Canadian truck, trailer aftermarket hits $4.06 billion

GRAPEVINE, Texas – The Canadian aftermarket that cares for Class 6-8 trucks, trailers and container chassis grew by 4% last year — reaching $4.06 billion.

The figures, from the analysts at MacKay and Company, were released Monday during the annual Heavy Duty Aftermarket Dialogue event that opens Heavy Duty Aftermarket Week.

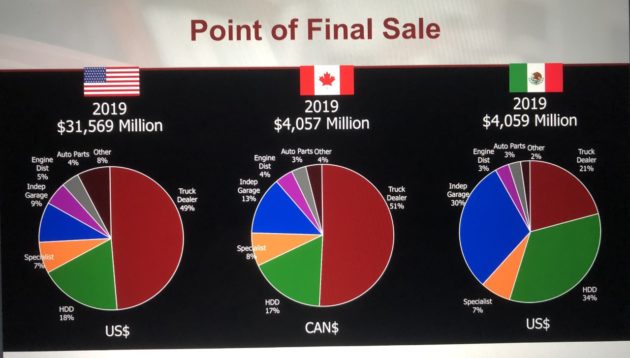

Canadian dealers accounted for 51% of those sales, leaving 17% for heavy-duty distributors, 13% for independent garages, and 8% for specialists. The remainder was split between engine distributors, auto parts stores, and other sales channels, the figures show.

This bettered the growth of the national gross domestic product and also topped inflation figures, but it was still lagging behind the 5.7% growth experienced by aftermarket businesses south of the border. The U.S. aftermarket is now valued at a comparative US $31.6 billion.

But the Canadian aftermarket for Class 6-8 trucks and trailers is still expected to grow 4.1% in 2020, reaching $4.2 billion, and is projected to reach $4.9 billion by 2024.

Some of the growth has come in the form of higher prices. Canada’s parts pricing rose 3.7% in 2018, and when final numbers are calculated they are expected to have risen 2% in 2019. Looking at the year ahead, MacKay and Company expects parts prices to rise 2.4%.

Here in Canada, the aftermarket is serving a population of 41,000 Class 6 trucks, 153,000 Class 7 units, 357,000 Class 8 trucks, and 558,000 trailers.

MacKay and Company expects those totals to drop marginally by 2024 – reaching 37,000 Class 6 trucks, 354,000 Class 8 units, and 555,000 trailers. Only Class 7 totals are expected to rise, nudging up to 158,000 units.

As for vehicle sales in the year to come, Canada is “somewhat of a flat market,” said John Blodgett, MacKay and Company’s vice-president of sales and marketing.

Class 6 and 7 truck sales are expected to drop 11% to 10,200 units, when compared to the 11,400 sold last year, although that is still above the 10-year average of 9,000 trucks. An anticipated 22% drop in trailer sales this year would represent a market of 35,000 units, down from the 45,100 sold in 2019.

The forecast U.S. truck and trailer sales are dropping as well, but still tend to remain above average levels. The projected 138,000 Class 6 and 7 truck sales would be down 10% when compared to the 153,000 sold in 2019, but still above the 10-year average of 114,000 units. The same can be said for the forecast sales of 275,000 trailers that represent a 17% drop from the 331,000 sold in 2019, but sit above the 257,000-unit average.

The drops in Class 8 truck sales are expected to be the most significant in the year to come.

The 25,300 units forecast for the year to come in Canada would be 22% off the levels seen in 2019, and below the average of 28,000 per year. There were 32,500 such trucks sold in 2019, and 34,300 sold in 2018. In contrast, the 203,000 trucks expected to be sold in the U.S. would be 26% lower than 2019, sitting just under the 10-year average of 204,000 units per year.

“They’re not terrible,” Blodgett said of the sales forecasts. “They’re still above where we’ve been for the average of the last 10 years.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.