ECONOMIC WATCH: Strengthening freight markets drive stronger truck orders

BLOOMINGTON & COLUMBUS, Ind. – Truck orders stormed back in July, with Class 8 orders marking the strongest month since October 2019 and Classes 5-8 orders reaching a six-month high.

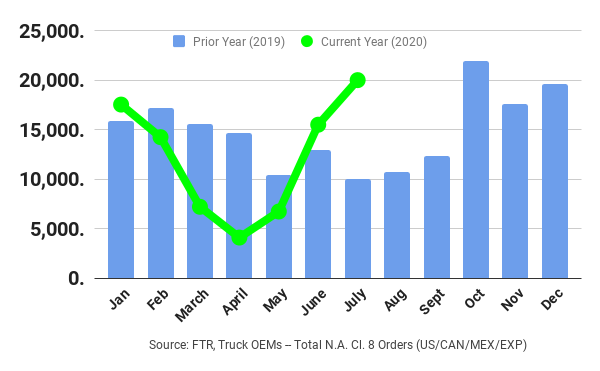

FTR reported 20,000 preliminary Class 8 orders for July, up 28% from June and double the number from July 2019. Orders were better than expected.

“As we hit the height of summer demand, the freight markets showed strength and resilience and that led to additional orders for trucks,” said Jonathan Starks, chief intelligence officer with FTR. “The order activity for both June and July was more robust than expected and is good news for the equipment producers. However, despite the increasing orders, FTR still expects the Class 8 market to maintain a slow, steady recovery.”

“The OEMs received a needed boost from July orders, activity that will help keep the industry moving in an upward direction,” Starks added.

ACT Research reported 20,300 preliminary Class 8 orders, while Classes 5-7 orders slipped 6% from June, to 16,700 units.

“Preliminary data show that July orders for medium- and heavy-duty vehicles jumped to a six-month high,” said Kenny Vieth, ACT’s president and senior analyst. “Less than a week ago, we learned that the U.S. economy was 9.5% smaller in Q2 than it was in Q1 and 10.6% below its end of 2019 level. Additionally, when the Covid began to bite in late February, there was a strong case to be made that the trucking industry was suffering from lingering overcapacity that was still putting downward pressure on freight rates, and by extension, carrier profitability.”

Relating these facts to the North American heavy-duty market, Vieth said, “The context of rising rates and improving carrier profits adds perspective to what is now occurring in Class 8 orders: Supply matters. With many drivers (and trucks) sidelined, there is now insufficient available capacity for rebounding freight volumes. There is a strong relationship historically between carrier profits and equipment demand.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.