Future emissions rules will push truck engine manufacturers to the limits

Truck emissions regulations are becoming evermore complicated. Regulators are pushing manufacturers to reduce nitrogen oxide (NOx) and particulate matter (PM or soot) while simultaneously improving fuel efficiency, which means a lower CO2 output. The diverging requirements will make compliance difficult and expensive for manufacturers.

Also contained in the current round of emissions rules — and a set of yet-finalized rules expected to kick in sometime around 2030 — are in-service standards and maintenance and reporting requirements for fleets that operate heavy-duty on-highway engines. These rules, if enacted, will place significant operational and cost burdens on fleets themselves.

Estimates of cost increases for Model Year 2027 trucks and engines range from US$25,000 to $30,000 for hardware alone. But the price of ongoing care and feeding can only be guessed at this point because there hasn’t been a single prototype built with this advanced technology and run to the end of its “useful life” – which the incoming rules seek to extend substantially.

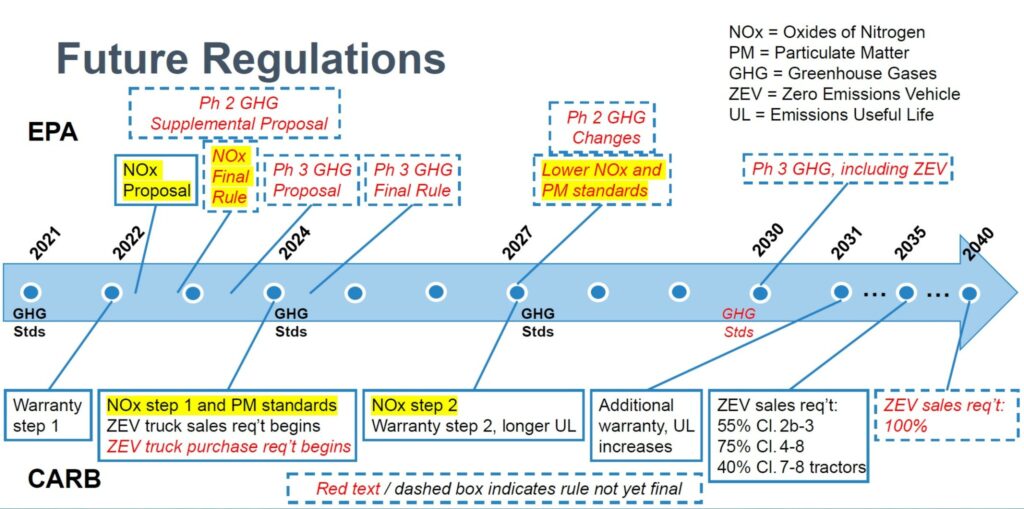

There are two environmental rule makings in progress in the U.S. now. The new rules published by the U.S. Environmental Protection Agency (EPA) on Tuesday, Dec. 20 are the first stage in that agency’s three-step Clean Truck Plan. They will be followed by proposed GHG Phase III standards for heavy-duty vehicles beginning in Model Year 2027.

CARB load

Meanwhile, the California Air Resources Board (CARB) is pushing forward with even stricter emissions standards that will apply to heavy duty vehicles operating in that state – including Canadian fleets.

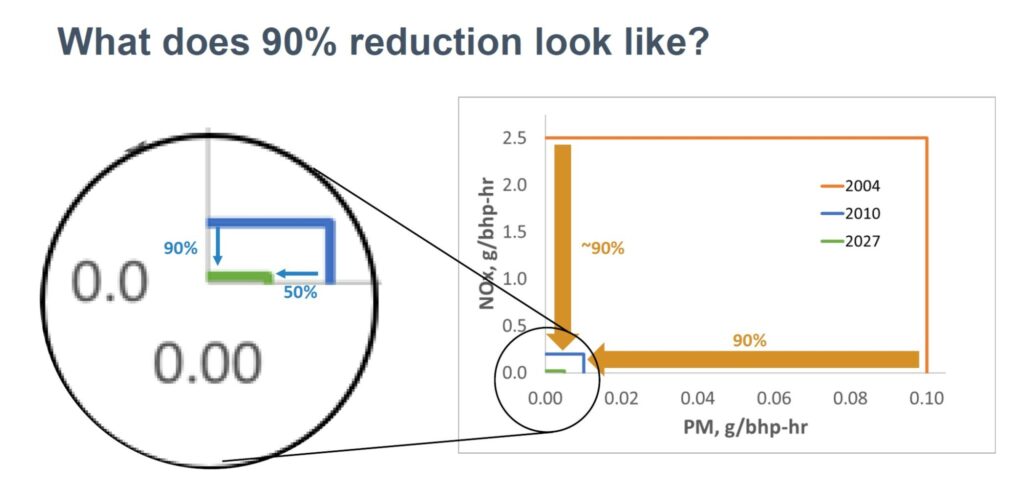

In August, CARB adopted a regulation that will reduce NOx emissions by 75%, from 0.20 grams per brake horsepower hour to 0.050 g/bhp-hr from 2024 to 2026, and a further reduction to 0.020 g/bhp-hr in 2027 for a total reduction of 90% from current levels. That move sets up a showdown between the industry, the engine makers and the two regulatory agencies over the depth of the reductions.

The EPA’s GHG Phase II plan was finalized back in 2016. The first phase came in 2021, the second comes into play in 2024, and the third part, published Tuesday, will come into effect in 2027. CARB’s rules would be stricter than those the EPA released this week and would impose unrealistic time limits on the development of the technology required to meet its Ultra-low NOx mandate.

Long before the EPA standards were published, the Truck and Engine Manufacturers Association (EMA) filed suit against the California Air Resources Board (CARB) looking to delay the implementation dates and “reinstate” the four-year lead time on new technology allowed under the U.S. Clean Air Act. That suit was withdrawn two months later, in August, after the EPA agreed to review the matter.

CARB’s ultra-low NOx emissions and GHG standards could be at odds with EPA provisions, which would demand that truck and engine makers meet one set of standards for California and a handful of states looking to follow its lead, and another set of standards for the rest of the U.S. and Canada.

But if you think that’s California’s problem, think again. The California standards would apply to any truck operating in the Golden State, even if the truck isn’t domiciled there. So, by extension, Canadian fleets with California exposure would need to comply with the California rules.

The coming regulatory onslaught

This is a strange time in the trucking industry, said Glen Kedzie, vice-president of the American Trucking Associations’ energy and environmental council, speaking at the fall meeting of the Technology and Maintenance Council (TMC).

“We’re not only dealing with past issues, but we’re dealing with a lot of new issues and new terms like environmental justice, advanced clean truck (ACT) rules, advanced clean fleets (ACF) rules, rules for greenhouse gas reporting rules for public companies, and more,” he said in his opening remarks. “How do we make sense of all this, still work our day jobs, and still remain profitable as fleets?”

That’s a million-dollar question, and one with few answers. The final part of the GHG Phase II rules is incredibly complex and technically challenging. And the rules CARB plans to implement, such as ACT and ACF, will be problematic for manufacturers and end users alike. The EMA, in their comments on the CARB proposal, called the Omnibus Regulations “cost-prohibitive, infeasible, unenforceable, and illegal, and, as confirmed by independent expert analyses, fall well short of any reasonable cost benefit metrics.”

Some people have said the pending rules were conceived to lower emissions from diesel engines and put an end to the diesel as we know it — pushing truck and engine makers toward Zero Emissions Vehicles (ZEV) because they’re less burdensome from a technical and regulatory perspective. That thinking, however, completely ignores how unfamiliar we still are with that technology, the lack or infrastructure to support such a transition, and the unreadiness of the technology to simply take over where diesels left off.

A sales mandate

Alissa Recker, product regulatory affairs engineer at Daimler Truck North America, described CARB’s ACT rule as a sales mandate. Manufacturers will have to sell a percentage of ZEVs based on their annual on-road sales volumes in California. That ramps up from 5% in 2024 to 40% by 2032. The rule sunsets in 2040 if the ACF rule is adopted along with its 100% ZEV sales requirement, she noted.

“We have expressed our concerns with the pace set by this rule … but it was adopted,” she said at the same TMC fall meeting. “We believe that there must be a marketplace and a ready and robust grid and charging opportunities for these vehicles to make implementation possible.”

She gave California some credit for pairing these mandates with healthy incentive and infrastructure investment programs but expressed concern about states that might follow California’s lead — particularly the jurisdictions that are not investing in the underlying infrastructure and vehicle incentives.

Washington, Oregon, New Jersey, New York, and Massachusetts have all adopted the ACT rule, and other states are considering it.

In addition to the final rule published on Tuesday, EPA is also considering whether to grant CARB a waiver, allowing it to skirt the requirement to provide four years of lead time. The EPA said it will decide on California’s waiver requests early in 2023.

“Part of EPA’s decision will be to see whether CARB’s rule meets the requirements of the Clean Air Act,” said Jackie Yeager, Cummins director of regulatory affairs. “That issue of four years lead time is definitely one of the things there’s a lot of debate about right now.”

What’s in the new emissions rules?

The forthcoming regulations still focus on reducing smog-inducing NOx as well as PM and soot, while simultaneously requiring reductions in GHG-producing CO2, which is a fancy way of saying improving fuel efficiency.

It becomes a bit hard to follow here because we have two agencies, EPA and CARB, seeking to regulate emissions. Their approaches are not mutually compatible, and under its Omnibus Low-NOx Rule, CARB has mandated a two-tier timeline realizing a 90% reduction in NOx compared to current levels.

EPA’s newly published rule is less stringent than CARB’s rule. It will require heavy-duty commercial vehicles to limit nitrous oxide (NOx) emissions to 0.035 grams per horsepower-hour during normal operation, 0.050 grams at low load, and 10.0 grams at idle.

The leading contenders for this level of NOx control are cylinder deactivation and close-coupled multi-stream dual aftertreatment systems (two selective catalytic reduction converters). Also under consideration are heated diesel exhaust fluid (DEF) dosers.

Emissions system warranties

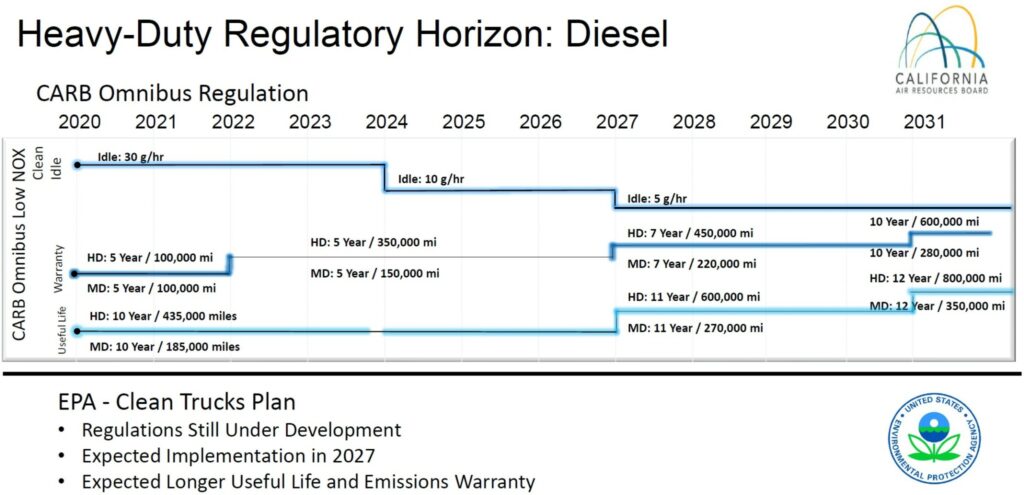

Then there’s another requirement that concerns fleets and OEMs: CARB’s Omnibus regulation will extend emissions system warranty periods in several phases, beginning in 2022 and 2027 before ultimately reaching 12 years and 800,000 miles in 2031. EPA’s new rule calls to increase the “useful life” of affected vehicles 1.5-2.5 times, and emission system warranties 2.8-4.5 times longer than current warranties.

The warranty is intended to address any condition in the engine or aftertreatment systems that causes emissions to increase beyond regulated levels – even if the equipment is not completely broken or malfunctioning. Everything must function at optimum levels.

This requirement is tied to the new definitions of useful vehicle life, during which the warranty period applies.

“It’s understood that emissions are going to increase as engines age,” said Aaron Prowell, Paccar’s greenhouse gas compliance manager. “To control that and try to stay under the limit throughout the useful life, manufacturers are going to try to make sure that it starts out below the standard. OEMs will add a compliance margin to deal with those uncontrollable factors.”

Higher equipment costs

It’s early days now, and manufacturers claim they can’t predict what long-term degradation might look like over 12 years. Manufacturers can’t control the environment where the vehicle works, end-user maintenance practices, and even driver tendencies, Prowell added.

These warranty requirements will drive up equipment costs, and probably the operating costs as maintenance requirements are stiffened. But, as Prowell noted, “It’s not all doom and gloom. We’ll see environmental benefits and lower cost of operation through improved fuel efficiency.”

As of this writing, truck and engine makers are still reviewing the fine print. None have issued statement regarding the feasibility of the rules or the technical hurdles they will need to clear to comply. At least we now know where we stand with the EPA and what form the rules will likely take here in Canada.

We still don’t know whether EPA will grant CARB a waiver on the Clean Air Act’s four-year lead-time provision. If EPA ignores the EMA’s recommendations and grants the waiver, it will likely be challenged vigorously in court.

The state of affairs is still in flux.

- This article has been updated to reflect newly released EPA emissions rules

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

For someone who knows very little about the trucking industry, this is a very interesting article. While it sounds as if much is still in flux, it is heartening to see that regulatory bodies are attempting to deal with the emissions from long distance trucks. It does sound like a hard shift, but the climate science is robust and beyond dispute….and we all have to start thinking about doing things differently.

We’ve been heartened to see how quickly EV’s have gained in efficiency and mileage capacity. Maybe big trucks can do it as well.

I am retiring in 4 years at age 70 and am glad I do not have to deal with all this crap. This will kill all of us o/o with such hi costs