Class 8 orders plummet, but not due to slowing demand

New truck orders plummeted in November, but not because demand for new equipment has waned.

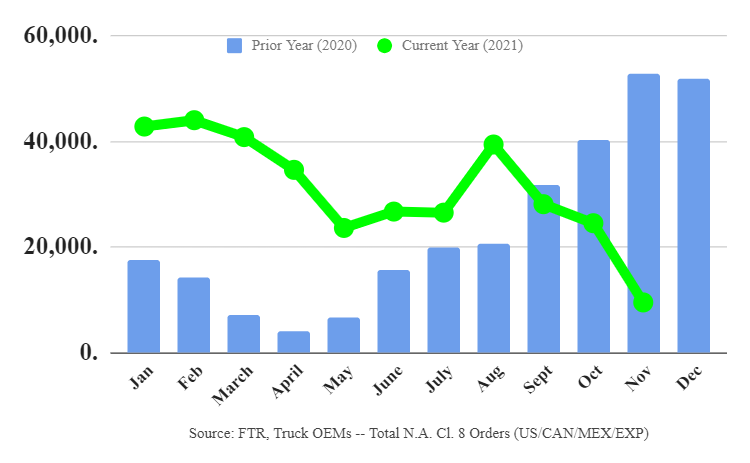

Preliminary Class 8 orders totaled 9,500 units according to FTR, down 41% from October levels and down 82% year over year. It was the lowest total for November since 1995. However, the industry forecaster days demand remains high, and OEMs are limiting order intake to manage customer expectations in the light of supply chain disruptions.

“The low order numbers in November in no way are representative of total demand. The weak volumes are because OEMs are managing their backlogs very carefully. After overbooking almost every month in 2021, the OEMs are being extremely meticulous about scheduling commitments in 2022,” said Don Ake, FTR’s vice-president – commercial vehicles.

“This strategy will continue until the supply chain situation improves. Once the OEMs are confident they can obtain the necessary production inputs, they will boost production and enter more orders. Backlogs remain at sturdy levels, but OEMs don’t want them much higher until they know their manufacturing capacity. Demand for new trucks is at record levels. There is tremendous pent-up demand generated in 2020 and 2021. Spot rates are at record levels, and contract rates are rising. Prices for used trucks are also at record highs. And when the manufacturing sector of the economy gets past the supply chain crisis, there will be even more freight to haul.”

ACT Research reported 9,800 Class 8 orders and 21,500 medium-duty orders in November, and also blamed production capabilities for the sharp drop.

“Long backlog lead times resulting from ongoing supply-side constraints continue to pressure new order activity,” said Kenny Vieth, ACT’s president and senior analyst. He continued, “With backlogs stretching into late 2022 and still no clear visibility about the easing of the ‘everything’ shortage, modest November order results suggest the OEMs are continuing to take a more cautious approach to booking orders so as not to extend the cycle of customer expectations management.”

He added, “Importantly, we reiterate, with critical economic and industry demand drivers at, or near, record levels, industry strength is exhibited in long backlog lead times, rather than seasonally weak orders. Looking to October data, the last full month of data in hand, the Class 8 backlog was nearly 281,000 units and at October’s build rate, the backlog-to-build ratio was 14.6 months, illustrating demand versus supply-side challenges.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.