Stand-alone Daimler Trucks to focus on zero-emission future

Daimler Trucks is gradually turning away from internal combustion engines (ICE) as it prepares for a changing future — one that will involve battery-electric vehicles, hydrogen fuel cells, and life as an independent business entity.

“We are going to refocus our R&D activities on zero-emission technology. The majority of our R&D spending will be focused on zero-emission trucks by 2025,” said Martin Daum, chairman of the board of management at Daimler Truck AG.

“Related to this, we are going to sundown our ICE activities with partnering strategies. We’ve done that already in medium-duty engines with Cummins, and we are working on more solutions that will allow us to manage our exit from legacy activities.”

The OEM projects that 60% of its global sales will involve zero-emission vehicles as early as 2030.

The comments came on Thursday during a series of Strategy Day presentations, as the OEM identified goals and targets that will apply as Daimler spins off its truck and business unit. That is scheduled to occur by the end of this year.

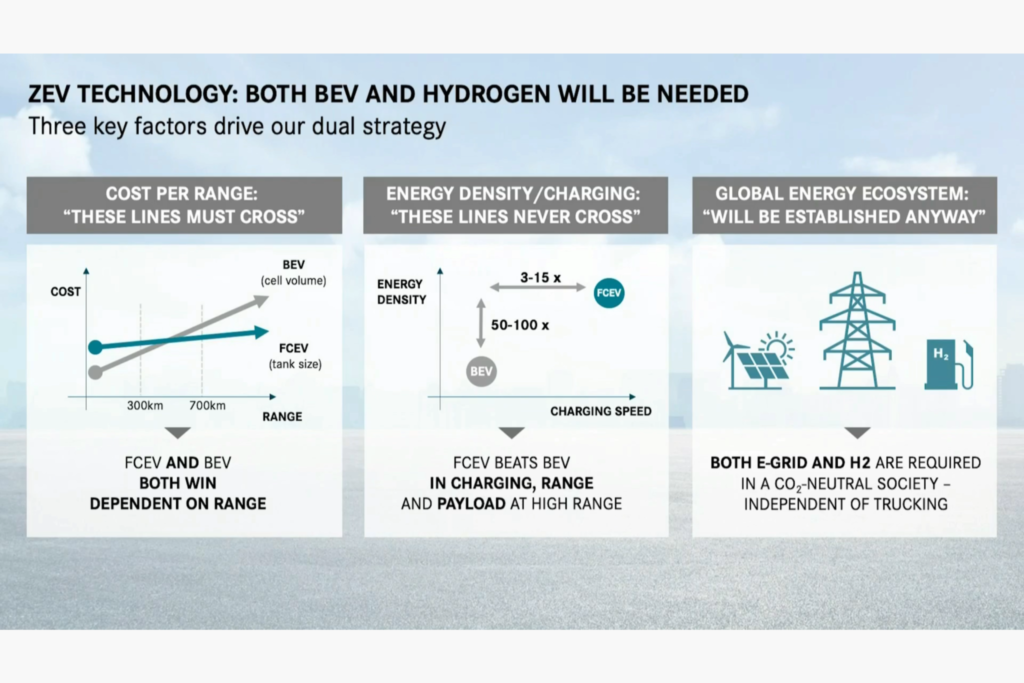

“We will follow a dual-track BEV (battery-electric vehicle) and fuel cell strategy because we are convinced our customers will need both technologies,” Daum said.

Batteries and hydrogen

While battery-electric trucks have been identified as a viable option for lighter loads and shorter ranges, the fuel cells are seen as a better option for heavier weights and longer hauls. And Daimler has raised questions about whether energy infrastructure could even support a future that focused on batteries alone.

“There is no way that we can do it with just one energy source. We need two,” Daum said, noting that hydrogen offers the opportunity to transport the energy over a distance. “The only way to transport it will be H2.”

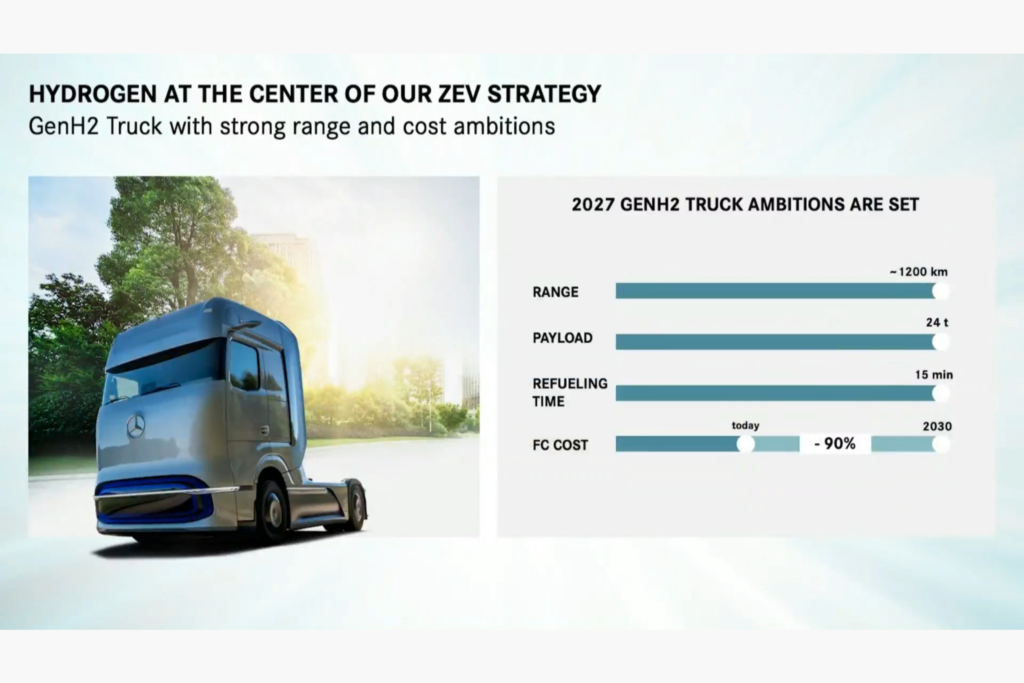

That has already led Daimler to establish the cellcentric joint venture with Volvo Group. Together they are looking to develop, produce and commercialize fuel cell systems, with a “gigafactory” to begin work in 2026.

But that is just one of many partnerships that Daimler is establishing to support its path to the future. Working with Linde Group it will establish a hydrogen refueling station in 2023, and the push for fuel cells across Europe will be supported through work with Volvo Group, Iveco, OMV and Shell. A newly announced initiative with the latter company will create a 1,200-km hydrogen corridor connecting Rotterdam, Hamburg, and Cologne, Germany.

“Hydrogen, along with electrification, can help to decarbonize the economy,” said Shell CEO Ben van Beurden, referring to the agreement as “a partnership of two industry titans”.

By 2027, Daimler projects it will have a hydrogen fuel cell truck with a 1,200-km range, capable of refueling in 15 minutes.

Establishing infrastructure

Plans for a North American hydrogen rollout have yet to be announced, but there is a history of technology migrating from Europe to North America, said Daimler Trucks North America president and CEO John O’Leary.

When the time comes, “we will have a product ready to go.”

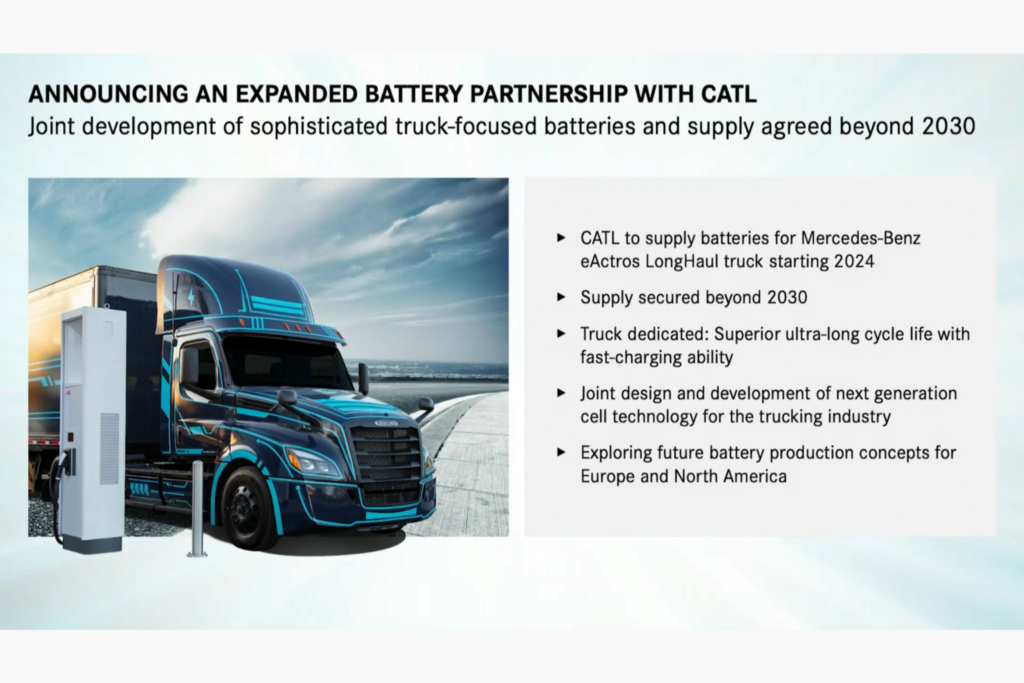

The focus on partnerships extends to battery-electric offerings, too.

A partnership between Daimler and CATL will deliver batteries for the eActros European tractor in 2024, and there are plans to produce batteries in North America and Europe under the partnership as well.

Current battery-electric vehicle ranges of 500 km are to increase to 800 km in the next generation of equipment, consuming 25% fewer kilowatt hours per kilometer, and with costs that are 40% lower, Daimler projects. Charging capabilities are to increase 170% to about 2 megawatts, up from the 700 kW seen today.

Signs of existing work can be seen in 40 battery-electric eCascadia and eM2 trucks in the midst of customer tests. Series production of both models is scheduled to begin in late 2022, and Freightliner Custom Chassis Corporation (FCCC) will begin producing an all-electric van later this year.

Electronics and services

As important as the powertrain will be, Daimler also projects significant changes in computing power for its trucks. Major releases are planned for 2023, 2025, and 2027 as it reduces the number of computing units on individual vehicles, but adds computing power to those that remain.

In terms of developing autonomous vehicles, another dual strategy sees ongoing investments through Waymo and Torc Robotics.

“Autonomous is one of the holy grails out there,” Daum said. “Our dual-track strategy will accelerate deployment.”

Waymo’s autonomous tech will be applied to a unique version of the Freightliner Cascadia. And Daimler’s Torc subsidiary will use its virtual driver to support hub-to-hub trucking. The latter lays the foundation for a new profit pool offering services beyond traditional vehicle sales.

“The growth potential we see with services is significant,” added chief financial officer Jochen Goetz, referring to offerings such as dynamic insurance and fleet management services.

There’s a goal to increase Daimler’s service-related revenues from today’s 30% share up to 50% by 2030.

European targets

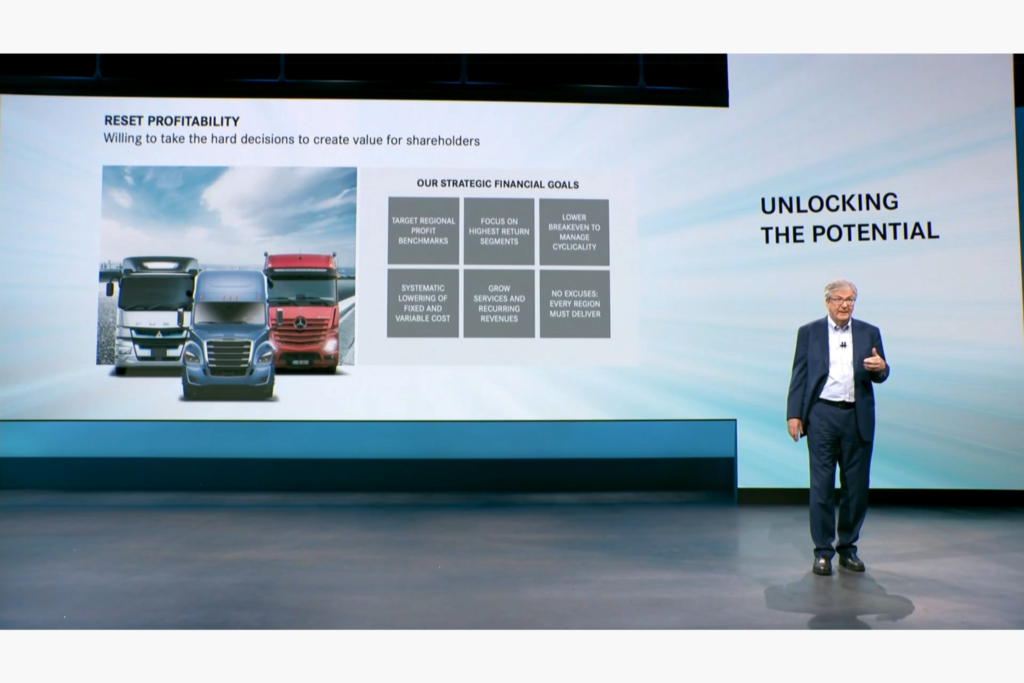

As Daimler Trucks prepares for evolving vehicles, it’s also committing to improve business activities in Europe, Brazil, and Asia.

“We absolutely need to raise our financial performance,” said Goetz. “We have the blueprint for how to do that – Daimler Trucks North America.”

While holding a 40% market share of truck sales here, the European shares dropped from 23% to 20% between 2012 and 2019. In one recent benchmarking survey regarding the seven brands available in Europe, Daimler products ranked fourth, sales fifth, and service sixth.

“To some extent we lost touch with our customers, and secondly our cost base increased but we weren’t able to increase our revenues,” said Karin Radstrom, the recently appointed head of Mercedes-Benz trucks in Europe and Latin America.

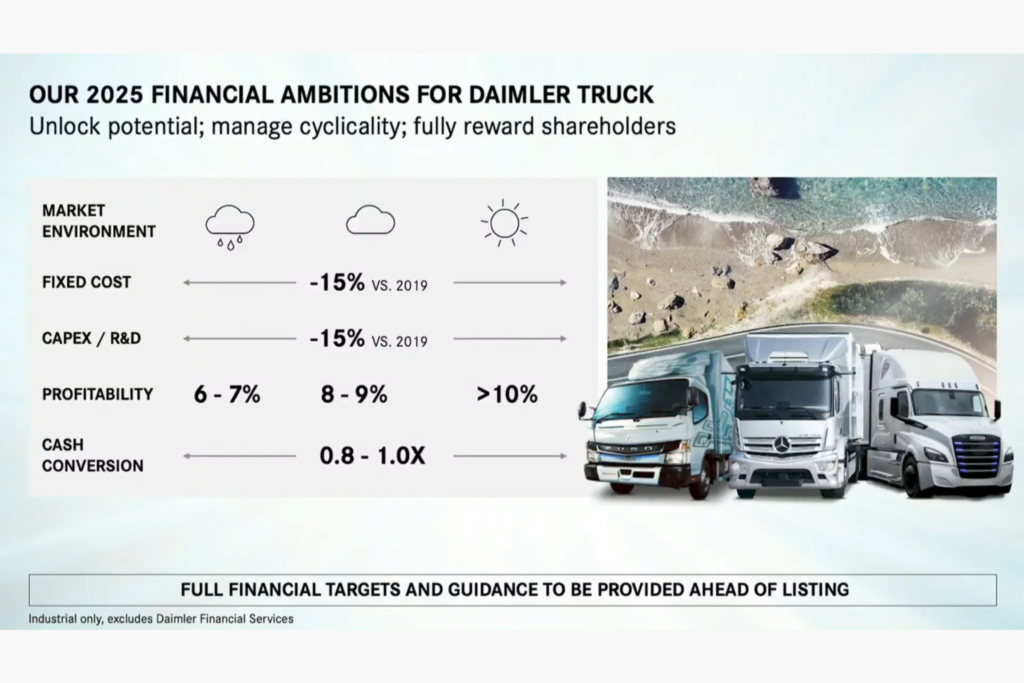

The OEM announced that it plans to reduce fixed costs, capex, and R&D spending by 15% as early as 2025, when compared to 2019 totals.

North American plans

It hardly means the growth plans for North America are coming to an end. Targets here will in part focus on the vocational business segment, building on the recent launch of the Western Star 49X as well as proposals for a US $2 trillion infrastructure spending bill, company officials say.

“Our vocational focus is coming at a perfect time,” O’Leary said, referring to the US$350-million investment into the truck.

There are opportunities to grow in the small fleet segment as well. While enjoying a 58% market share among large and mega-sized fleets, DTNA’s share dips to 33% among smaller fleets, and into second place in the vocational business segment with a 28% market share.

In the meantime, Daimler faces some of the same supply chain challenges restricting production by other OEMs.

“We have a lot of uncertainty at the moment regarding the availability of chips or semiconductors,” Goetz said, noting it will have a “significant impact” on production during the second quarter of this year.

But the industry and its challenges evolve.

“There’s a fundamental technology shift going on in this industry,” said Ola Kallenius, chairman of the board of management at Daimler AG. “And we intend to lead it.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.