Economic Trucking Trends: Class 8 orders rise to start year, spot rates settle

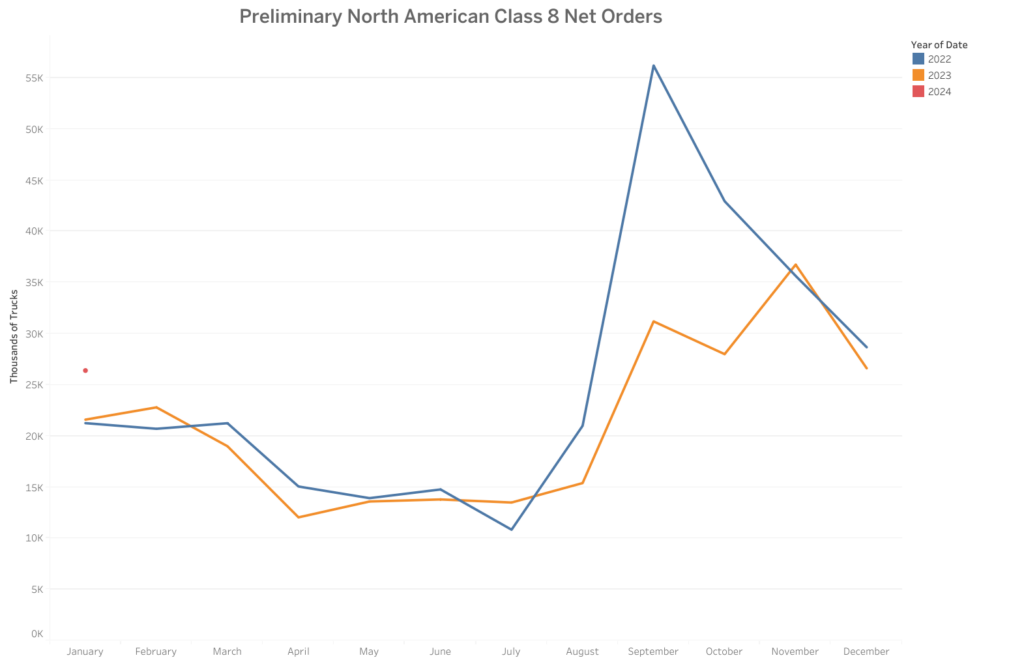

Truckers continue to order new iron at a healthy pace to begin the year, with preliminary orders up 35-45% year over year and marginally compared to December 2023 volumes.

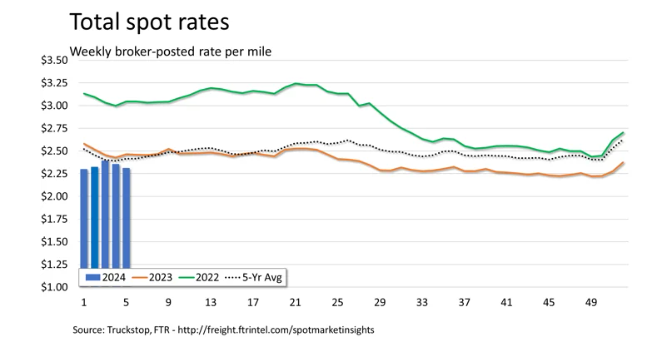

And spot market rate momentum has come to a halt, after getting a bump earlier in the year due to severe winter weather. If there’s good news it’s that spot market rates are…less bad.

Class 8 orders rise to begin 2024

Class 8 truck orders surged 35% year over year and 2% from December levels to 26,400 units, according to preliminary data from FTR.

“Build slots continue to be filled at a healthy rate,” said FTR chairman Eric Starks. “With January orders coming in at a rate that was comparable to the previous month, the market is still performing at a high level historically. It was a mixed market for OEMs this month with some seeing increases and others seeing decreases in orders. Fleets continue to be willing to order new equipment despite uncertainty in the freight market. Order levels were above the historical average and above seasonal trends, although we still expect 2024 activity to reflect replacement demand.”

Forecasting rival ACT Research reported Class 8 preliminary orders of 27,000 units, a 45% year over year increase.

“Weak freight and carrier profitability fundamentals, and large carriers guiding to lower capex in 2024, would imply some pressure in the North American Class 8 market’s largest segment, U.S. tractor,” said Kenny Vieth, ACT’s president and senior analyst. “While we do not yet have the underlying detail for January orders, Class 8 demand continuing at high levels at the start of 2024 suggests that over-the-road U.S. truckers are still buying.”

ACT also reported Classes 5-7 orders came in at 20,300 units, a 16% year over year increase.

Spot rate momentum dies

Truckstop and FTR data indicated spot market conditions weakened for truckers in the week ended Feb. 2. Rates settled further after a jump in January attributed to severe winter weather, returning to a more normalized pattern.

Dry van and reefer rates fell back to pre-Christmas levels, while flatbed rates fell for the first time in five weeks. Spot rates have now fallen in three of the year’s five weeks but are “less negative year over year” than any week between mid-August 2022 and the third week of this year.

Truck postings rose slightly, and combined with falling load postings, the Market Demand Index declined to its lowest levels of the year at 61.1.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.