analysis and research.

Manufacturers also appear unwilling to officially open 2023 orders because of concerns about pricing, he added.

“A positive development was indication that some supply chain relief was beginning to be felt.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

That backlog is with company limits on the number of order they will take in many cases to 50% of the average number the company purchased in each of the previous 5 years for dry boxes and reefer trailers. Has anyone else seen this happening.?