Strong economy, $60 oil driving truck sales, Peterbilt says

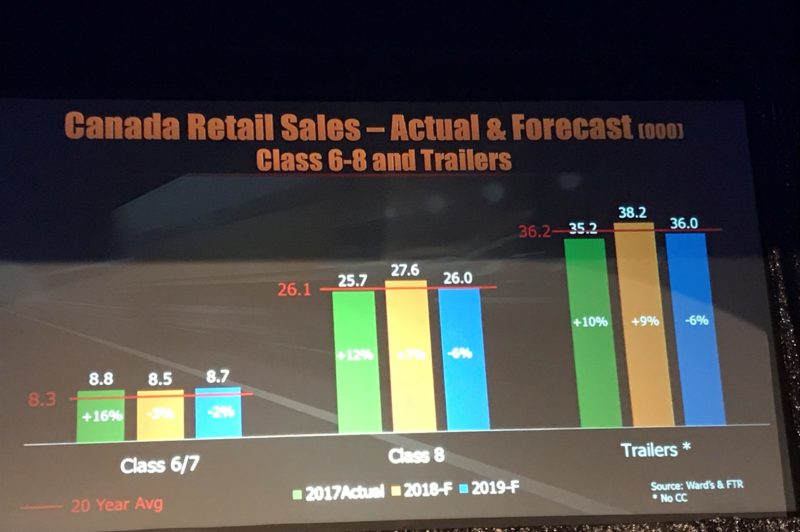

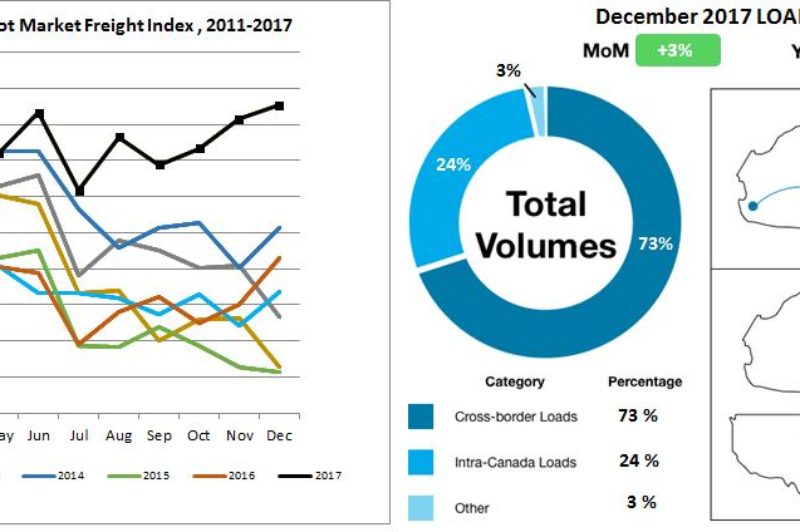

SCOTTSDALE, Ariz. – Peterbilt is projecting sales of Class 8 trucks in Canada and the U.S. to reach between 235,000 and 265,000 units this year, with another 85,000 medium-duty trucks to be sold on top of that. Several economic conditions back the healthy projections.