Knorr-Bremse leaders discuss Covid-19 challenges, and path to future trucks

Knorr-Bremse’s business of producing vehicle systems was going according to plan early this year, even as a sizzling truck market began to cool.

Everyone was expecting a “replacement year”, says Peter Laier, the member of the executive board responsible for Commercial Vehicle Systems operations that include Bendix CVS. It was a mere dip in the natural cycle of building and selling trucks.

Then came the economic shutdowns of Covid-19. Global truck production plunged 27% in the first quarter as manufacturing facilities were silenced.

But the recovery has been just as pronounced. Production volumes in the third quarter reached 90% of pre-pandemic levels.

“It’s been as hard coming back as it was coming down,” says Bendix president and CEO Michael Hawthorne, referring to the V-shaped recovery.

Truck production in a Covid world

Good news, to be sure, but there have been plenty of challenges along the way.

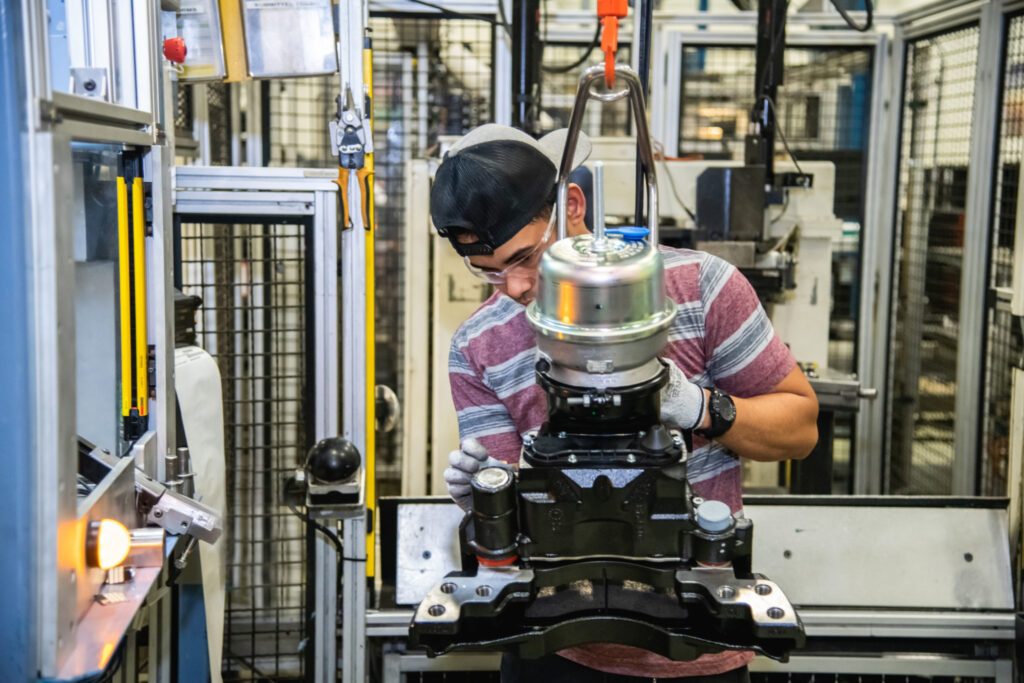

Like other manufacturers, Bendix scrambled to source personal protective equipment for employees. Production facilities, designed to be compact, had to be realigned to support social distancing. Shift changes had to be rescheduled to ensure workers didn’t cross paths.

It is hardly business as usual. Not yet.

“We just practically cannot produce the same levels of output,” Hawthorne says.

The business is facing challenges with its own supply chain, too.

“On electronics, there’s a specific challenge at the moment because the demand for electronic bits and pieces is extremely high at the moment,” Laier says, offering one example.

Advanced safety and electric trucks

While trucks are often thought of in terms of steel, iron, aluminum and fiberglass, the underlying electronics are powering their future – as the industry drives further in the direction of advanced safety systems, and even autonomous and electrified vehicles.

It’s a global business, too. As advanced as equipment is becoming in North America, Chinese and European markets are on similar journeys of their own.

They’re just influenced by different forces.

In North America, today’s evolving safety systems are largely driven by a desire to make driving jobs more comfortable, helping to address the challenge of hiring and retaining truck drivers, Hawthorne says. “You’re trying to ensure you can compete for that talent.”

In China and Europe, there are more regulatory forces at play.

China is regulating pedestrian automatic emergency braking systems, and mandating electronic stability controls for trucks that haul dangerous goods. Its latest Five-Year Plan even includes commitments to develop highly autonomous vehicles.

European trucks and buses will soon need systems to eliminate blind spots that might otherwise hide cyclists and pedestrians, adding to mandates for emergency braking systems. And Laier believes systems to help with steering will not be far behind.

Steering to the future

Knorr-Bremse has assembled many of the pieces to make a new generation of steering controls a reality.

It recently acquired RH Sheppard, a well-known maker of steering gear, from Wabco Holdings. But that US $149.5-million deal wasn’t the only one. It’s also picked up JM Engineered Products’ ProSteering Business, Japan’s Hitachi CVS Steering, and tedrive Steering, and expanded a joint venture with Dongfeng Motor in China.

What’s emerging are the systems that can help keep trucks in their lanes, compensating for issues such as the crown on a road or cross winds, as well as tracking between the lines.

Says Hawthorne: “Truck motion control is really the product.”

In the process, advanced braking systems and the steering controls combine to support the development of highly autonomous vehicles.

The journey to autonomous vehicles is not about building trucks that can travel from L.A. to New York under autonomous controls, Laier says. He sees them making more sense in confined settings like harbors and logistics centers.

“I think we have two countries in the world where it will come first – that’s the U.S. and China,” he adds.

In U.S., the interest comes through the business case and the shortage of drivers. In China, the targets are set by the state.

“On electronics, there’s a specific challenge at the moment because the demand for electronic bits and pieces is extremely high at the moment.”

– Peter Laier, Knorr-Bremse

Lower emissions

Advances for future trucks are not limited to the steering and braking, of course. Global markets are placing an increasing focus on e-mobility, whether it comes in the form of a battery-electric vehicle or hydrogen fuel cells.

In Europe, the interest is largely driven by emissions-related regulations. The European Commission wants to reduce greenhouse gas emissions by 55% as of 2030, when compared to 1990 levels.

In North America, the strongest push to electric trucks has been more regional in nature. Every new truck sold in California will need to be a zero-emission vehicle as early as 2045, and the shift from diesel to zero-emission offerings is to begin in 2024.

“That’s ambitious, and I want to see how hard they hold that line,” Hawthorne says of the timelines, referring to some of the underlying challenges that still need to be addressed.

One California fleet recently noted that just five of its 125 depots had access to the infrastructure needed to charge electric trucks, he notes, referring as well to sagging and aging powerlines that contributed to recent wildfires.

“You just can’t get access to the electricity.”

But there’s no question that it will play a part in their future. Knorr-Bremse’s eCubator development arm was established specifically to adapt products for e-mobility needs, but also to identify growth opportunities in the field.

Laier says he expects a mixture of powertrains to come, with manufacturers offering a combination of highly efficient diesel engines, battery-electric systems, or hydrogen fuel cells depending on the application.

The business cases vary from one operation to the next, but some are undeniably closer to electrification options than others.

“You don’t have to do it because you’re a good steward of the earth. You do it because it’s good business,” Hawthorne says, referring to package delivery trucks.

Decisions will even need to be anchored in brakes, he says, referring to other questions that need to be answered. Will they be driven electrically, or rely on compressed air?

Evolving brakes

It isn’t the only way the brakes themselves continue to evolve. North America continues to lag behind the European adoption of disc brakes, but they’re still becoming more popular on this side of the Atlantic.

The main barrier for disc brakes is the customer experience, Hawthorne says. “There’s a familiarity with drums. It’s a historically understood product.” Disc brakes cost more than drums as well.

But there’s no denying the benefits. Discs aren’t prone to fading like drum brakes. The servicing is easier, too, Laier says.

It explains why adoption rates exceeded expectations last year and this year.

Knorr-Bremse’s corporate strategies are supporting growth in this area as well. A wheel end manufacturing facility in Kentucky is being expanded to meet the higher demand.

There’s no stopping the journey to the future, even if that future involves new and better ways of stopping.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.